Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

It’s great to see you in the Community, kmatta.

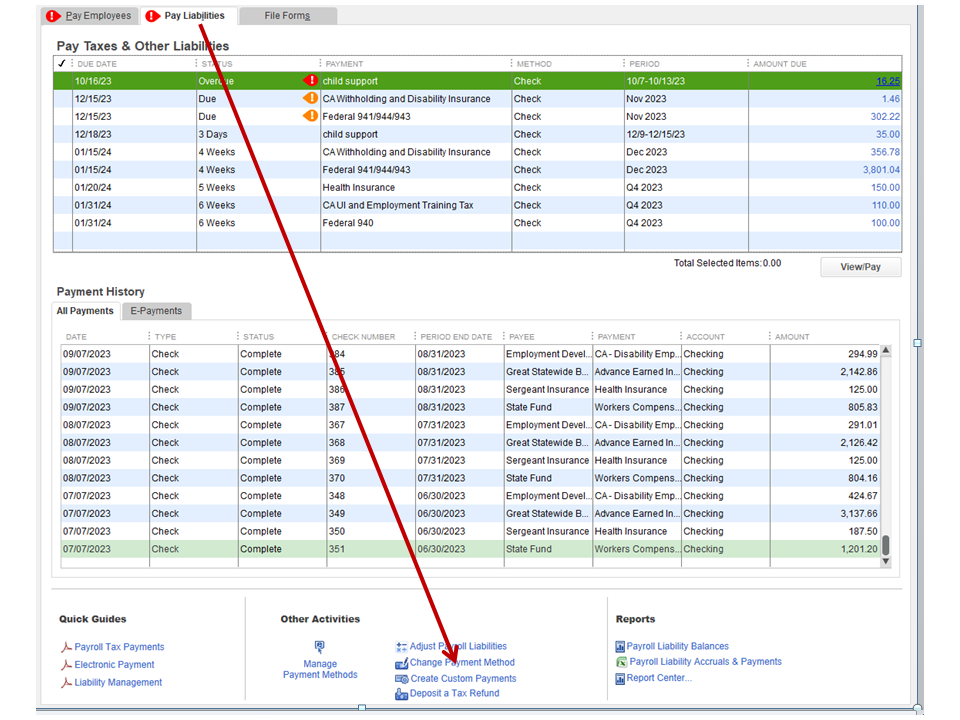

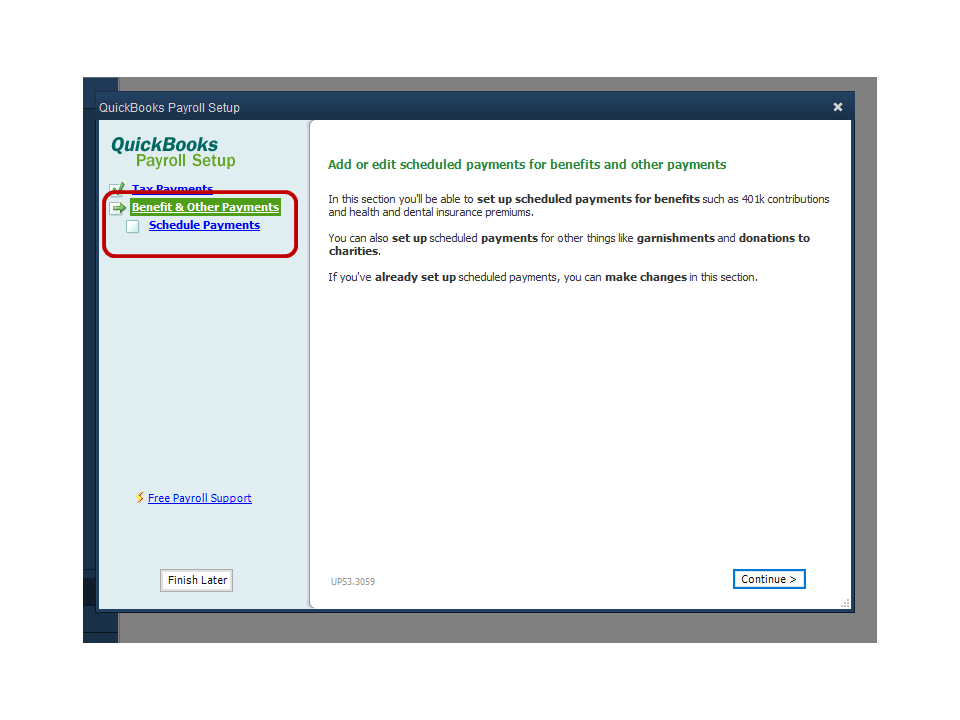

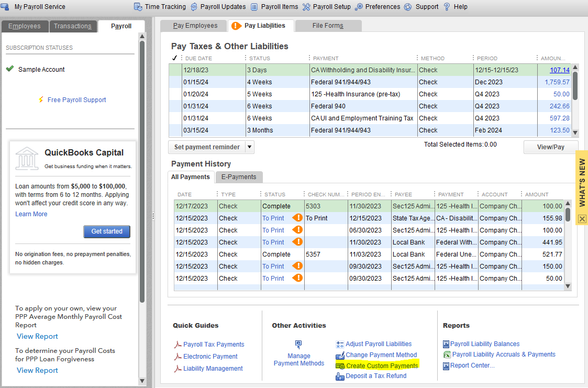

To display the child support payment, you’ll have to set up a payment schedule. This way, it will show in the Pay Taxes & Other Liabilities section.

With just a few clicks, you can accomplish this task in your company file. Here’s how:

Next, go back to the Pay Taxes & Other Liabilities section and then pay the child support.|

The following article provides an overview of how to create a payment schedule as well as for instructions on how to pay child support. To view the steps, simply click the How to pay a schedule liability link: Set up and pay scheduled or custom (unscheduled) liabilities..

If you need further assistance while working in QuickBooks, click the Reply button and post a comment. I’ll get back to help you. Have a great rest of the day.

The above information was excellent. The child support payment is now showing in the Pay Taxes and Other Liabilities window. However, the pay period needs to match my weekly payroll period. How do I correct the pay period for the child support liability?

Lisa

Thanks for joining this thread, lmg6215. I'm happy to hear Rasa-LilaM was able to help with getting your payment to show in the Pay Taxes and Other Liabilities window.

When it comes to editing pay periods, your steps will differ depending on the Payroll subscription you're using.

Here's how to edit pay period dates if you're subscribed to a Basic, Standard, or Enhanced plan:

In the event you're using a Payroll Assisted plan, your steps will be a bit different.

I'll be here to help if there's any additional questions. Have a wonderful Thursday!

The pay period on the employee's weekly check is correct. I set up a child support garnishment that needs to we withheld from every weekly pay period and must be issued on the paycheck date.

The employee pay period is Wednesday thru Tuesday.

The paycheck date is Friday.

The garnishment liability check withheld from the previous Wednesday thru Tuesday needs to be dated and paid and printed on Friday.

For example:

pay period is Wednesday 2/14/24 thru Tuesday 2/20/24

paycheck date will be Friday 2/23/24

liability check date will be paid and printed Friday 2/23/24

Pay Taxes and Other Liabilities window says it is due Monday 2/27/24 with period Saturday 2/17/24 - Friday 2/23/24.

Lisa

Thank you for getting back and providing us further details, @lmg6215.

I can share insights on matching your child support payment schedule to your weekly payroll report period.

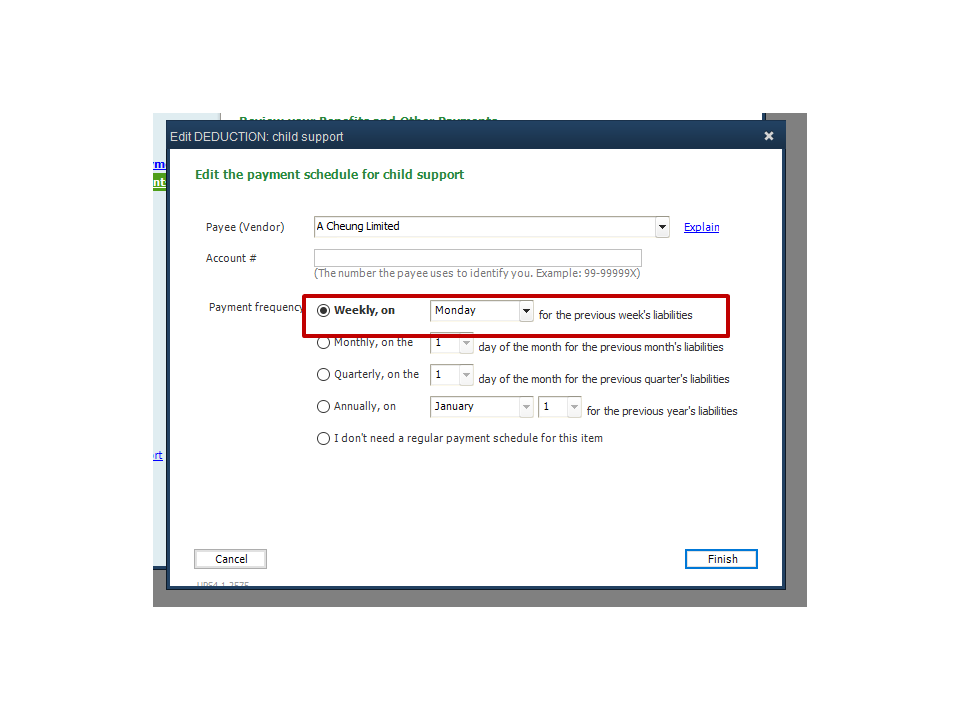

If you have set the child support payment to Weekly, on Monday for the previous week's liabilities for period 2/17/24-2/23/24, the Pay Taxes and Other Liabilities window will show that it's due on Monday. Since the standard practice for paying non-tax payroll liabilities (e.g., child support payment) is scheduled days or weeks after paychecks are issued, I'd recommend consulting a tax or payroll professional.

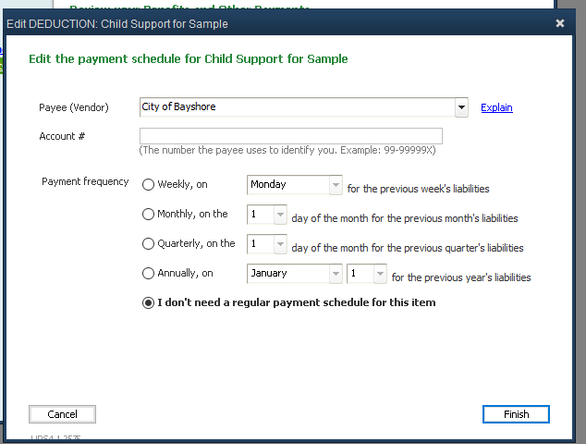

Nevertheless, if you want to pay the garnishment on the same day you issued your employee's paycheck, you can unschedule the payment. Then, you can create a custom payment. Here are the steps to achieve this:

Let me add this article as a reference in running payroll reports in QBDT: Run payroll reports.

We'll be here in the Community if you have further questions setting up the Child Support garnishment in QBDT. We're committed to offering ongoing support. Take care.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here