Thanks for reaching out to the Community about your concern, hrtransmission.

I appreciate you for performing the initial steps to check why the information on the 941 form doesn't match with the payroll reports. To clarify, which line on the tax return shows a different amount?

While waiting for your reply, let me share some information on why the number of employees shows a different number. Then, run some payroll reports to determine the difference in the figures of the 941 form as well as the workers.

Line 1 of the 941 form shows the number of employees who received wages, tips, or other compensation for the specified pay period, which includes the 12th day of the third month of the quarter. Let’s use the following reports to verify the amounts shown on the federal tax form.

- Payroll Tax and Wage Summary

- Payroll Details

- Payroll Tax Liability

- Payroll Tax Payments

Here’s how to access them:

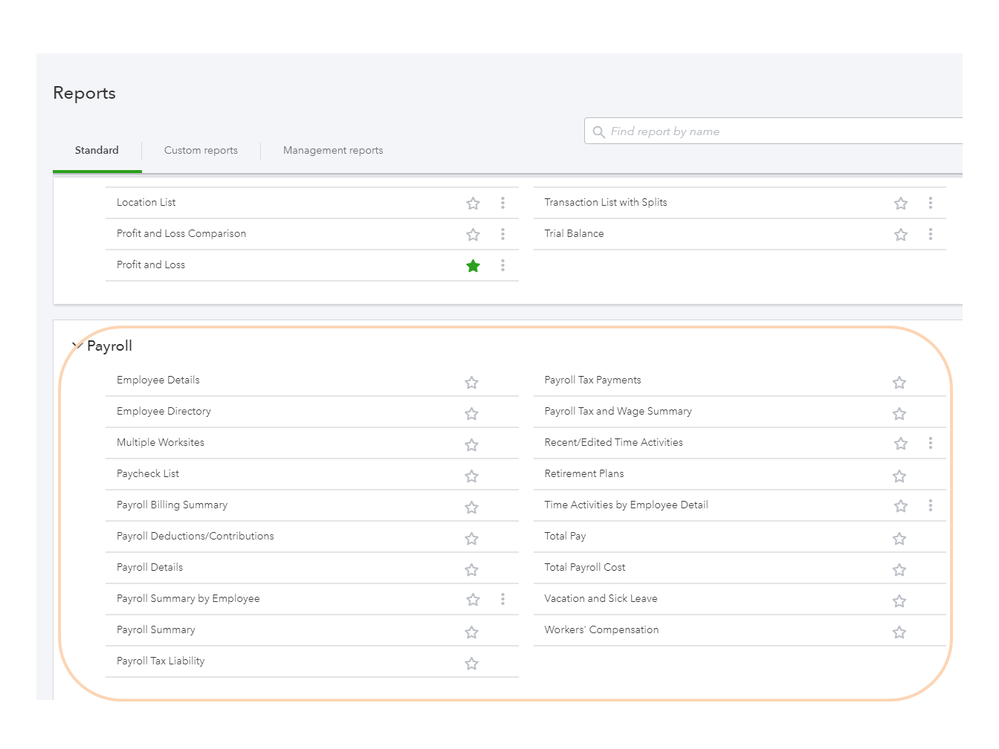

- Tap the Reports menu on the left panel to access the Standard tab.

- Go to the Payroll section to choose the report you want to run and click on it to view more details.

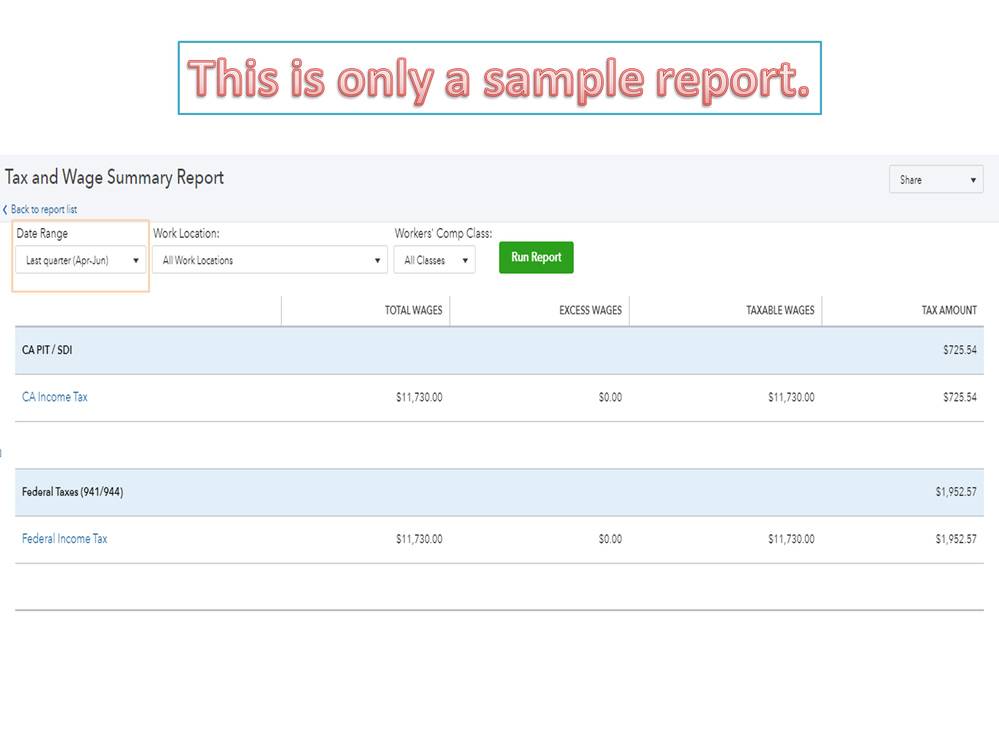

- In the Date Range drop-down, select the correct period to get the accurate data.

- Press the Run Report button to view the changes.

From there, compare the amounts and number of employees paid. If it still shows the incorrect data, I suggest contacting our Payroll Support Team for further assistance.

They have tools like screen-sharing to help find the root cause and apply a permanent fix to it.

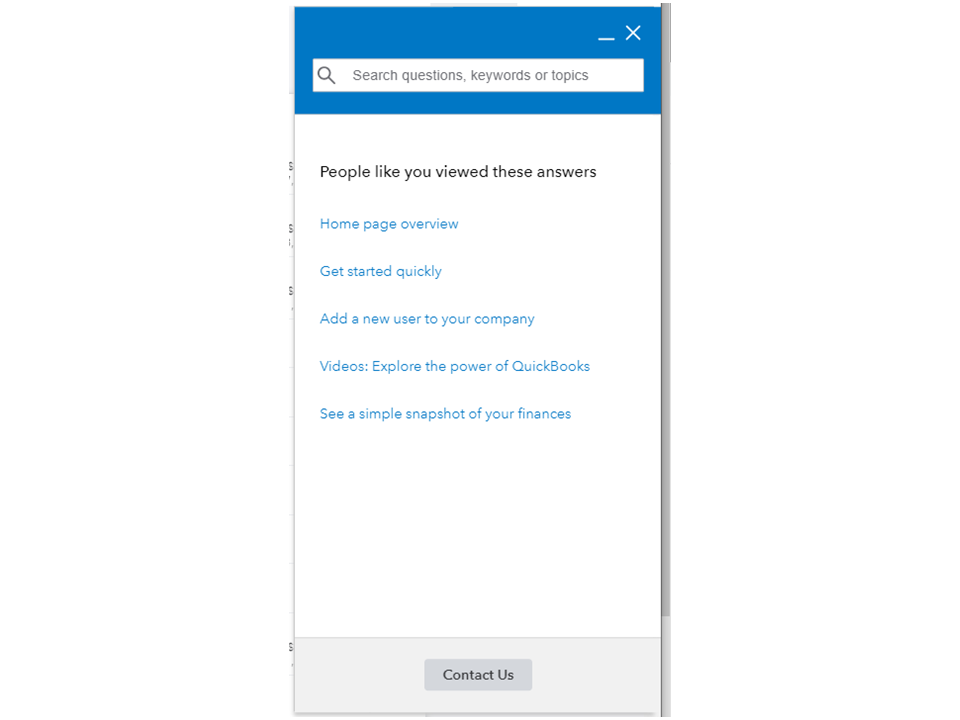

- Choose the Help menu in the upper right hand to open the Search window.

- Scroll down to click the Contact us link.

- Key in the issue/topic in the field box and then click the Let’s talk button.

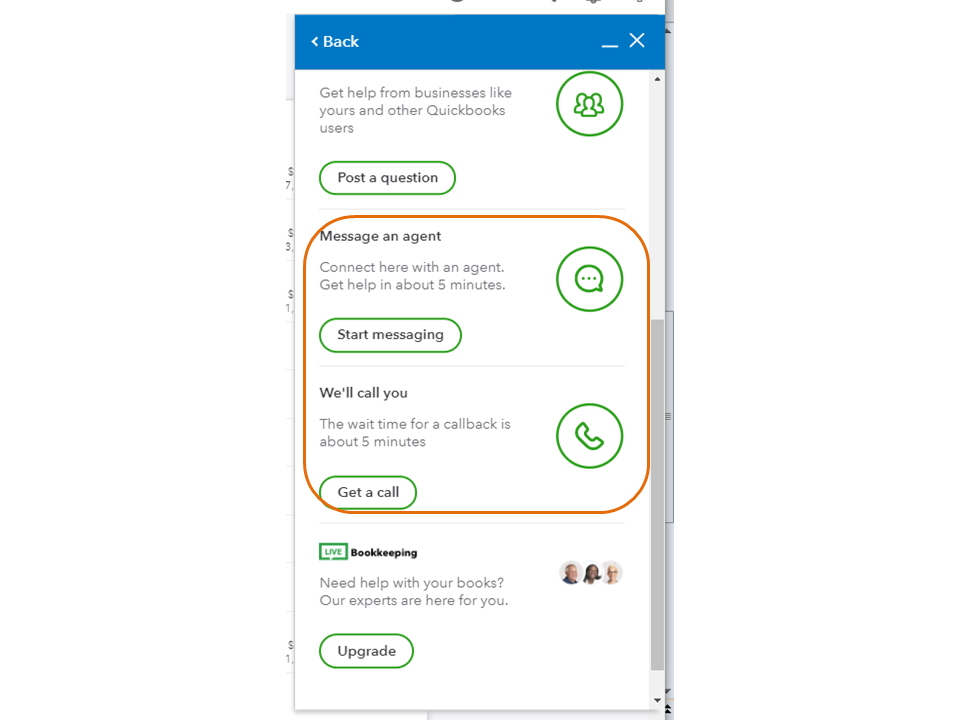

- Select Start messaging or Get a callback.

Check out the Verify federal form amounts using payroll reports article for future reference. It can help verify amounts on specific lines on the 941 form.

Also, the Run payroll reports guide provides a breakdown of reports that contains important data about your business and employees. Click on the link to open the self-help article.

Stay in touch if you have any other concerns or concerns. I’ll jump right back in to answer them for you. Enjoy the rest of the week.