Hello there, hasames,

Let's give remaining amount to your employee by creating a second paycheck. Doing this will make sure you have accurate payroll records including those taxes in QuickBooks Online Payroll.

The following steps shown below will guide you through the process:

- Select Payroll from the left navigation bar, then Employees.

- Click Run payroll.

- Choose a pay schedule, then Continue.

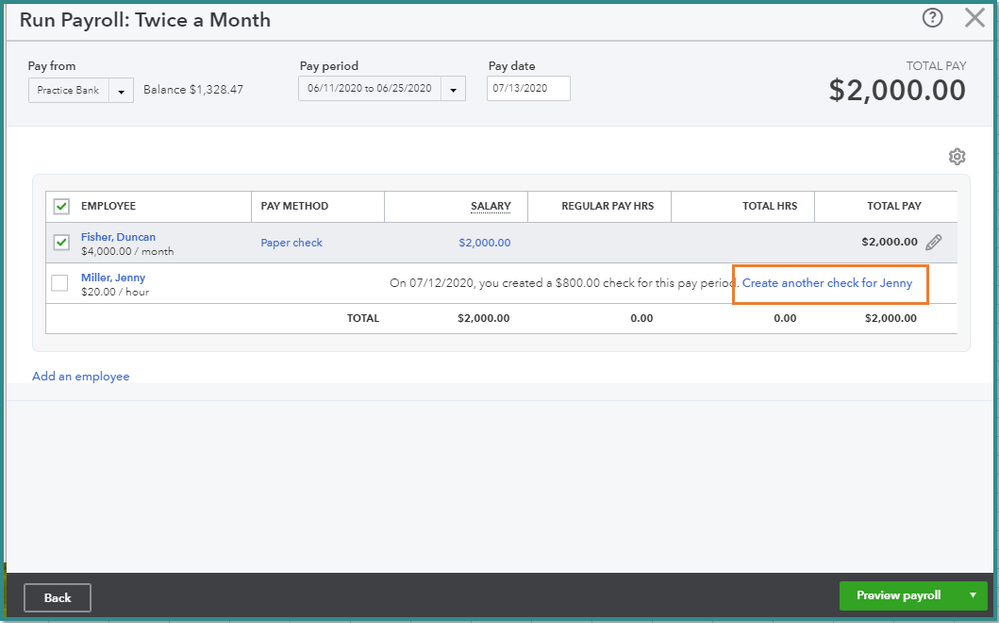

- Mark the employee you want to pay, then choose a pay period.

- Click the Create another check for the employee.

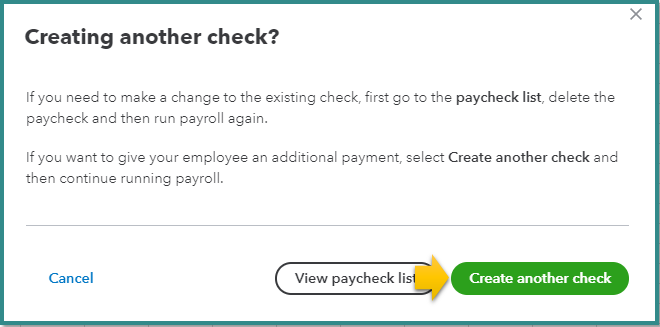

- Choose Create another check to confirm.

- Follow onscreen instruction, then continue submitting the payroll.

If ever you want to correct the previous paycheck, I suggest chatting our QuickBooks Online Payroll Team. They can void the payroll so you can manually re-create the pay out with the exact amount.

Then, write a check for the missing net pay and hand it over to your employee.

Stay in touch by commenting below. I'm always around whenever you need anything else concerning payroll.