I’m happy to see you in the Community, sbsk.

You can run the Payroll Summary Report and customize it to get the full-time employee calculations. Allow me to help and guide you through the process.

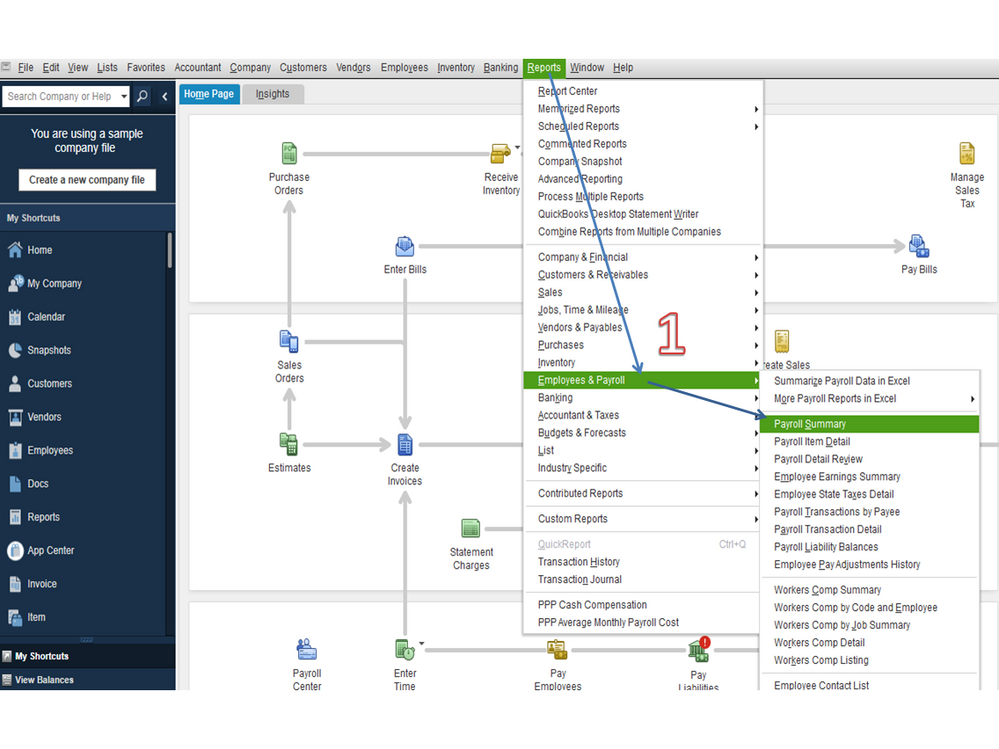

- Tap the Reports menu at the top and choose Employees & Payroll to select Payroll Summary.

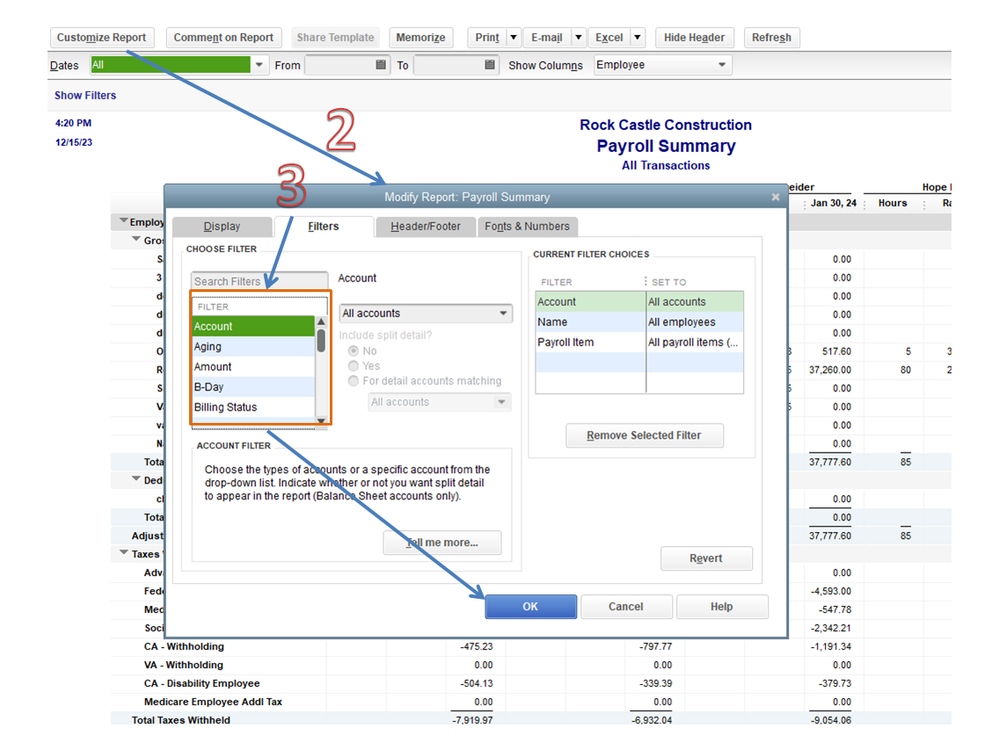

- Click the Customize Report button in the upper right to open the Modify Report: Payroll Summary window.

- From there, go to the Filters tab and pick the payroll items you want to show on the report.

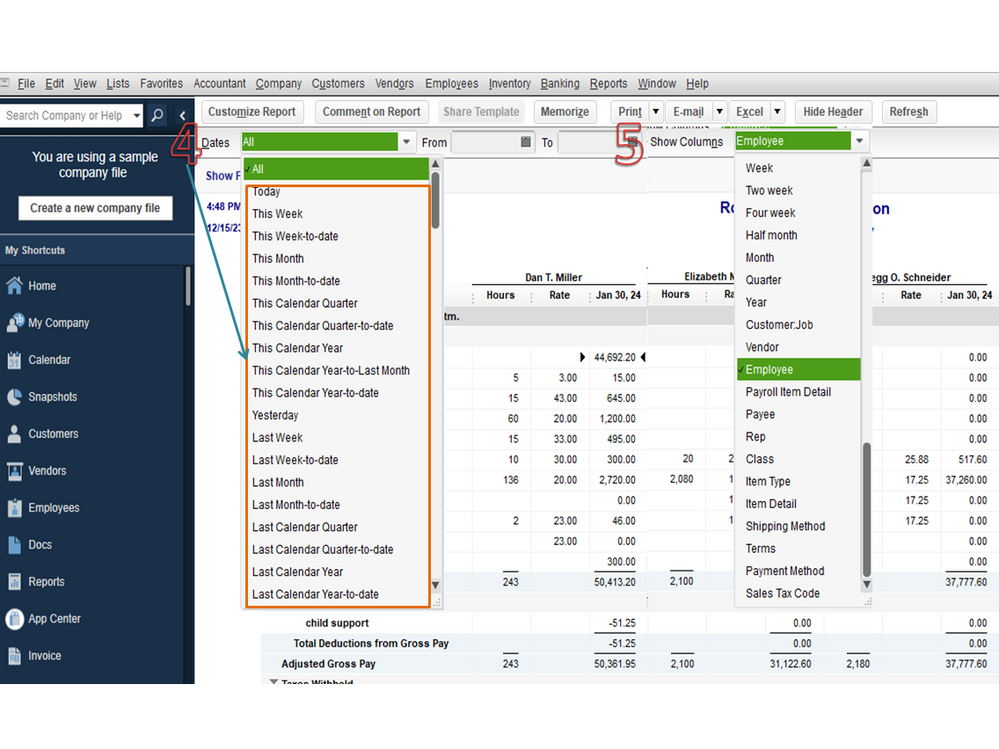

- On the Payroll Summary Report page, hit the Dates drop-down to set the correct period. For example, This Calendar Year or This Calendar Quarter.

- You can also use the Show Columns feature to sort the data according to Employee, Payroll Item Detail, etc.

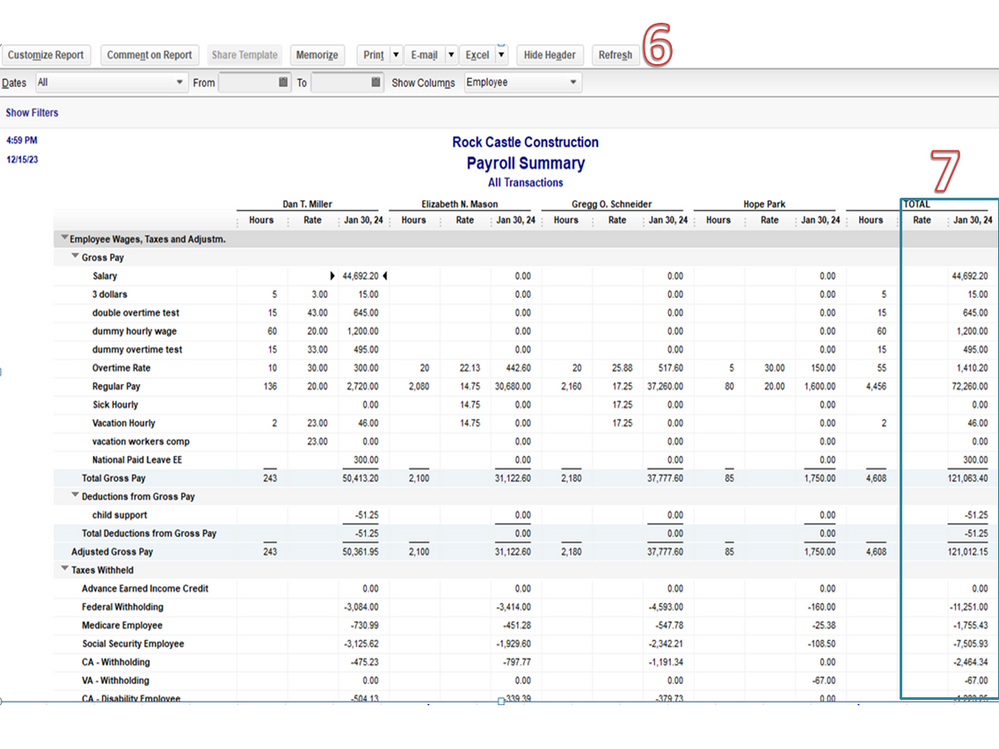

- Press the Refresh button to view the changes.

- Navigate to the Total column to get the sum of all amounts for each employee’s wages, taxes, additions, and contributions.

For more insights about building and refining payroll reports, see the following guide: Customize payroll and employee reports.

For more insights about the PPP Program, the following articles cover all the information you need about the application process and documents you need to submit.

Keep me posted if you need additional information about processing the PPP loan. I’m more than happy to lend a helping hand. Have a great day ahead.