We can record a regular deposit into the bank where the tax refund was transferred, dhen. I'm here to show how.

- Open your QuickBooks account.

- Go to the + New menu, then Bank deposit.

- Choose the receiving bank on the Account dropdown. Then, enter the deposit Date.

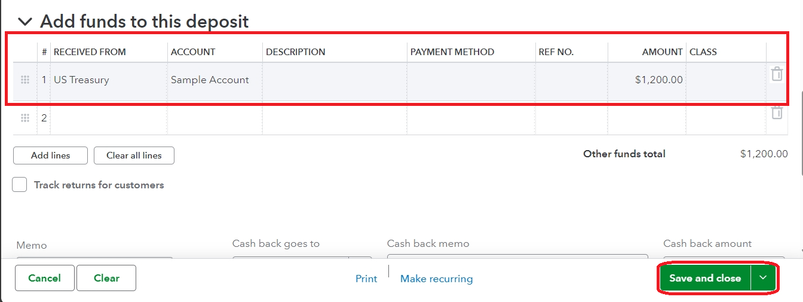

- Scroll down to the Add funds to this deposit section.

- Pick your tax agency (US Treasury) in the Received From column, select the appropriate account in the Account field, and enter the refund Amount.

- Double-check everything, and once done, hit Save and close.

On the other hand, if you need to record tax adjustments in QuickBooks, our Customer Support Team can help you through the process. They have the tools to make necessary corrections to your tax records.

You may also review your previously filed tax forms and payments on the platform. Doing so can help you verify the accuracy of your entries and identify any possible discrepancies.

Should you have follow-up questions about handling payroll tax refunds in QuickBooks, click the Reply button. The Community is always here for you.