Hi there, mur59tre,

I'm here to show your total mileage for 2019. QuickBooks Self-Employed (QBSE) calculates the total mileage you can deduct from your taxes.

We use the standard mileage rate from the IRS to help estimate your tax write-off. QuickBooks multiplies your total business miles by the current rate:

You'll need to review your total miles driven through the Miles tab. This will also show the current mileage rate from the IRS. Just make sure those business trips are already added in QBSE to have an accurate calculation.

Let me show you how:

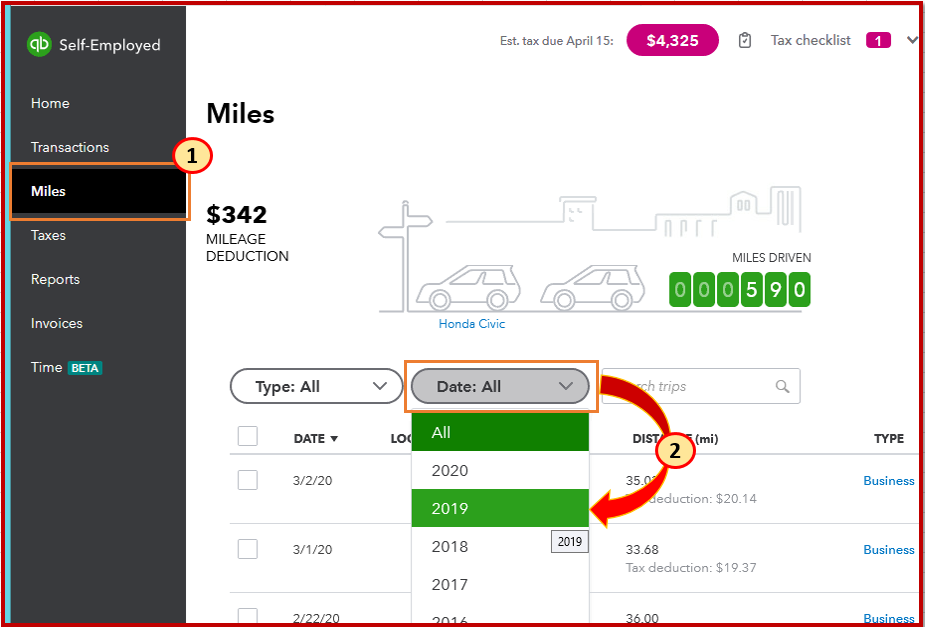

- Go to Miles from the left menu.

- Select 2019 from the Date drop-down.

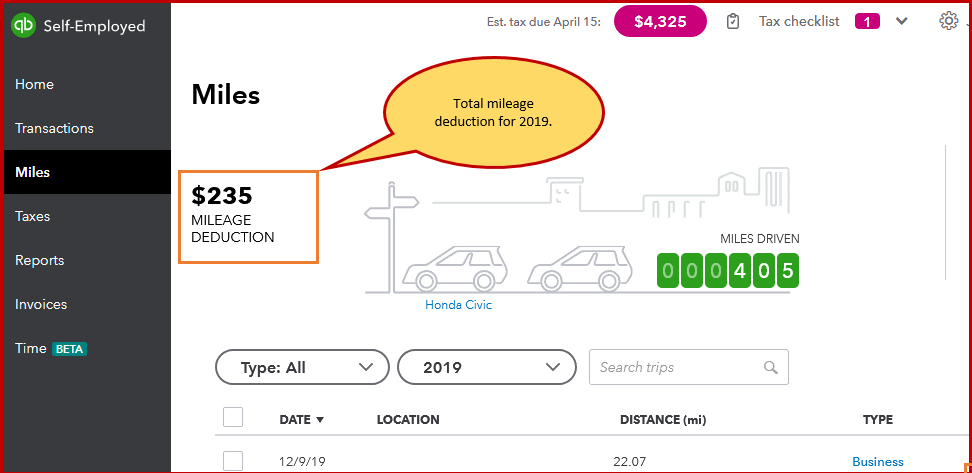

- You'll see the total mileage deduction on the left side of your vehicle.

What trips should I categorize as a business?

If you own or lease a car, you can deduct the miles you drove for work-related purposes. Here are some examples of business trips:

- Driving for a rideshare company (check with your specific company for details)

- Going between offices or work locations

- Picking up supplies

- Dropping off orders

- Having coffee with clients.

I've also added the About the Miles page and vehicle info settings article to review your vehicle information. It's important to enter correct information so you have them ready when it comes to annual tax time.

If you're referring to something else, feel free to leave a comment below. I'm always around to help you out.