Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowI have employees that work in two different states. Now MO is requiring sick pay. How do I setup sick pay to accrue on just the employees MO hours? We already have to have separate payroll items to account for KS vs MO pay, one each for regular, OT and Saturday pay for each state. I do not see that I can have sick pay accrue based on hours worked from only certain payroll items and not all hours from all payroll items. Am I missing something or is there really no way to do this in QB desktop? We would need to accrue 1 hour sick time for every 30 hours worked in MO. They can only USE 56 hours per year but can accrue more. Also, they can only roll over 80 hours to the next year.

@MidStateshc There is a workaround in Desktop, but it has its own drawbacks.

When you click the 'Open Paycheck Detail' button in the Enter Payroll Information window, the Preview Paycheck window opens.

On the right hand side, underneath the sick/vacation summary area, you'll see a 'Do not accrue sick/vac' box.

One option would be to create a paycheck for each state's hours and mark the box mentioned above for the state where you do not want to accrue sick/vacation hours.

If you do want to accrue vacation but not sick pay, I'm out of practical ideas.

I'm glad to see you here, @MidStateshc.

To accrue the sick pay to your MO employee, you'll need to assign the payroll items you created to those workers. Here's how:

Concerning the accrued 1-hour sick time for every 30 hours worked in MO isn't possible at the moment since the available accrual period in QuickBooks Desktop (QBDT) is the Beginning of year, Every paycheck, and Every hour on paycheck.

I agree with @FishingForAnswers' suggestion to create a paycheck for each state and tick the Do not accrue sick/vacation box to the state the sick hours should not accrue. I also suggest submitting direct feedback to raise this feature request to our Product Development Team.

Let me know if you have additional questions by leaving a comment below.

RE: To accrue the sick pay to your MO employee, you'll need to assign the payroll items you created to those workers. Here's how:

Does that answer the OP's question? No, it doesn't. No one asked how to accrue sick pay - and also assigning earning items to employees changes nothing about how sick pay is calculated and accrued.

Did you even read the question before copy/pasting an inappropriate canned answer just to get some sort of points?

I doubt it.

Is QuickBooks finding any resolution for this new Missouri EPST law that employers must now pay? There will be many states following and in effect in 2025

We would need to accrue 1 hour sick time for every 30 hours worked in MO. They can only USE 56 hours per year but can accrue more. Also, they can only roll over 80 hours to the next year.

With the additions of Alaska, Missouri, and Nebraska, a total of 22 states will have paid sick leave laws in effect in 2025. Washington D.C. and approximately two dozen municipalities across the country also mandate that employers provide paid sick leave. Navigating differences in various state and local paid sick leave laws can be a significant challenge for employers with multistate operations.

I haven't gotten any answers from Quickbooks. The best is Fishing for Answers work around above... so far. Hopefully they will fix it or someone else may come up with a different work around.

I think you can set that up in QB without any issue. What additional support within QuickBooks are you looking for?

The issue is we have employees that work in both Kansas and Missouri in a single pay period. QB does not differentiate between payroll items so it will accrue sick hours for each employee base on all their hours and not just Missouri hours. It also doesn't let you allow you to have hours that will accrue for sick time and not vacation time IF you also have a vacation accrual policy. At this time separate checks will have to be written for each set of hours that has a different circumstance.

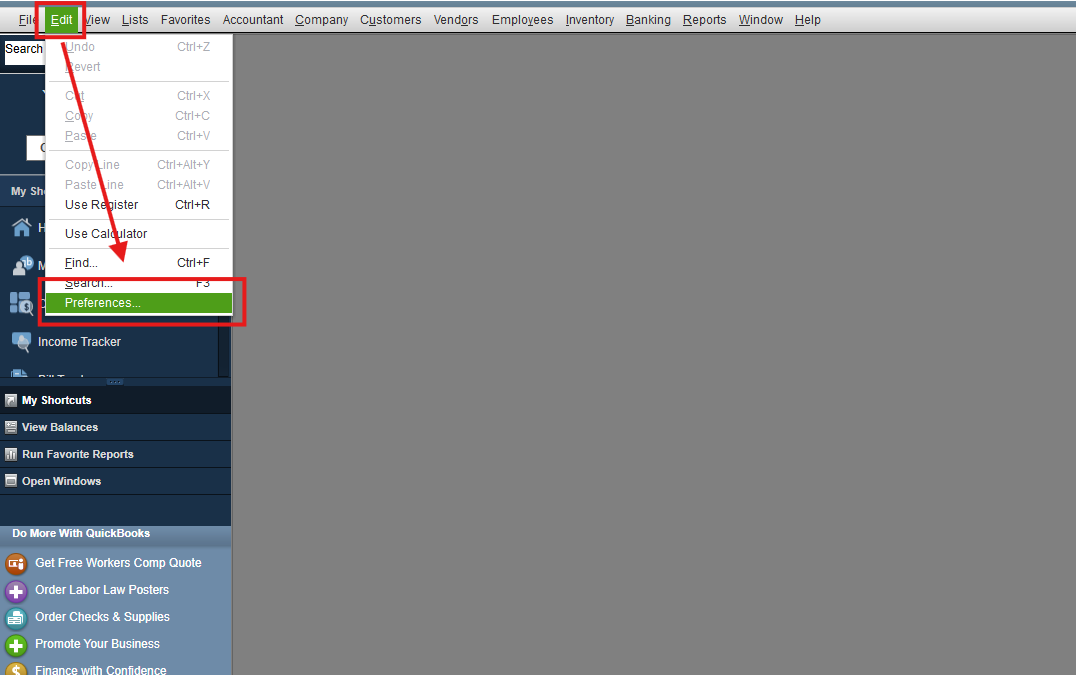

Yes, @Onegr8scorpio. QuickBooks Desktop offers many preferences to help you manage and set up your paid sick leave policy or employee sick time accrual. I'll show you how to set them up below.

Here's how:

Moreover, for further assistance on how to set up your payroll preferences, check this resource: Set payroll preferences in QuickBooks Desktop Payroll.

Additionally, here's a guide material on how to set up paid or unpaid time off pay policies to track the accruals and sick pay for your employees in QuickBooks Desktop to help: Set up and track time off in payroll.

Should you have further inquiries regarding the application of sick pay to specific hours in QuickBooks, please do not hesitate to respond to this thread. I am here to assist you.

Appreciate your reply however, that does not help with the issue of having sick pay in Missouri and not in Kansas and dealing with that on a single check. The preference is basically on all hours or not. There is not a way other than multiple checks per pay period to have sick pay accrue on just the Missouri hours.

Thanks for checking back in, @MidStateshc.

At this time, QuickBooks doesn't have a direct feature for handling withholding for employees in multiple states on a single paycheck. You'll want to check this article for additional information in the Roaming employees section: Set up employees and payroll taxes in a new state.

For now, I recommend sending this suggestion to our Product Development Team for further review. Our Developers review each request and consider them all for future updates. You can send your feedback on this by going to the Help menu in your company file> Send Feedback Online> Product Suggestion.

Please don't hesitate to let me know if there is anything else I can assist you with. Take care!

Thank you for the reply. I should have made myself a little clearer on the issue at hand. We are a IT consulting firm operating in Texas and we have a remote employee in Missouri. We currently have a PTO plan in place with our employees that we use this field for. This employee who is not on the PTO plan moved last month to Missouri, so now we need to implement this deduction solely separate. I need a resolution on how to apply this to their pay check for compliance issues and to properly tax track the much needed payroll item.

I don't know if you have the PTO set up in QB using the sick time feature. If so, you would just need to open this employee and click the sick/vacation button to adjust this employee only. For accrual period you would choose "per hour worked". then on hours accrued per hour put in 0:01:59, next leave maximum box empty. Click to checkmark the box for reset hours each year, maximum hours to carryover is 80. Year begins on May 1, date to start accruing is 05/01/2025. You of course can choose to begin before that date but that is when MO requires you to start by. That is how I have set ours up. If your employee only has Missouri hours then there is not an issue with just using the feature this way. Above there are answers in setting up sick pay in company preferences but I would think you already have that set up for using it as PTO. Hope that helps.

I don't know if you have the PTO set up in QB using the sick time feature. If so, you would just need to open this employee and click the sick/vacation button to adjust this employee only. For accrual period you would choose "per hour worked". then on hours accrued per hour put in 0:01:59, next leave maximum box empty. Click to checkmark the box for reset hours each year, maximum hours to carryover is 80. Year begins on May 1, date to start accruing is 05/01/2025. You of course can choose to begin before that date but that is when MO requires you to start by. That is how I have set ours up. If your employee only has Missouri hours then there is not an issue with just using the feature this way. Above there are answers in setting up sick pay in company preferences but I would think you already have that set up for using it as PTO. Hope that helps.

@MidStateshc RE: The issue is we have employees that work in both Kansas and Missouri in a single pay period.

Oh, I see. you want QuickBooks to support multi-state payrolls, where an employee works in two or more states in the same period and has to be taxed differently by state, or in this case accrue sick pay on only some hours based on the state. Unfortunately, QuickBooks doesn't support this case and probably never will.

RE: At this time separate checks will have to be written for each set of hours that has a different circumstance.

Federal and State withholding will always be wrong if you split the pay between two checks, unless you carefully manage and overwrite the amounts on the second check so the total of the two checks is the same as if you'd created one check.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here