I can guide you through how, @MickWein.

You'll have to update your SUI rate from the payroll settings. QuickBooks will automatically adjust your paychecks. Let me guide you how.

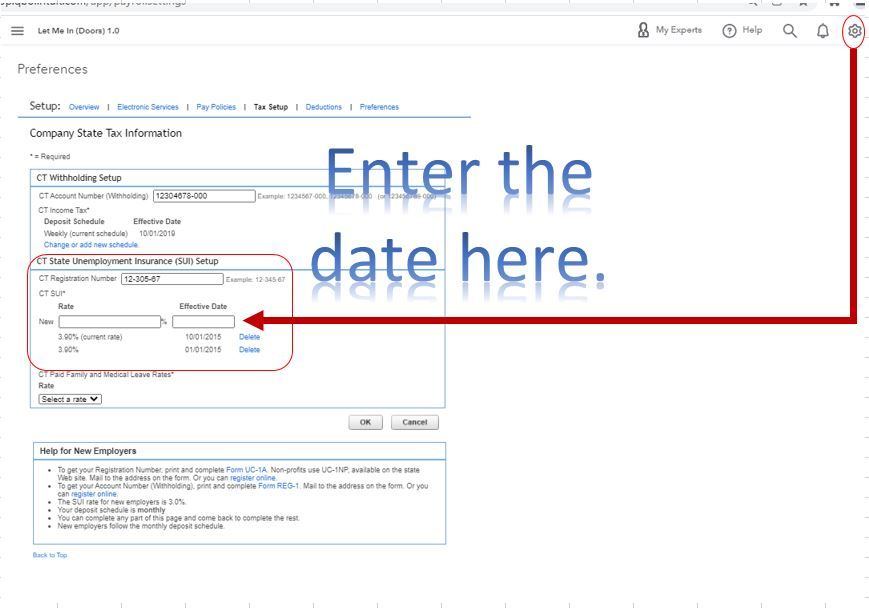

- Go to Gear, then choose Payroll settings.

- Next to the state you want to update, select the Edit ✎ icon.

- In the State Unemployment Insurance (SUI) Setup section, tap Change or add new rate.

- Enter your new rate and its effective date. For most states, the effective date is 1/1. For TN, VT, and NJ the date is 7/1.

- If you have already created paychecks with the wrong rate, or need to correct a prior quarter rate, contact us.

- If you have a surcharge or assessment tax rate, enter it here as well.

- Enter your new rate and its effective date.

- Click OK to save your changes.

For details, check out this guide: Update your State Unemployment Insurance (SUI) rate in QuickBooks Payroll.

Also, here's a link that'll help you manage payroll tasks. It has our general payroll topics with articles: View all help for QuickBooks Online Payroll.

Feel free to let me know if you have follow-up questions or concerns with SUI rates. I'm always here for you. Take care and have a great day ahead.