Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Our business only operates in KY and only has active employees in KY. However, in order to send W-2's to a few of our prior employees, we had to update their addresses to other states (VA and AL). Now QBO insists that we send quarterly payroll reports to those states. How do we turn those reminders off (particularly since some of them show up on the main Dashboard as unfinished tasks?

Hello there, @davefackler.

Let me share information about reminders that show up on your Dashboard when updating your employee's address.

QuickBooks generates the forms and taxes to set up based on the employees’ residence and work locations. Virginia and Alabama appeared in the Payroll Tax Setup because the employees were initially set up under these states.

We want you to stay compliant with your tax regulations, which is why the software will require and prompt you to enter the information for each state. Even if the business and employees are in different states, some agencies have reciprocity agreements and may require employers to file and pay taxes for each one.

Since there isn’t a way to turn off those reminders, you’ll have to complete the payroll setup. Just make sure to enter 0 for the rates and dummy account numbers.

For additional reference about changing employee details and processing W-2s, you can check out these articles:

Let me know if there's anything I can help you with. I'm always around to help. Take care.

Joseph,

Your statement below, "QuickBooks generates the forms and taxes to set up based on the employees’ residence and work locations. Virginia and Alabama appeared in the Payroll Tax Setup because the employees were initially set up under these states" is not correct. These were prior employees who originally lived in KY and worked for us. They were terminated (one quit and one was fired) in 2019. As we were preparing to send out W-2's for 2019, we updated the addresses for those two employees (since we had notification from them) to reflect their new addresses - one in VA and one in AL. At no time were they active employees with those addresses.

When we go into the tax setup for our company, since we do not have any locations listed for VA or AL, it will not let us do as you suggest "...you’ll have to complete the payroll setup. Just make sure to enter 0 for the rates and dummy account numbers" It seems ridiculous that QBO Payroll would think that we have to do that for inactive employees that happen to live in states that we are not in and have no active employees living in.

Dave F.

Joseph,

Thanks for the reply. However, your statement below, "QuickBooks generates the forms and taxes to set up based on the employees’ residence and work locations. Virginia and Alabama appeared in the Payroll Tax Setup because the employees were initially set up under these states" is incorrect in this case. Those employees originally lived in KY when they worked for us in 2019. During the year, one quit and moved to VA while another was fired and moved to AL. Neither was listed as an active employee living in another state during 2019. While preparing to send W-2's for 2019 in January, we updated their addresses (since we received notice about address changes from both of them) but they remained inactive employees.

Since we do not have any locations in VA or AL, I don't think we can take your suggestion "...you’ll have to complete the payroll setup. Just make sure to enter 0 for the rates and dummy account numbers". When we go to our tax setup in QBO, it does not give us any options for VA or AL.

It would seem that QBO Payroll should not require us to do anything if an inactive employee has an address in another state. Please advise...

Dave F.

Thanks for the additional details, Dave.

Based on what you've shared, one of the reasons why QBO is prompting to send a quarterly report is because there are employees whose current addresses are set to VA and AL.

After sending or printing their W2s, you can go back to the former employee's addresses and change it back to the original information. Once done, the unfinished task will no longer appear since the system no longer detect that there are employees with VA and AL addresses.

You can also check out this article about managing your removing tasks: Manage Your To Do list.

The Community is always here if you need anything else.

Thanks Jeno, but I have already tried that. I changed the employee with the AL address back to her original KY address. QBO is still prompting me with a task to file an AL quarterly return for income tax withheld... Sigh.

In general, doesn't it seem that this is a bit of a bug in QBO Payroll? If there are no ACTIVE employees with an address in a state (like AL and VA in my case), why would QBO Payroll insist that there's anything to do for those states? Seems like the logic that generates those tasks could easily filter out the inactive employees - and even take their paycheck history into account if needed (i.e. don't require a form in a quarter or month where there were no paychecks to employees in any given state).

Guess I'll just live with the task staring me in the face every day because there doesn't seem to be a way to get rid of it...

Dave F.

Hi there, @davefackler.

Usually, you can archive those forms that you see on your Dashboard. So moving forward, this won’t generate on the system.

Here's how:

1. On the left pane, select Taxes.

2. At the top left, select the Payroll Tax tab.

3. Under Forms, click Quarterly Forms or Annual Forms.

4. Click the form you want to archive.

5. Choose the liability period.

6. Click Archive.

Here's an article about archiving forms in QuickBooks Online: Archive (save) a form that I have filed.

Once done, you can opt-out of the second state so that our system will only provide the tax liabilities for that state. It will no longer provide support or reminders for tax payments and form filings to that state.

Here’s how:

Also, you can check this article to know more things if you have multiple work locations in different states: About multistate employment payroll situations

Don't hesitate to add a comment below if you have any other payroll concerns. I'm always here to help.

Thanks MaryAnn. Unfortunately, archiving the form that is still popping up on my dashboard does not seem to work. The form listed is the AL A-1 (which is a quarterly form). When I follow the steps you describe, it is not listed - but it remains listed on my dashboard.

With regards to opting out of other states (the second part of your reply), we don't have any locations in other states - and never have. So when I review our work locations, I only see our KY location - which is the only one we've ever had.

So this looks like a bug in QBO Payroll to me. I should either be able to get rid of the task, archive the form, or something. But no matter what I try, I cannot...

Dave F.

Thanks for the update about the AL A-1 form showing up on the Dashboard, davefackler.

Allow me to add one more step for you to get rid of the task. Aside from archiving the form and removing VA and AL addresses on your employees' profile, you'll need to change their filing method.

I'm glad to show you how:

Stay in touch with me if there's anything else you need. Just tag my name and I'll get back to you.

Thank you and stay safe!

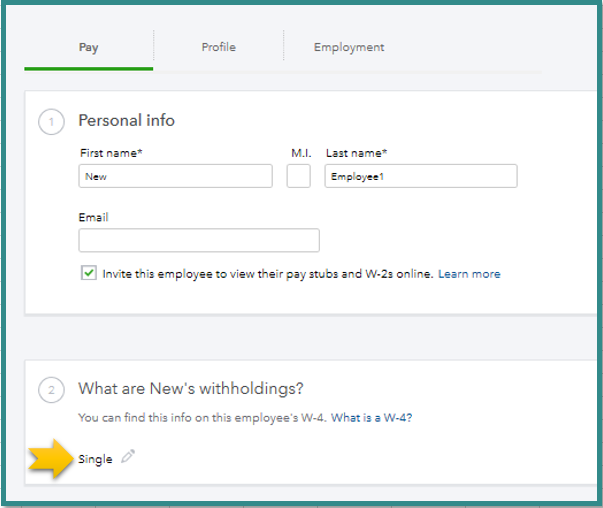

Mary, thanks for the reply and the additional suggestions. Unfortunately, that did not work either. Here were the steps I took:

- First, I made the employee with the AL address active again (just to see if that would help).

- Second, I updated her address back to AL (as I had updated it back to KY based on Jeno's suggestion)

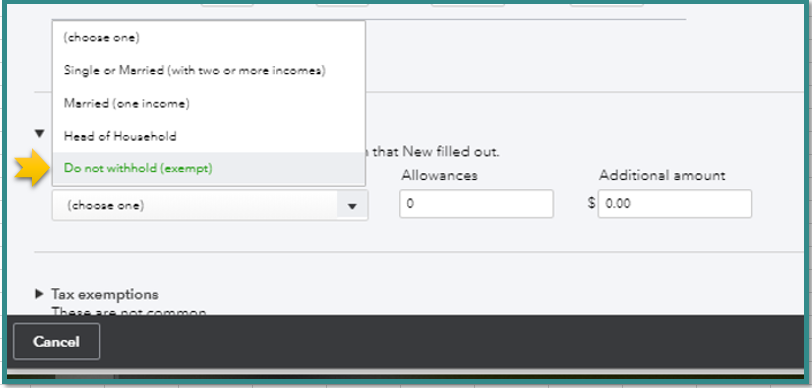

- Third, I updated her withholdings for AL to say "Do Not Withhold" as you suggested.

At that point, I checked my Dashboard in QBO and the AL A-1 task still appears.

- Fourth, I updated the employee to have her original KY address again.

- Fifth, I updated the employee to be terminated again.

And at this point, the AL A-1 task still appears.

Dave F.

Hello there, @davefackler.

I recommend reaching out to our Payroll Support for further assistance. Rest assured, they have the tools that can look further into this behavior and help you get everything straightened up. Here's how to get in touch:

Let me know how the conversation goes! They can get on a screen share with you to naivete your account to find out why this behavior is happening.

I'll be here if you have any other questions or concerns. Have a beautiful day.

Dave,

Did QB ever fix your issue with this? I did the same thing you did, changed a terminated employees address in his profile so it would reflect his current OUT-OF-STATE mailing address on his W-2. Was that ever a mistake! Who knew something so simple as wanting to mail a W-2 to the correct mailing address would create so many wrong reports to be generated in my To Do List and Action Needed list. The simple thing would be for the QB Support team to remove these reports which we aren't required to file because we have never had employees who live out of state while being employed with us. I've wasted well over 3 hours on the phone talking to 3 different QB Support team and nothing was resolved. Did you ever get these erroneous reports off your page? I refuse to file them in a wrong state like QB suggested.

Peg

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here