Thanks for reaching out to us here in the Community, @stanleyttu.

Yes, QuickBooks Online (QBO) Payroll is designed to automatically stop calculating and making SUI payments once your employees' wages reach the state-imposed wage limit, which for Texas is $9,000.

Given that you have an overpayment, I recommend reviewing your previous paychecks to ensure they were calculated correctly. Here's how you can do that:

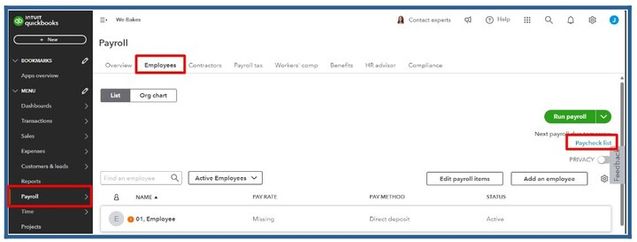

- Navigate to Payroll, then Employees.

- Click Paycheck list.

- Select the paycheck(s) you'd like to review.

If your paycheck calculates to zero, it means that the wage limit has not been reached, and this could be why SUI is still being calculated.

However, if your paychecks are calculated accurately, I recommend contacting our QuickBooks Online Payroll Support team. They have specialized tools, including screen-sharing capabilities, to investigate and resolve issues thoroughly, provide guidance on managing overpayments, and create a support ticket if further investigation is needed.

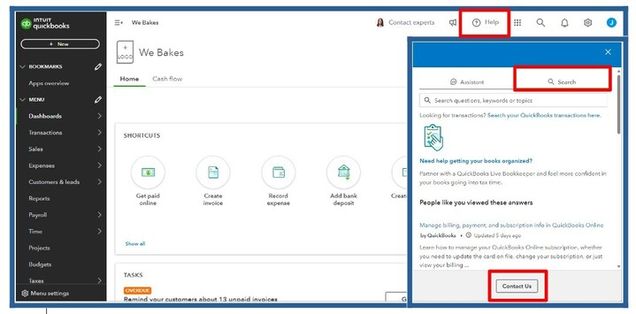

- Log in to your QBO company, then go to Help (?).

- Click on Search, then Contact Us.

- Select Payroll as the topic, then choose Have us call you to save your spot in line. We will call you back to connect with us.

For a deeper understanding of federal and state payroll tax wage bases and limits, refer to this article: Understand payroll tax wage bases and limits. This contains information on how these limits impact your paychecks and tax payments in QuickBooks.

Moreover, QuickBooks offers a range of payroll reports that offer a comprehensive view of your employee's gross pay, deductions, and tax data over a specific period. For a detailed list of available payroll reports and instructions on how to access them, please visit this article: Run payroll reports.

If you have further questions about SUI payments and wage limits in QuickBooks, please don't hesitate to reach out. We, in the Community, are always here to help.