Having a clear view of your finances, particularly managing your Escrow account, can lead to better business results, Roberts. I have some info on this process.

You can reduce your Escrow liability account by using that same account as the category on the check/expense entry. Then, make this entry Billable to reflect it on your client's account and recognize the expense. I'd be glad to guide you through the process.

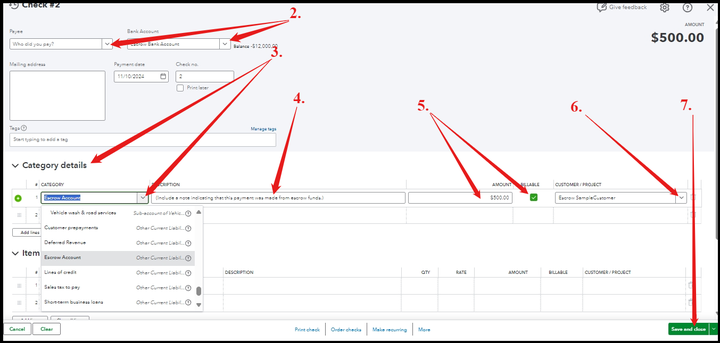

Here's how:

- Go to the + New button and select Check.

- Choose a Payee and a Bank Account for the payment.

- Navigate to the Category details section and press the CATEGORY dropdown arrow to pick your Escrow liability account.

- (Optional) In the DESCRIPTION, include a note indicating payment was made from escrow funds.

- Enter the payment amount and tick the BILLABLE check box.

- Choose your client under the CUSTOMER / PROJECT option.

- Once done, proceed to Save and close.

I've included a screenshot for your reference:

Moreover, I'd recommend working with your accountant to properly identify the best approach suitable for your business structure when managing Escrow in QuickBooks Online (QBO). If you need one, check out this article: Find a ProAdvisor in your area.

Furthermore, I'm leaving this article for future reference in handling transactions, so your books always match your bank and credit card statements: Reconcile an account in QBO.

Update us through this thread if you still have questions about Escrow accounts in QBO. I'll be around for you, Roberts. Have a wonderful day ahead.