Hello there, @office234.

I'll share some insights on how you can calculate and record Q1 figures for 941 and DE9/9C taxes using W-2 information.

It would be best to contact our Payroll Support team if you have already run payroll into the system. From there, they can pull up your account and assist you to enter data like prior paychecks.

Let me show you how:

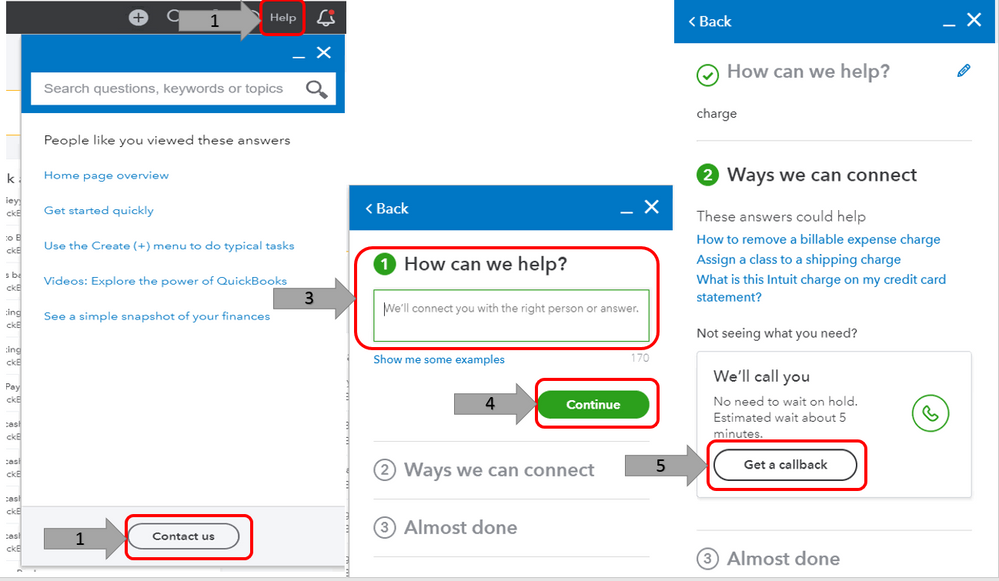

- Sign in to your QuickBooks Online company.

- Select Help on the top right and click Contact Us.

- Enter your concern prior payroll adjustment and then hit Continue.

- Choose to Start a chat or Get a callback.

In case you haven't run payroll in the system and paid the taxes for the prior period, you can record the tax payments in QuickBooks Online (QBO). Here's how:

- Go to the Taxes, then select Payroll Tax.

- Choose Enter Prior Tax History, then hit Add Payment.

- Enter the needed information and hit OK.

- Repeat the steps until all the tasks will clean up.

See this article for the detailed guide on how to enter tax payments made for prior tax periods: Recording prior tax payments.

For future reference on how to view/archived forms and check the tax payments you've made in your account, please visit these articles:

Feel free to leave a comment below if you have follow-up questions about recording prior tax history. Anytime I can help. Take good care!