Allow me to enlighten you about modifying your federal withholding tax, idf_5c.

Taxes are calculated automatically in QuickBooks Online (QBO) Payroll. We can't edit the federal withholding tax amount.

The Federal Income Tax (or withholding) is based on the following factors below:

- Employees' W-4

- Pay frequency

- Gross wages

- Percentage/wage bracket method

Thus, a workaround is adding an extra withholding to increase the calculated amount. Please refer to the steps below:

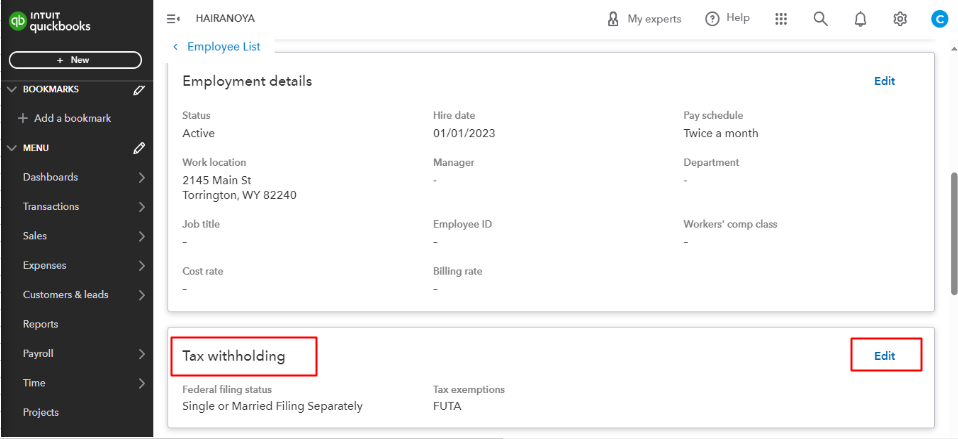

- Go to Payroll and choose Employees.

- Select the employee. Then, scroll down to the Tax withholding section and click Edit.

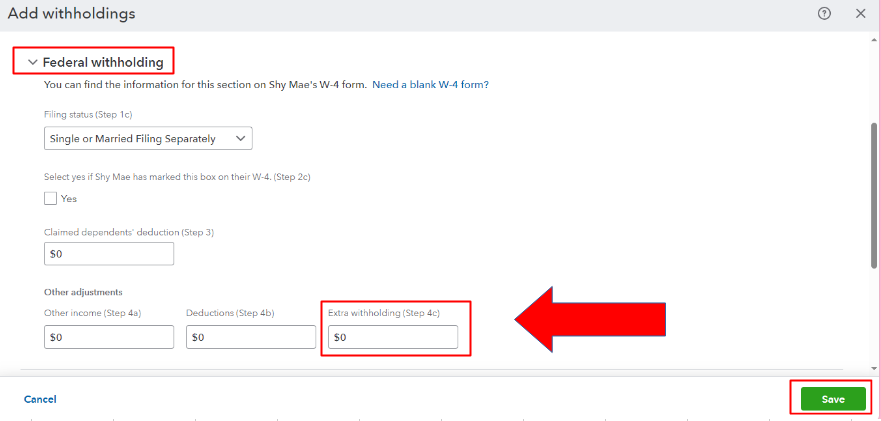

- Tap the Federal withholding dropdown and make the modifications in the Extra withholding box under Other adjustments section.

- Hit Save.

Furthermore, check out this resource to help you view information about your business and employees: Run payroll reports.

I'll be around if you have other concerns about managing your federal withholding tax or running payroll reports in QBO. Take care!