Hello there, innominate. I appreciate you sharing your concerns in detail. Your setup is already correct. I'll walk you through how to make your payroll item appear in the Payroll Center.

Let's create a scheduled payment for the payroll item to appear in the Payroll Center area. You can follow these steps:

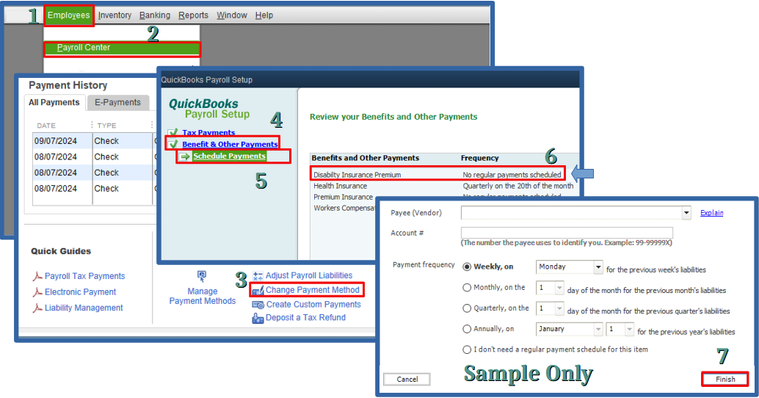

- Hover over the Employees menu. Choose Payroll Center.

- Select Change Payment Method in the Other Activities section.

- Press Benefit & Other Payments, then pick Schedule Payments.

- Double-click on the specific payroll item and fill in all the necessary details. Once done, hit Finish.

After completing these steps, the payroll item will appear in the Payroll Center, specifically in the Pay Taxes & Other Liabilities section.

Moreover, you can visit these resources as a guide in managing your payroll items and employee's paycheck:

Rest assured that completing the steps above will ensure the payroll item will appear in the Payroll Center, which makes it very accessible for you. I'm still here if you need additional questions on this matter. Stay safe, and best wishes!