I'm here to help keep the process of changing the information on W-2 easy and simple, jrsshopauto.

If you haven't created the last payroll yet for last year with S-Corp Health Insurance, you can set up this pay type to your employee's profile so you can add this to their paycheck.

Here's how:

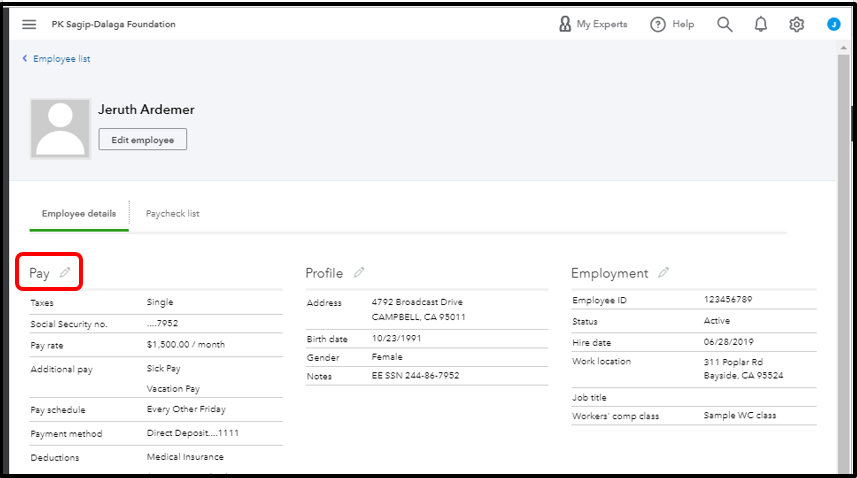

- Click Payroll in the left panel and choose Employees.

- Double-click the employee's name you want to pay the S-Corp Owners Health Insurance amount.

- Beside Pay, click the pencil icon to edit,

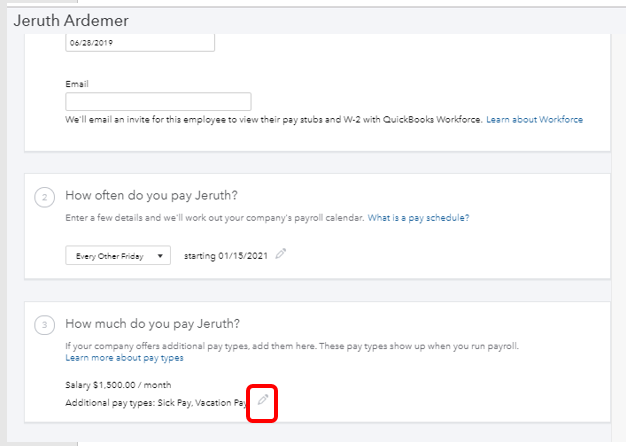

- From the How much do you pay this employee? click Add additional pay types: if you haven't selected any other pay types, or click the Pencil icon if you have.

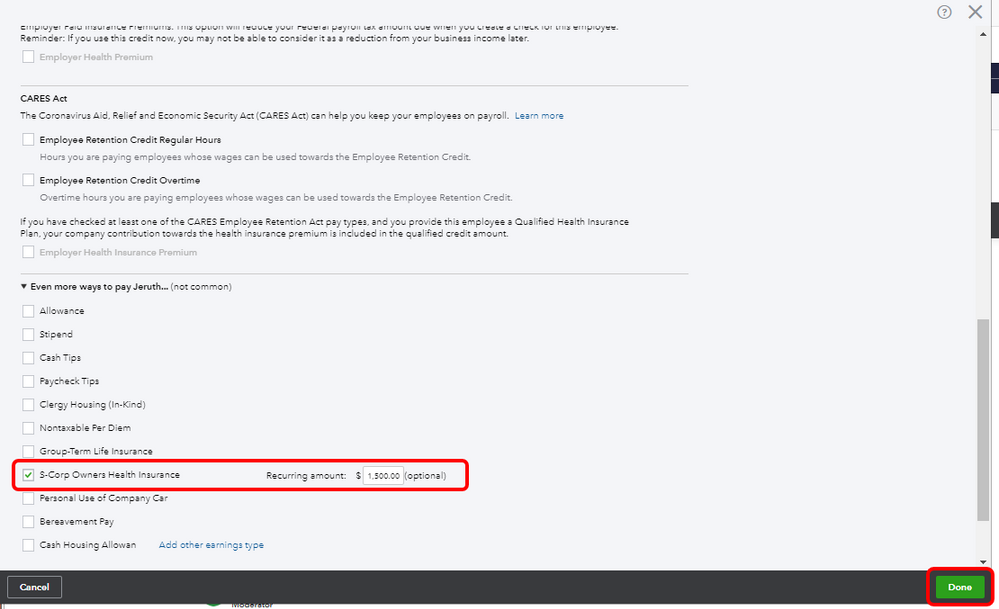

- Select the S-Corp Owners Health Insurance checkbox. If the pay type is not in the Additional pay types list, click Even more ways to pay this employee to see more pay types, and select it from there.

- Hit Done.

However, if you already run the last paycheck for last year, I'd suggest getting in touch with our QuickBooks Payroll Support to have the information changed. Agents have the necessary tools to ensure your W-2 boxes are accurate.

Please be reminded that our Support Team is available from 6:00 AM until 6:00 PM from Mondays to Fridays. Here's how to contact us:

1. Click the Help (?) icon.

2. Choose Contact Us.

3. Enter a brief description of your situation in the What can we help you with? area, then click Let's talk.

4. You'll be presented with a few options for connecting with Intuit. Select Get a call.

You might want to check this article: Report employer health insurance on W-2s. This will provide you details on how this insurance is reported on W-2s in QuickBooks Online.

If you have followed up questions regarding health insurance and other payroll forms in QuickBooks Online, please let me know. I'm always here to lend a helping hand. Have a good one.