It’s nice to see you in the Community space, mobrien3287.

I can help ensure you can add accounts for your 1099-MISC.

Before doing so, review your vendors’ profile and check if the box for Track payments for 1099 is selected. This is to ensure the payments are tracked via 1099-MISC.

Next, prepare the form in QuickBooks. For the detailed instructions, follow these steps:

- Go to Expenses on the left panel, and select Vendors.

- Choose Prepare 1099s.

- Review your company information, and click on Next.

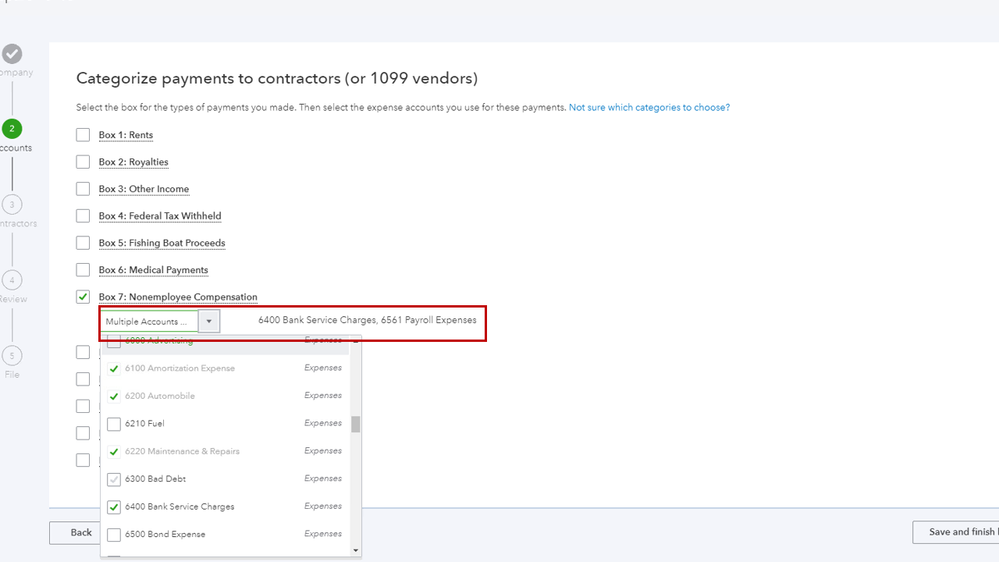

- In the Categorize payments to contractors (or 1099 vendors) window, select the types of payment you made.

- Click on the drop-down, and select the expense accounts you want to use.

Note: Most contractor payments are considered non-employee compensation, so most businesses select Box 7.

- Choose Next, and review your contractors’ information.

- Select Next.

- Click on Finish preparing 1099s.

After following these steps, the added accounts will show on the form. I'm also attaching an article that will guide you on how to prepare 1099-Misc form.

Please let me know if you have additional questions processing 1099s. I'll be happy to lend a helping hand. Wishing you the best.