Let me assist you with your payroll concern in QuickBooks Online (QBO) Payroll, @stephanie-tsang.

You can edit the amount in the Employee deduction section to zero once your employee hits the $3000 contribution. This way, QuickBooks will automatically stop the calculation for every pay period.

Let me show you how:

- Go to the Payroll menu and select Employees.

- Click the name of the employee and then select the pencil icon in the Pay section.

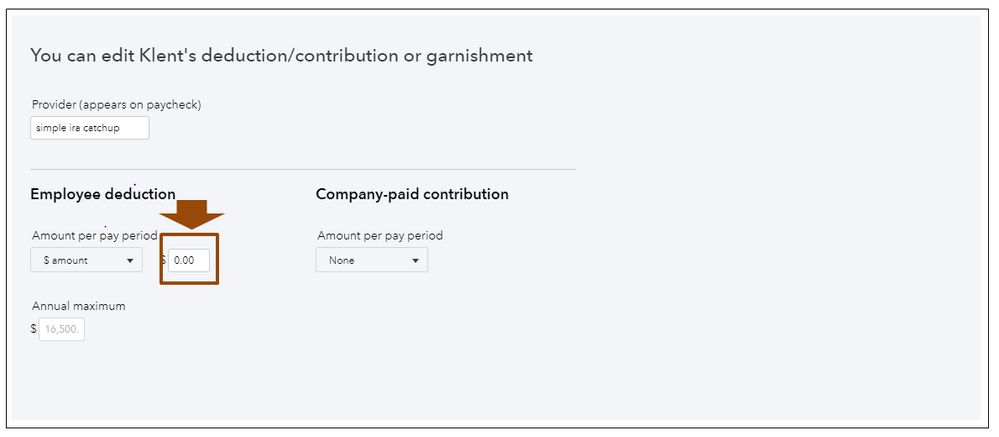

- Under Does (name of the employee) have any deduction? section, click the Pencil icon to edit.

- Change the amount to zero once your employee hits $3000 worth of contribution.

- Select OK to save the changes.

In addition, the amount that shows in the annual maximum contribution is base on the regulation that was set by the IRS. That's why changing the amount is not an option.

You can also run several payroll reports to view useful information about your business and employees in QBO Payroll.

The Community always has your back, so please let me know if you have any other payroll concerns. Have a great weekend, and stay safe.