Good day, fmc.

It’s great to see that you are preparing to process a year-end annual reimbursement for your health insurance premiums via your S-Corp, of which you are the sole shareholder. It’s important that you know the $19K should be reported as wages but is exempt from Social Security, Medicare, and other specified taxes like FUTA.

The tax treatment for S-Corp medical insurance payroll can fall into one of two categories:

- Partially taxable, which includes Federal Income Tax (FIT) and State Income Tax (SIT) only.

- Fully taxable, encompassing FIT, Social Security, Medicare, and SIT, with State Unemployment Insurance (SUI) varying by state.

To ensure the correct taxability for your S-Corp medical insurance, it's advisable to work closely with your accountant or tax advisor.

Once it's verified that S-Corp insurance is exempt from Social Security and Medicare (FICA) taxes, as well as FUTA, you can select No, my employee will pay the taxes when running the Fringe benefit only paycheck since the taxable amount will be based only to this fringe benefit. You can follow these steps:

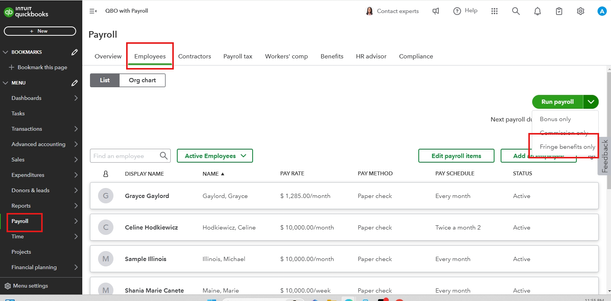

- Go to Payroll. Then, Employees.

- On the Employee's page. Select the drop-down beside Run payroll.

- Select Fringe benefits only.

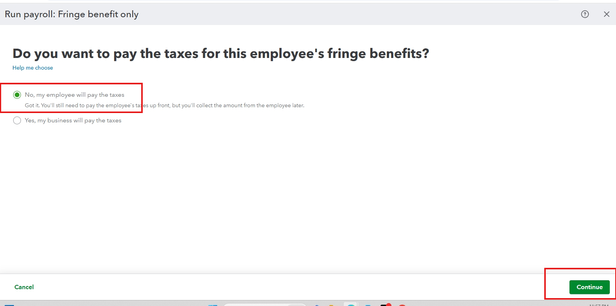

- On the Do you want to pay the taxes for this employee's fringe benefits? page, choose No, my employee will pay the taxes.

- Hit Continue.

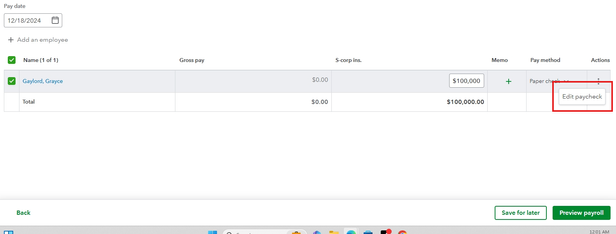

- Enter the S-Corp Ins. amount.

- Click on the ellipsis vertical icon, and then, Edit paycheck and review the Employee taxes section.

For your reference, open this article on how to set up an S-corp medical payroll item for your corporate officers.

For your future reference, open this link: Run payroll report.

If you require any help setting up your tax exemptions, please don't hesitate to reach out. We're always here to provide assistance and address any concerns you may have.