You can remove and recreate the paycheck if it was not paid via direct deposit (DD), thayers. I'll provide the detailed procedures below.

Beforehand, let's double-check your paycheck's mapping. It can impact how it will show on your report and Chart of accounts (COA).

It's essential to note that reviewing this would depend on the QuickBooks version you're using.

For QuickBooks Online (QBO):

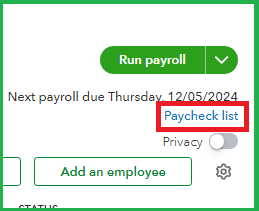

- Go to the Payroll menu, then Employees.

- Click the Paycheck list option.

- Click the Filter dropdown and modify the Date range and other necessary Filters.

- Once done, hit Apply.

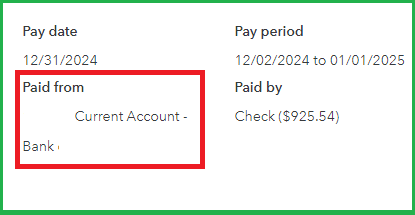

- Select the paycheck from the list and check the indicated Paid from account.

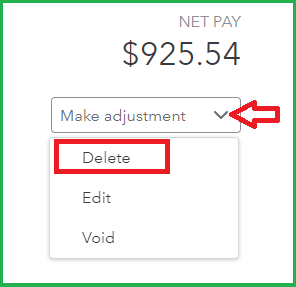

You can safely erase the paycheck if it was not processed through DD. To do so, click the Make adjustment dropdown, choose Delete, and confirm the action by selecting Delete again.

After that, let's edit your payroll accounting preference to post it to the correct bank:

- Go to the Gear icon, then Payroll settings.

- Scroll down and click the designed Pencil icon on the Accounting field.

- Tick the Pencil icon on the Paycheck and payroll tax payments section.

- Choose the correct Bank Account.

- Hit Save. Then, Done.

Then, recreate the paychecks to record the transactions in the correct register:

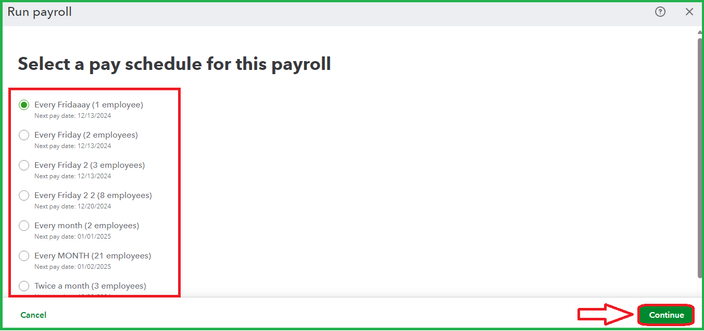

- Go back to the Payroll menu, then Employees.

- Click Run payroll and Select a pay schedule for this payroll. Then, Continue.

- Enter all the necessary details and proceed with generating the paychecks.

However, the steps above are not applicable if the paycheck was processed and sent via DD or not from the last period. In this scenario, you can create a journal entry to transfer the amount from one bank to another. You can seek guidance from an accounting professional to ensure this entry is entered accurately in QuickBooks:

Meanwhile, here's how you can review the mapping for QuickBooks Desktop (QBDT):

- Go to the Reports menu, then Report Center.

- Enter and run the Payroll Transaction by Payee on the Search bar.

- Modify the Dates field.

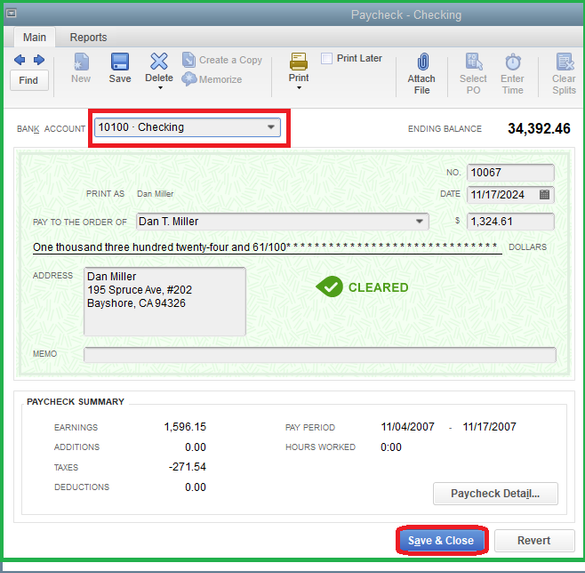

- Review the paycheck's linked Account. If inaccurate, you can click each paycheck and select the correct Bank Account.

- Once done, hit Save & Close.

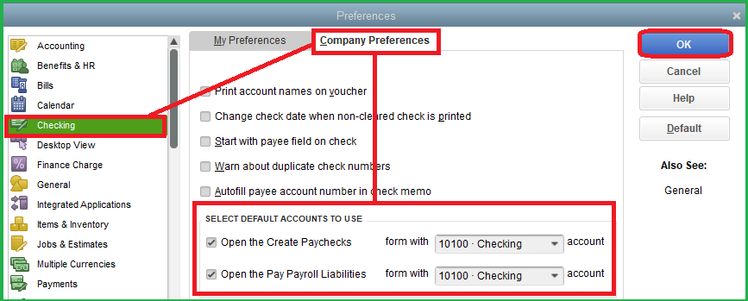

Following that, change the Open the Create Paychecks account. This way, your upcoming paychecks will be posted to the correct bank:

- Go to the Edit menu, then Preferences.

- Choose Checking and then Company Preferences.

- From the Select Default Accounts To Use section, choose the appropriate account.

- Once done, hit OK.

Nevertheless, you can follow this article to handle your situation if it's paid through DD: Recreate a missing or voided direct deposit paycheck in QuickBooks Desktop Payroll.

I'm also attaching this article, which will be handy once you need to modify and handle your pay schedules in the software: Set up and manage payroll schedules.

If you have more questions about your missing paychecks in the QuickBooks COA, hit the Reply button. We in the Community are always here to help.