Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Solved! Go to Solution.

Hi there, @info686.

Great to see you back in the Community. I can assist with mapping payroll payments to the correct account in QuickBooks Online.

To prevent payroll and tax payments from coming out of the incorrect account, follow the steps I have provided below:

As for the payment that has already come out of the checking account, you can correct this with a journal entry. I'd suggest contacting your accountant to ensure accuracy for the existing transactions.

Please reach out if there's anything else I can do to help, I'm determined to be your number one resource for QuickBooks.

Hi there, @info686.

Great to see you back in the Community. I can assist with mapping payroll payments to the correct account in QuickBooks Online.

To prevent payroll and tax payments from coming out of the incorrect account, follow the steps I have provided below:

As for the payment that has already come out of the checking account, you can correct this with a journal entry. I'd suggest contacting your accountant to ensure accuracy for the existing transactions.

Please reach out if there's anything else I can do to help, I'm determined to be your number one resource for QuickBooks.

Thank you so much, how do I go about making a journal entry?

Thanks for following this thread, @nancivnpac.

If your concern is similar to the issue above, yes, you can create a journal entry to correct your payroll record. Be sure to update the Accounting Preferences so payroll and tax payments are deducted to the right bank.

Before adding the entry, I suggest consulting an account for guidance on the specific posting account. This is to ensure the accuracy of your books. To help find one, visit this link and then enter your city or zip code in the field box: ProAdvisor.

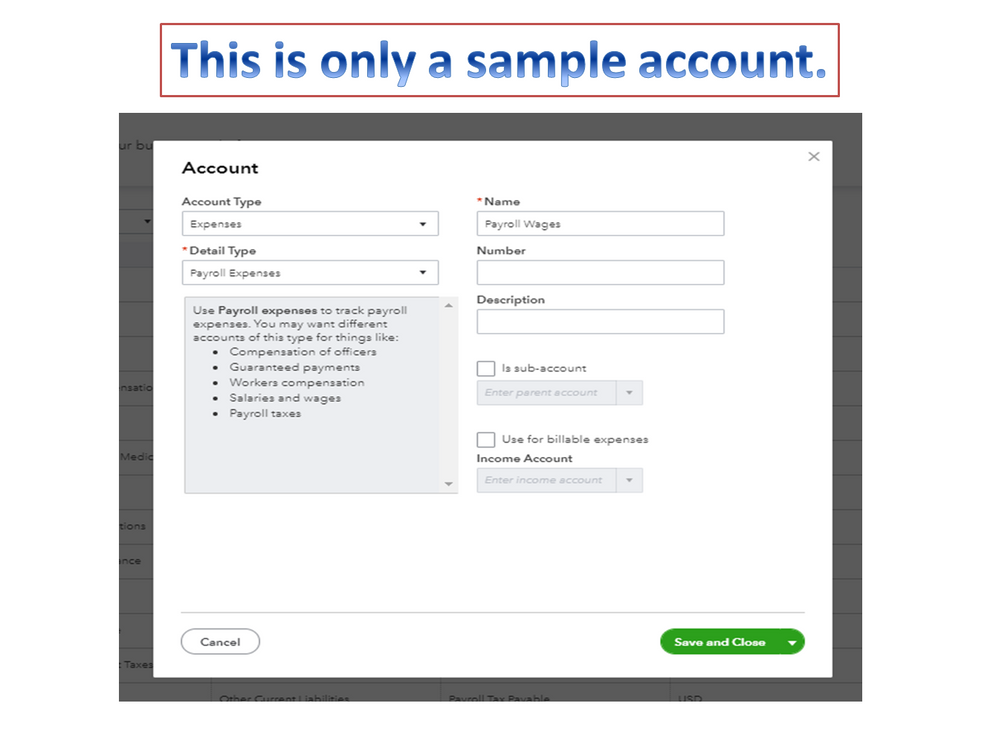

Once you have the complete details, set up the accounts in QBO and we’ll have to do it one at a time. Here’s how:

Now that everything is already setup, you can start creating the journal entry. With just a few clicks, you can perform this task.

I’m also adding an article that provides an overview of how to enter the debits and credits for wages and taxes, as well as a sample paycheck: Manually enter payroll paychecks in QuickBooks Online.

Leave me a comment below if you have any clarifications or questions about QuickBooks. I’ll be glad to lend a helping hand. Enjoy the rest of the day.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here