Thank you for visiting the Community, francuone.

Let's head over to the Payroll Tax Center to send your CP 136 tax notice. I'm here to make sure you can complete the steps in just a few clicks.

Here's how:

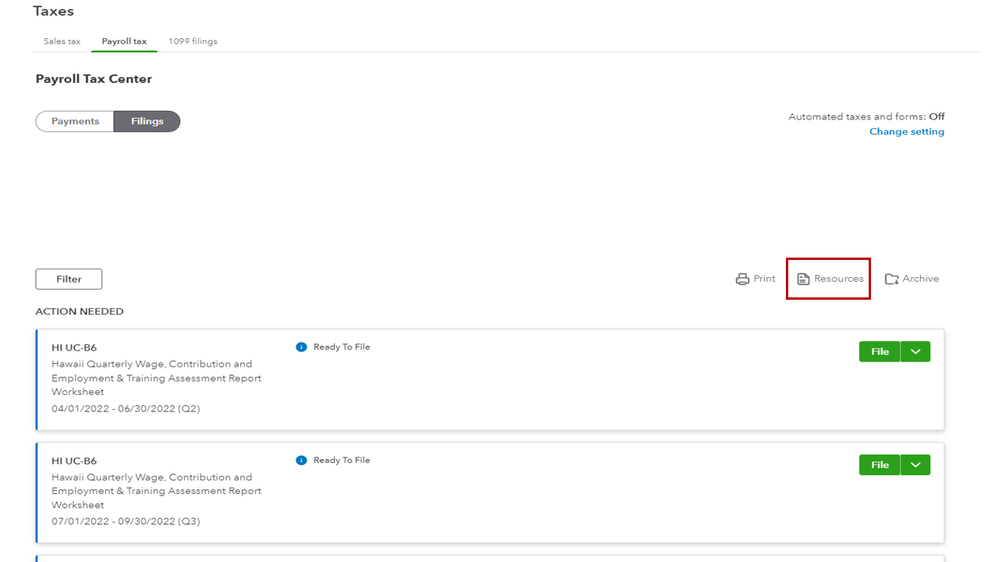

- In your company, go to the Taxes menu on the left panel and choose Payroll tax.

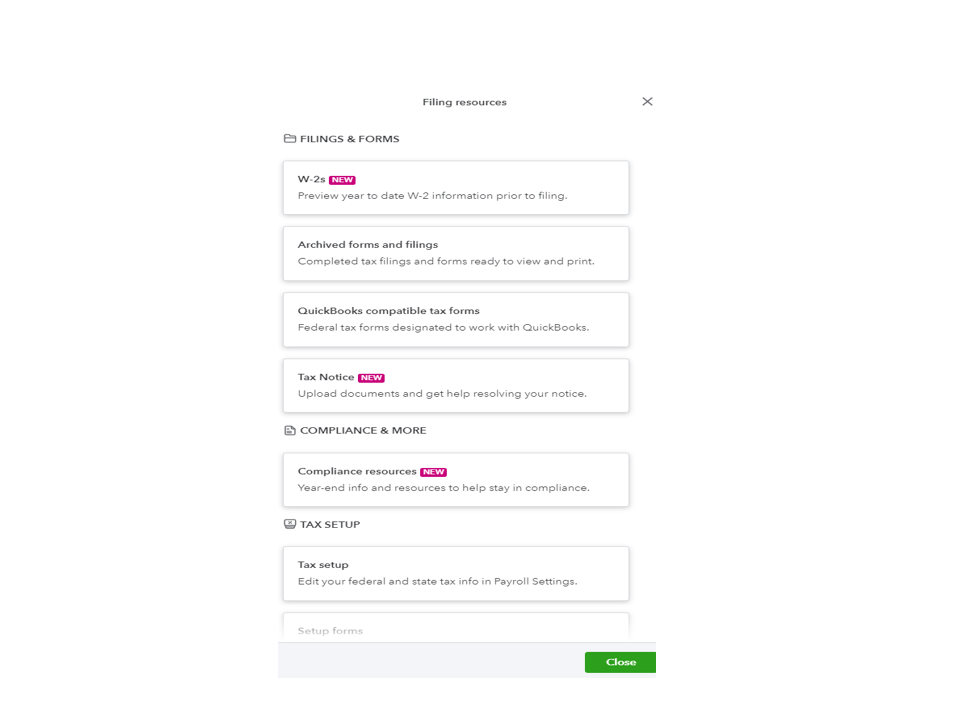

- In the Payroll Tax Center, select Resources to display the Filing resources window.

- Follow the on-screen steps to send the tax notice.

You'll receive a confirmation email with a case number and more information as soon as we receive your tax notice. When the process is complete, a tax specialist will email you with the required resolution, any steps we took on your behalf, as well as additional action required from you.

For users who no longer use our payroll service, send the notice to us via email at taxnoticeresolution@intuit.com. Then, add it to your email as an attachment. These are the acceptable formats: .pdf, .jpeg, .doc or .docx, .xls or .xlsx, .tiff.

This reference explains in detail how to handle tax notices in QBO Payroll: Send in your payroll tax notice.

If you need more help or details on a specific payroll process, feel free to browse our online resources. There, you'll find topics that will walk you through the steps of managing your employees' information, processing payroll, dealing with taxes, and submitting payroll forms.

If you need any help managing your taxes and other payroll-related processes, leave a comment below and tag my name. I'll jump right back in to assist you, francuone. Have a great weekend.