Form 941 is now available in QuickBooks Online (QBO). Recognizing the importance of precise tax form management, I offer you a more comprehensive explanation to address your inquiry thoroughly.

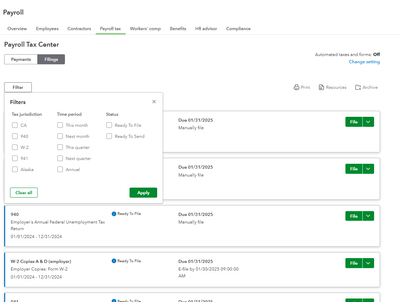

If you've opted Intuit to file forms on your behalf, all the tax forms are available to view or print approximately 35 days after the end of the quarter. If the Automate Taxes and Forms option is disabled, let's ensure to apply the correct filters. This way, we can able to view your tax forms.

To manage your payroll details:

- Go to the Payroll section.

- Select Payroll tax from the options above.

- Choose Filter and ensure the correct filters are applied.

If you continue to have difficulty viewing your tax forms, please get in touch with our Customer Care Support Team. For information on the best times to contact our team, please refer to the following article: Get help with QuickBooks products and services.

Additionally, if you'd like to review your past tax forms and payments, please refer to this helpful article for guidance: View your previously filed tax forms and payments.

Enhance your workforce management with QuickBooks Payroll. This advanced tool streamlines the automation of employee payments, guaranteeing precision and timely execution. By tracking work hours, you have better control over scheduling and can effectively evaluate team performance. This allows you to customize your management approach to align seamlessly with your business objectives.

If you have any questions or need further assistance with Form 941, Kindly Reply to this thread. We're here to help ensure your tax form management is precise and seamless. We're eager to assist you in any way we can as you continue to manage your business finances.