Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowWe have an employee set up who is receiving direct deposits to 2 bank accounts. It worked well until now.

What happened?

Employee requested and we updated one of the accounts. Then we ran payroll. Employee reported to have received the whole amount to just one account. The updated account was ignored.

Any ideas?

P.S. we noticed the bank name did not update. the routing number points to Capital One Bank

Thank you for adding a screenshot, proreo.

Let's fix the issue by double-checking your employee's bank information. I'm here to guide you through the process.

To start with, let's revisit your employee's payment method. Here's how:

Moreover, if you want the system to pay your employees automatically, you can check this article: Set up and manage your Auto Payroll in QuickBooks Online Payroll.

You can always post in the forum whenever you have payroll concerns.

Hey Adrian

I will reiterate: the employee's accounts had been updated and checked before we ran payroll.

It shows the correct account and routing, the bank name is not correct.

Any other ideas?

P.S. trying the screenshot again because I can't seem to be able to open the 1st one

I appreciate your prompt response and additional details about your issue, proreo.

Updating the employee's account should fix the problem. Due to the incorrect bank name and the fact that the entire amount is only shown in the other account, I recommend contacting our Payroll support team. They have the tools to access your account and double-check the setup further.

Please note that our support for QuickBooks Online Payroll Core - is Monday to Friday, 6 AM to 6 PM PT. And QuickBooks Online Payroll Premium, Elite - any time, any day. Except for closed holidays: 4th of July, Thanksgiving Day, Christmas Day, and New Year's Day.

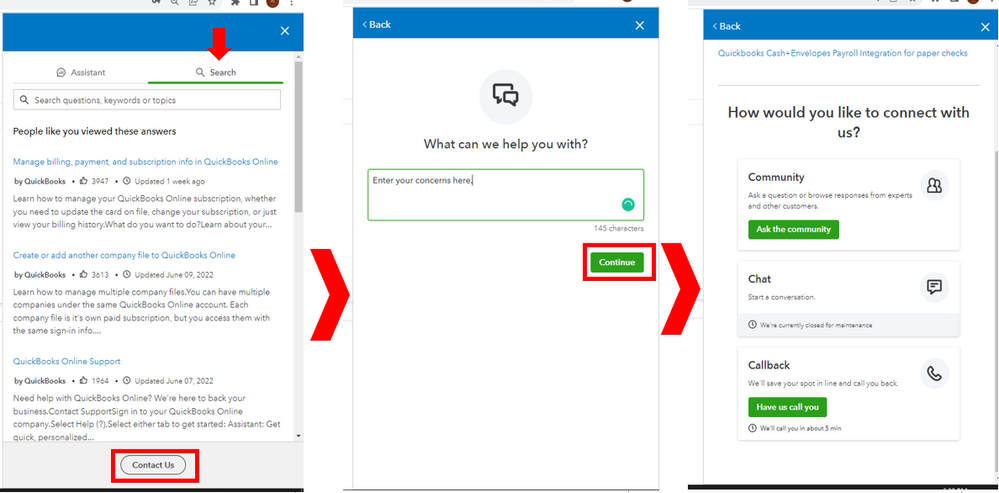

Here's how to contact them:

Once all the settings are configured accurately, QuickBooks Online offers a range of customizable payroll reporting features tailored to your specific requirements. These reports assist in efficiently managing payroll taxes and monitoring employee expenses. To learn more, check this article: Run payroll reports.

You can add details below for further assistance with payroll or other related concerns. I'll be happy to provide and guide you.

Thanks Glinette

You just condemned me to spending a half day with your clueless support until they route me for the Nth time to someone competent

I think it's time to say goodbye to QuickBooks Payroll and get someone who knows what they are doing

curious if this got resolved? We have the same issue. Ironically - or maybe not - with the same bank Capital One. I can't get two deposits set up again for this employee and this account wont hold at all in QB. Not sure what is happeing. Support was useless.

Thanks for joining the thread and providing information about your concern, hlindz.

To ensure that you can set up your employee's deposits again, I suggest getting in touch with our Customer Support Team. This way, they can pull up your account securely and investigate this further.

Here's how:

For future reference, you can also see this article about deleting and voiding paychecks in QuickBooks Online.

Please keep in touch if there's anything else I can do to help you succeed with QuickBooks. Thanks for coming to the Community, and I wish you continued success.

Long story short, figured it out, bonus gets paid only to one account while paycheck can get split into two accounts.

If you have account A for $200 and rest for account B, bonus gets paid fully to the secondary account which is B in this case.

The emp really wanted a bonus from capital one, so we changed his settings to just one account (yes, the display name of the bank shows still the old name, but the account and routing numbers updated). Then we reverted to the old settings.

I hope that helps.

We're delighted to know the information you've shared with us here, proreo.

I appreciate you joining into this thread and sharing updates about the issue. Your timely response helps inform other users with their employee account for direct deposits.

We'll keep this forum open for any additional queries you may have when working with QuickBooks. You can always leave them in the comments below, and we'll be here to assist you. Keep safe!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here