I want to ensure you're able to process the direct deposit to your contractor, @usersanchez-daniel-s.

Based on the error message you received, it could be that no expense account was selected during the setup. To verify, let's open the transaction and make sure to choose an expense account you use to track paychecks in QuickBooks.

Here's how:

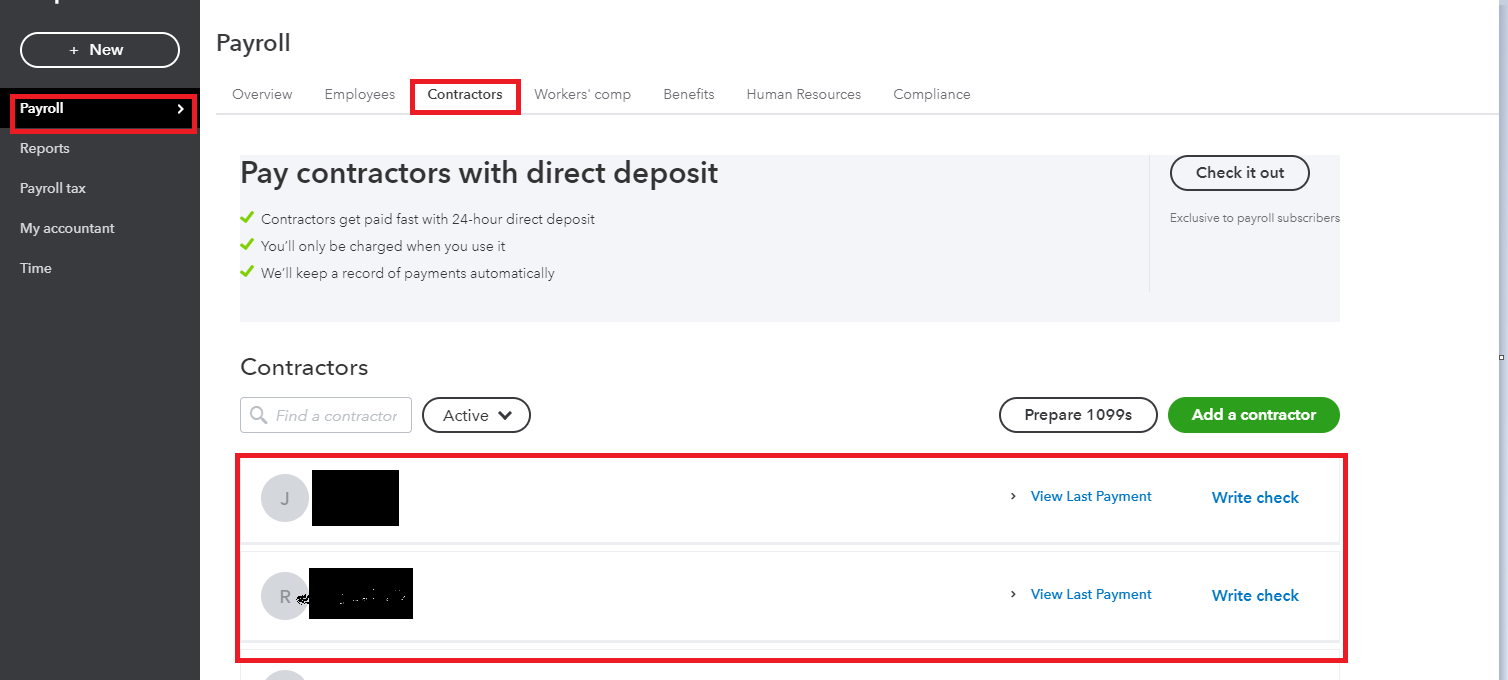

- Open your QuickBooks account.

- Go to the Payroll menu.

- Choose the Contractors tab.

- Click the contractor’s name to check the transaction.

Once confirmed, make the necessary changes and starts the direct deposit process. After the transmission finishes, you'll get a confirmation message.

For more insights, please check out this article: Pay a contractor with direct deposit. It covers ideas on how to manage direct deposit and how you can void them.

Additionally, I've added these articles that'll help you stay informed about managing direct deposit for your contractors in QuickBooks Online.

Please don't hesitate to let me know if you have other concerns or questions about setting up direct deposit. I'd be glad to help you again. Keep safe always