Thanks for joining us here today, @usermonica.whitten.

I have some information about reimbursing the use of your employees' car. You record it as reimbursement, and it's non-taxable. You'll have to add the reimbursement pay type and then use it when creating a paycheck. Let me guide you how.

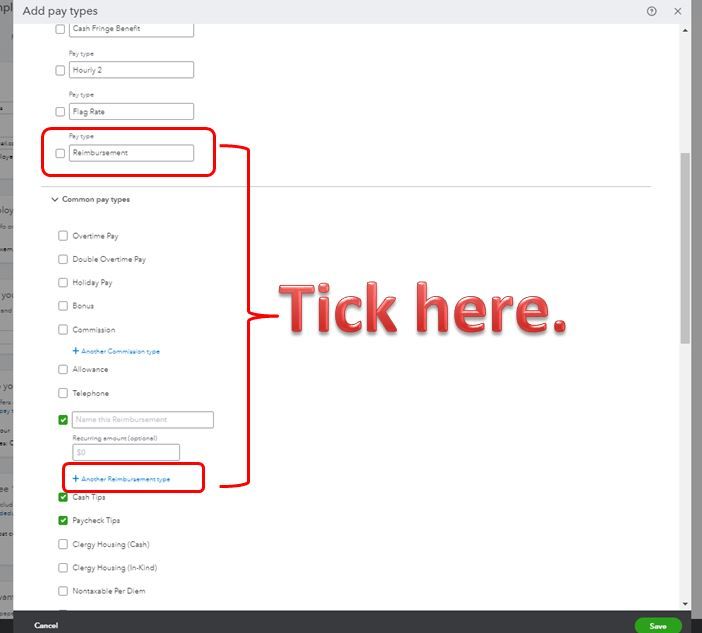

To add the Reimbursement pay type:

- Go to Payroll, then select Employees.

- Look for the employee you want to reimburse, then hit Edit employee.

- Under How much do you pay this employee? pick Add additional pay types if you haven't selected any other pay types, or tap the pencil icon if you have.

- Tick the Reimbursement checkbox, or the + Another Reimbursement type link and enter "Reimbursement".

- Click Save and then Done.

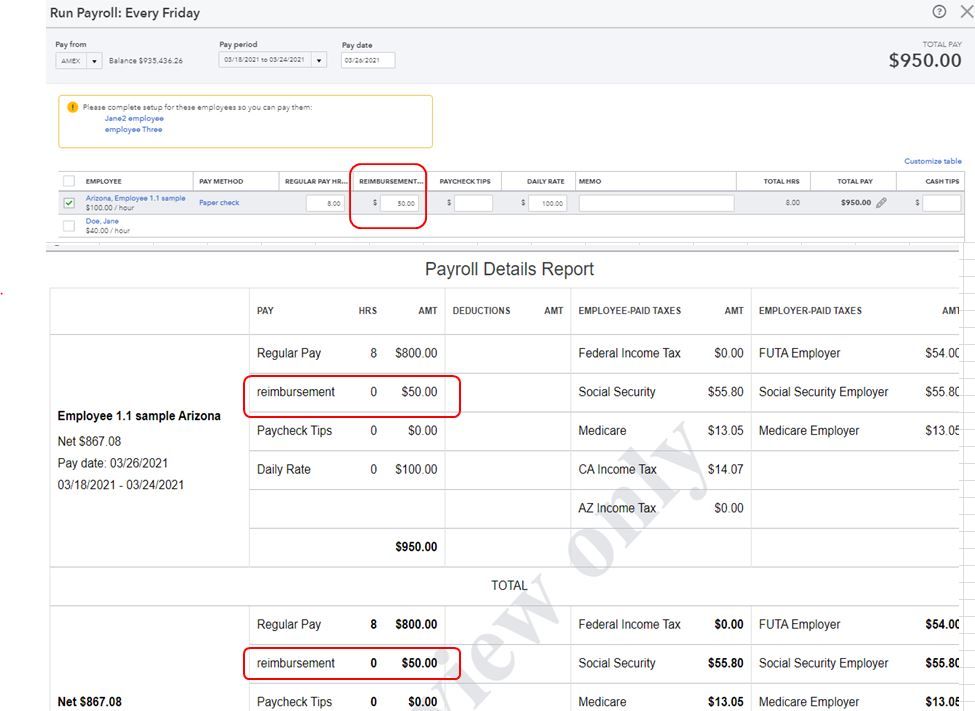

After adding the pay type, run a payroll to add it on the employee's paycheck. Here's how.

- Go to Payroll menu and select Employees.

- Tap Run Payroll. Then, choose the employees you'd like to pay.

- Enter the hours and the Reimbursement amount.

- Tick Preview payroll. Then, Submit payroll.

- Click Finish Payroll.

Please check this article for more information about reimbursement: Reimburse an employee.

Additionally, here's a link that cover all the tasks you can do when using the payroll feature.

Keep me posted if you still have questions or concerns with payroll. I'm always here to help. Take care and have a wonderful day ahead.