I've got the steps to help you edit the type of withholdings taxes, clester.

In QuickBooks Online (QBO) Payroll, we can modify the state withholding tax and choose what state you won't collect any taxes.

Here's how:

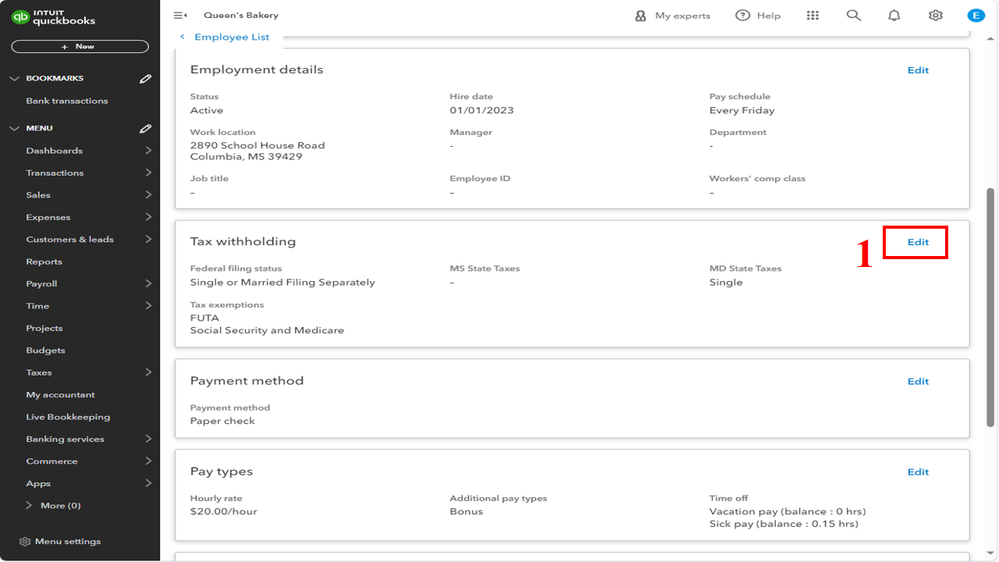

- On the Tax withholding tab, click Edit.

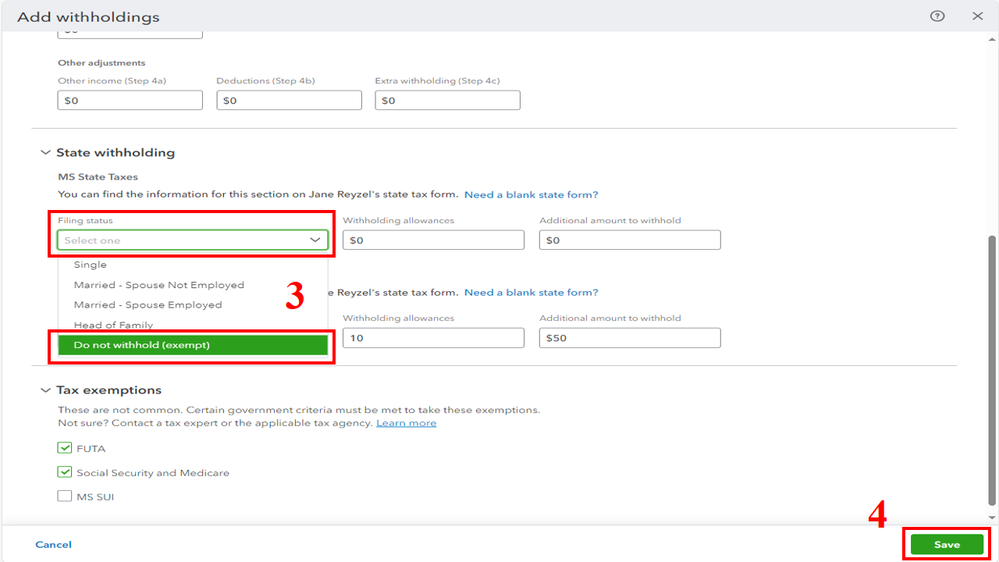

- From the State withholding section, select the State you won't collect any taxes.

- On the Filing status dropdown menu, choose Do not withhold (exempt).

- Hit Save.

For more information, visit this guide: Set up employees and payroll taxes in a new state.

Then, we can run payroll reports to give you a closer look at your business and employees.

If there's anything else you need about managing your employee's taxes, come back to this post. I'll be here to offer additional assistance. Have a great day!