Hello, @ccpjim. I've got some information on how you can set up union contributions to be deducted from the company in QuickBooks Online (QBO).

We can make adjustments to ensure that union contributions are deducted from the company and reflected on the paycheck.

Here's how:

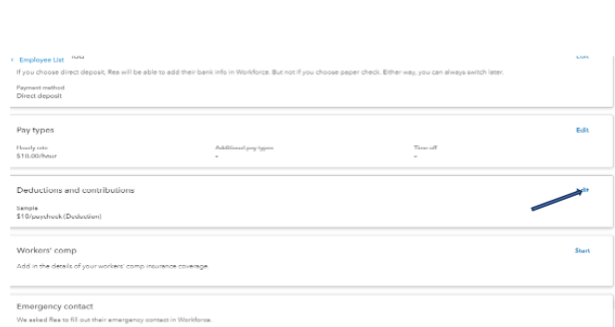

- From the Payroll menu, select Employees.

- Select your employee.

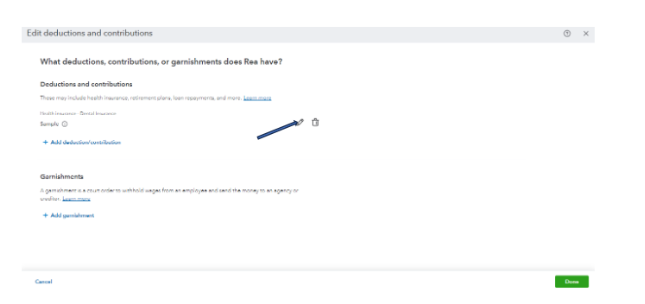

- Click Edit from Deductions and contributions.

- Next to the contribution you want to modify, select Edit.

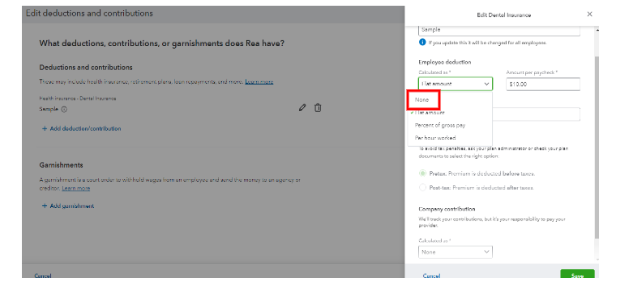

- Select None from the Calculated as* drop-down under Employee deduction.

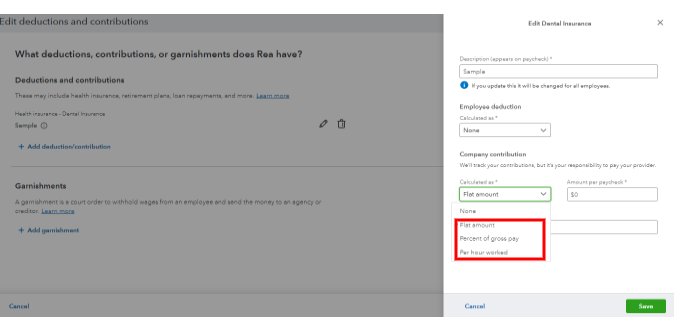

- From Calculated as* drop-down under Company contribution, select how you want it calculated from the lists.

- Click Save, then Done.

You can refer to the screenshots below:

Moreover, if you want to set up another company contribution item, refer to this guide: Set up a company contribution item in QuickBooks Online Payroll.

Additionally, to learn more about how to manage payroll reports efficiently in QuickBooks Online, you can check this guide: Run payroll reports.

If you have follow-up questions about setting up company contributions or any other concerns within the program, please let me know by replying below. I'd be happy to help. Have a good one.