I'm glad to walk you through the steps on how to update the State Unemployment Insurance rate, ryansmith080880.

Whenever your SUI rate changes, you need to update it in payroll. This keeps your SUI tax liability accurate. And, I'm glad to show you how.

- Sign in to QuickBooks Online.

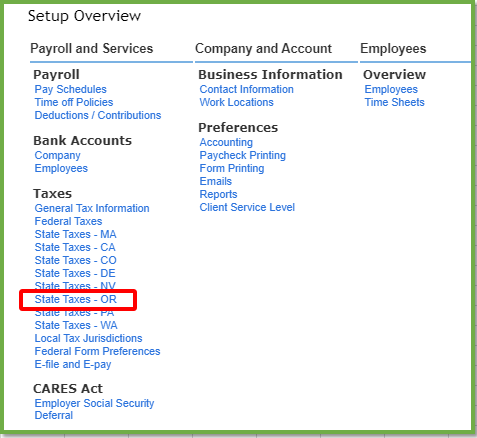

- Go to Settings ⚙, then select Payroll settings.

- Under Taxes, click State Taxes - OR.

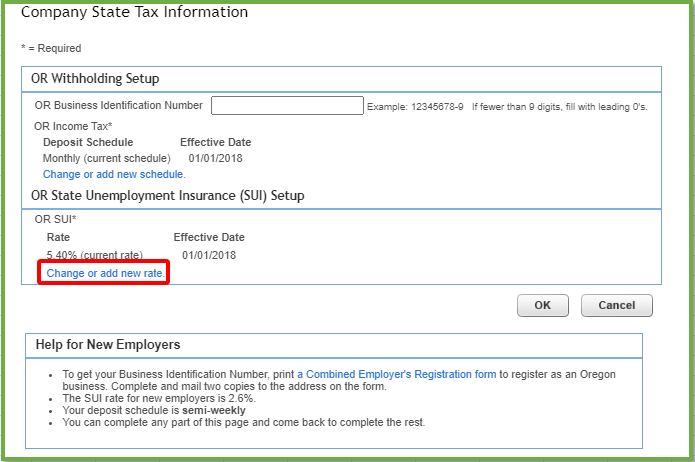

- In the OR State Unemployment Insurance (SUI) Setup section, click Change or add new rate.

- Enter your new rate and its effective date.

- Click OK to save your changes.

If you don't have an option to change the rate, you can contact our QuickBooks Online Payroll. They can change the SUI rate for you.

Select your product and fill out the form to chat with an expert:

If you have already created paychecks with the wrong rate, don’t worry, QuickBooks Online will retroactively adjust your paychecks to correct your tax liability.

If your rate is incorrect in a previous quarter, you may have an overpayment. Or owe extra tax money to the state and need to make a tax payment.

Keep in touch with me if there's anything else I can help you with concerning payroll. I'm always available here in the Community to help you.