Let's review the steps you must take to get the withholding taxes filing process started, lmulbrook.

Since you mentioned that QuickBooks (QB) is currently awaiting agency approval to file your withholding taxes, this suggests that you have already granted QB the authority to file on your behalf. In the meantime, let's review the automated taxes widget to identify any tasks you may need to complete and to confirm the status of your authorization request. Here's how:

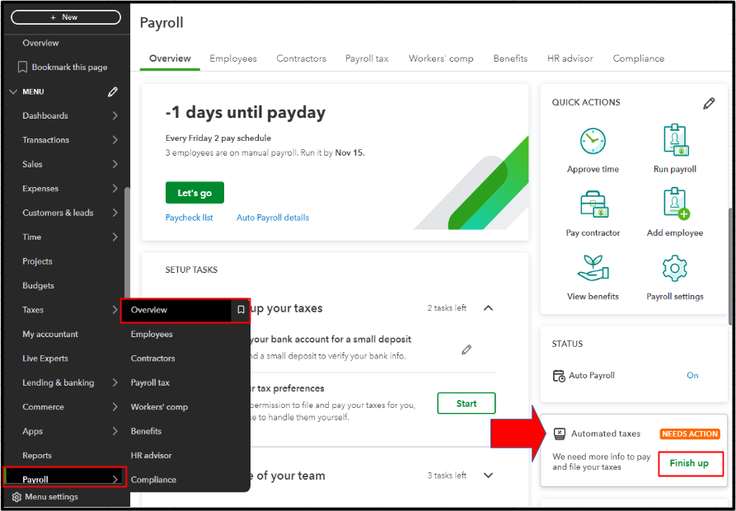

- Go to Payroll, then select Overview.

- In the Automated Taxes section, click Finish up.

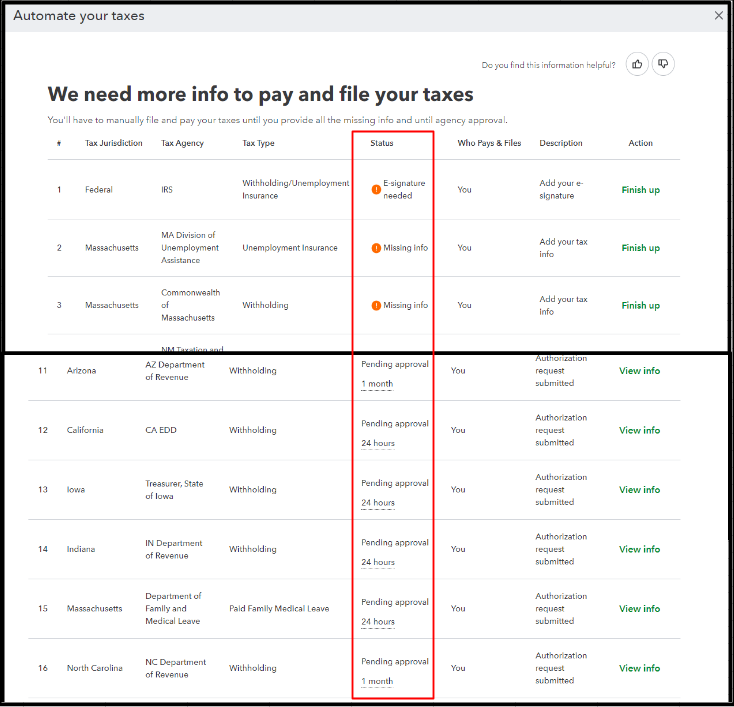

- Locate your Withholding Tax Agency and check the Status column. If it indicates Missing info, selectFinish up and complete the required details. However, if it indicates Pending approval, we'll need to wait for the tax agency's confirmation.

Moreover, you can refer to this article for more information about setting up QB to pay and file your payroll taxes and forms: Set up QuickBooks Online Payroll to pay and file your payroll taxes and forms.

Finally, I'll provide this resource to help you with running, printing, and customizing payroll reports.: Run payroll reports.

I'm always ready to back you up if you need more help handling payroll taxes in QB. I'll keep the thread open so you can comment back.