If payment is made and QBSE still indicates an approximate amount owed, there's no need to submit payment through the software again. Instead, you'll just have to record the transaction to keep your records accurate, Ohwhaleshop.

If you paid by mail, here's how to record your Federal Quarterly Tax estimates transaction:

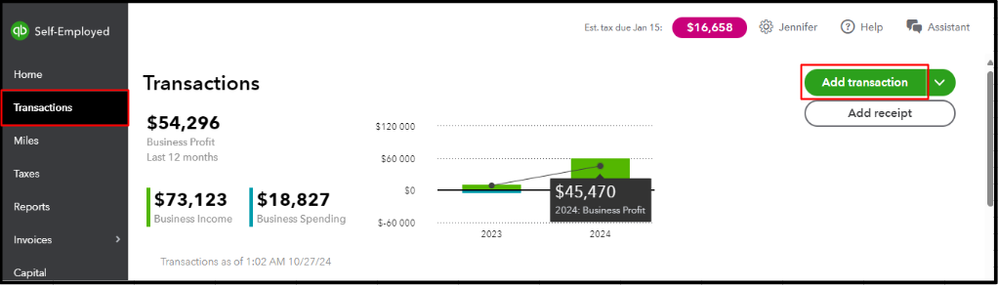

- Go to Transactions and select the Add Transaction button.

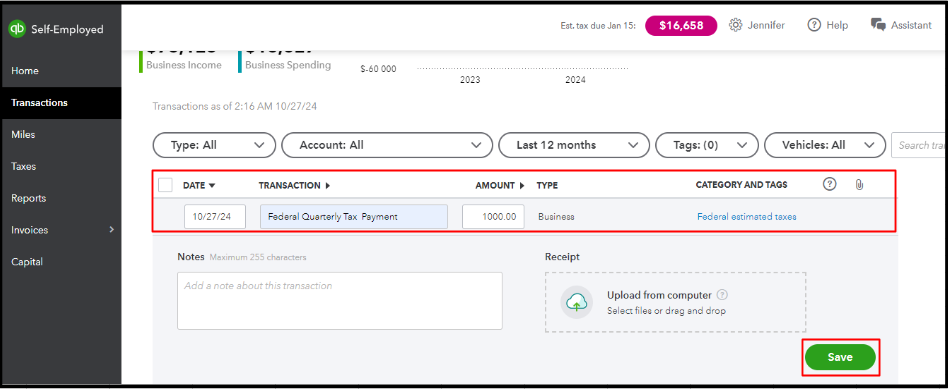

- Enter the amount and the date you made the payment.

- Click Select a Category, then choose Federal Estimated Taxes.

- Hit Save.

For more information about handling these processes in QBSE, check out this article: Pay federal estimated quarterly taxes in QuickBooks Self-Employed.

Additionally, I'll share this resource to guide you about the latest tax payment schedules: QuickBooks Self-Employed Overview.

If you have other questions about managing tax dues, comment below. I'm here to make sure your documentations are accurate.