Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Connect with and learn from others in the QuickBooks Community.

Join nowOne of our employees has a loan against her 401k that is being repaid. Is the proper (or an acceptable) recording for this to make a liability account titled "401k Loan Payable" which would get decreased by the amount paid back each month/year and take this money out of payroll expenses? So you would have a negative liability shown on balance sheet.

Normally an employer cannot touch the 401k and any authorized by plan loan is direct from plan account to employee and it is responsibility of employee to separately repay the loan direct to the account. You, as employer, should really not get involved, you would be adding an obligation of sorts to your books that has no business in the business and if employee leaves prior to repaying you have this hanging around. I guess you want to deduct the loan payments from wages as a convenience and that is your right but that right doesn't make it the right thing to do.

You definitely DO NOT want to make this a company liability as it is not a company obligation. If you choose to do this, set it up the same as child support, not other retirement as this repay has no tax consequence on taxable wages. Oh, and do not place an amount on this liability other than what you deduct and transmit. Check with the plan and see if you can actually pay on the loan on behalf of the employee. There might not be that option when you go online to submit after each payroll run

I just accepted the payroll function at my current job. I'm trying to streamline our 401K contribution process. There is a 401K excel report that would work great, other than the 401K loan repayments are not showing on this report. The column is there, but none of my payroll deducts for the loan payments is pulling to the report. I read your response that the employer really shouldn't get involved in the loan repayment process, but my employer chose to do otherwise. We are manually keying data into our 401K provider website, and I'd like to just upload a file. This 401K payroll excel file would work if the loan payment data would pull. Any ideas? Thx.

Welcome to the Community, @jpenn.

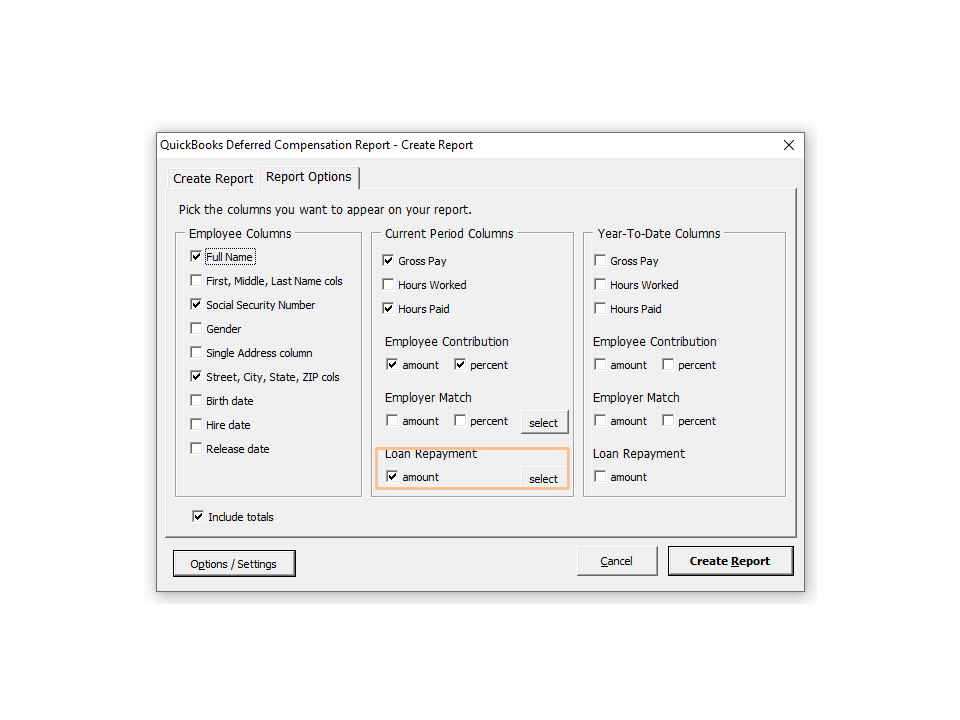

Congratulations on the new role. There’s a way where the loan payment will show on the Deferred Compensation Report.

We’ll have to set up the payroll item and then create an adjustment. For detailed instructions of adding the loan repayment, check out the Deduct 401(k) loan repayment from the employee paycheck article.

Now that you already have the payroll item ready, let’s perform the adjustment process. The steps are easy to follow.

To open the report:

When pulling up the report, the amount will show in the Loan Repayment column.

For additional resources, I’m adding a few links containing detailed instructions on how to adjust liabilities as well as steps to open Excel-based reports in QuickBooks Desktop.

Reach out to me if you need further assistance while working in QuickBooks. I’m always ready to help and make sure you’re taken care of.

Thank you so much for the DETAILED information. The Deferred Compensation Report is not the report I am trying to use. The one I'm trying to use is under:

Reports

Employees & Payroll

More Payroll reports in excel

401(K) reports

Then I can chose either Report Type "Census" or "Payroll" with a specific paycheck date. I am trying to select PAYROLL for each paydate.

Will all the same steps you outlined result in the 401K loan payments appearing on this report? See the attached example of my blank loan column. Again THANK YOU! You are the first contact I've made that has been helpful! :-)

Hey there, jpenn.

Yes, the process provided by my colleague Rasa-LilaM will result in your loan payments appearing on your 401(k) Excel reports. If you need any assistance while walking through the steps provided, you can count on the Community to be here to help.

I'll be here to answer any questions, so please don't hesitate to reach out if necessary.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here