Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowIt's great seeing you in the Community, amandareetabikha.

I have the steps you need.

You can view and print past filed payroll tax forms by following the steps below.

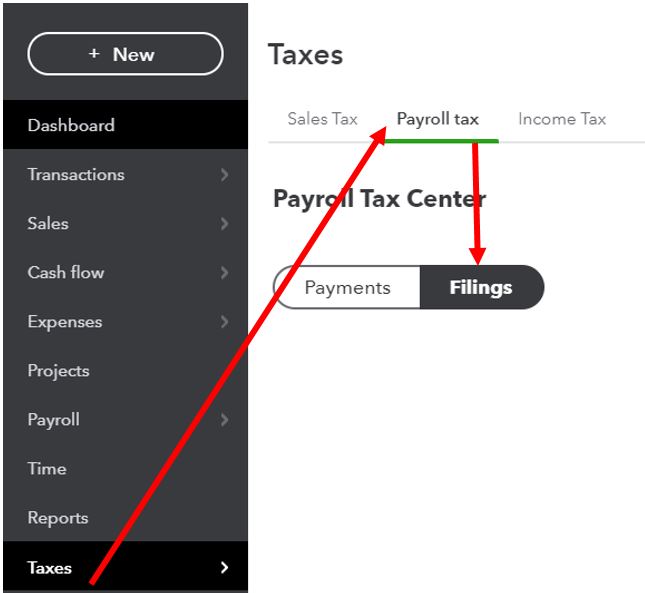

If you have the Enhanced version of QuickBooks Online Payroll, you can follow these steps:

Here's a sample screenshot for a visual reference:

For QuickBooks Online Payroll Core, Premium, and Elite, here's how to access the form:

You can read this article for reference: Access payroll tax forms and tax payments.

Please let me know in the comments below if you have more questions related to the payroll forms. I'll be around to provide the instructions. Have a great weekend!

It says no forms have been archived

Hello there, @amandareetabikha. Thanks for getting back to us.

There are two reasons why it says No forms have been archived when following the suggestion shared by my colleague above. Possibly, you haven't archived the form, or it was submitted outside QuickBooks.

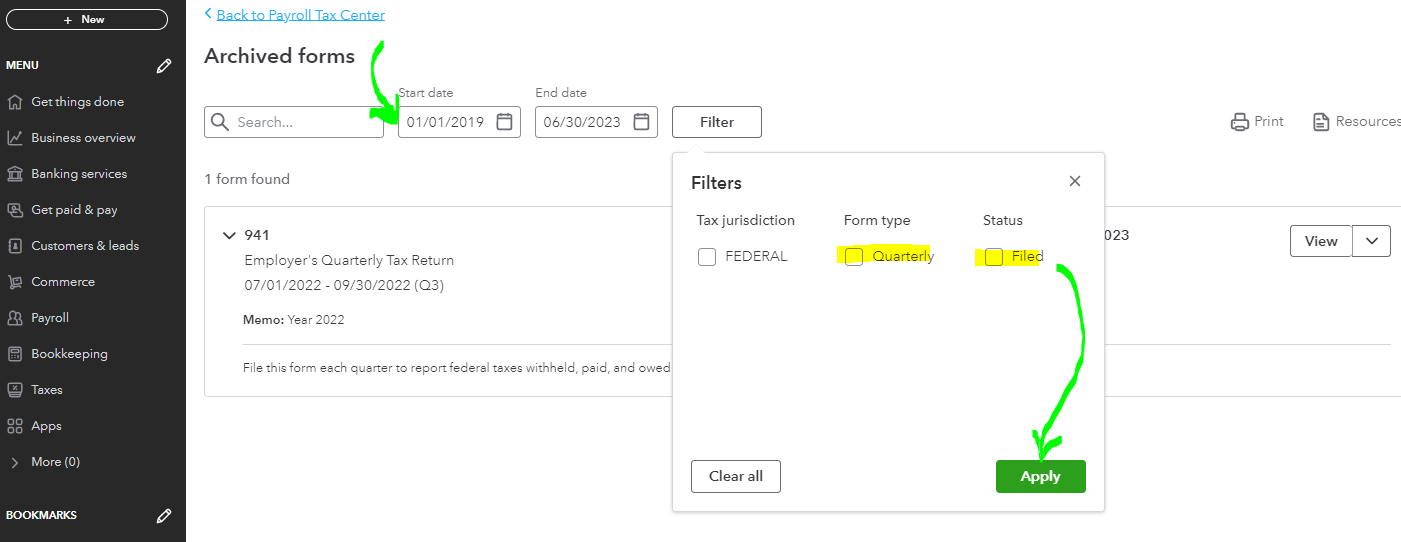

If you've filed the form within QuickBooks, you'll need to archive the form. Here's how:

If you filed a form electronically, you can't archive the form again after you make any corrections. In this case, save a copy for your records. I've added this article for further instruction in completing this task: Archive old forms in QuickBooks Online.

Still, I recommend giving us a short call to help you archive the form from an earlier period since these forms have been previously filed. It requires the collection of personal data to open your account. This way, our Payroll Team Support can look into this further in a secure space. Also, our payroll specialists have tools to archive the forms and ensure you can process them.

Here's how:

I've gathered some articles for insights about accessing tax forms, and running some payroll reports within your QBO account:

Please don't hesitate to leave a reply below if you have any other concerns or additional questions. I'm always here to help. Take care and have a good one!

QBO has changed a bit in order to find these reports. I am able to locate them, but seems there is no way to download the actual filed report. It just gives a snap shot of the dates and that it was accepted.

Quickbooks, this workflow is no longer accurate. Will you please post instructions for the 2023 version of Quickbooks Online?

Hi @PRGav.

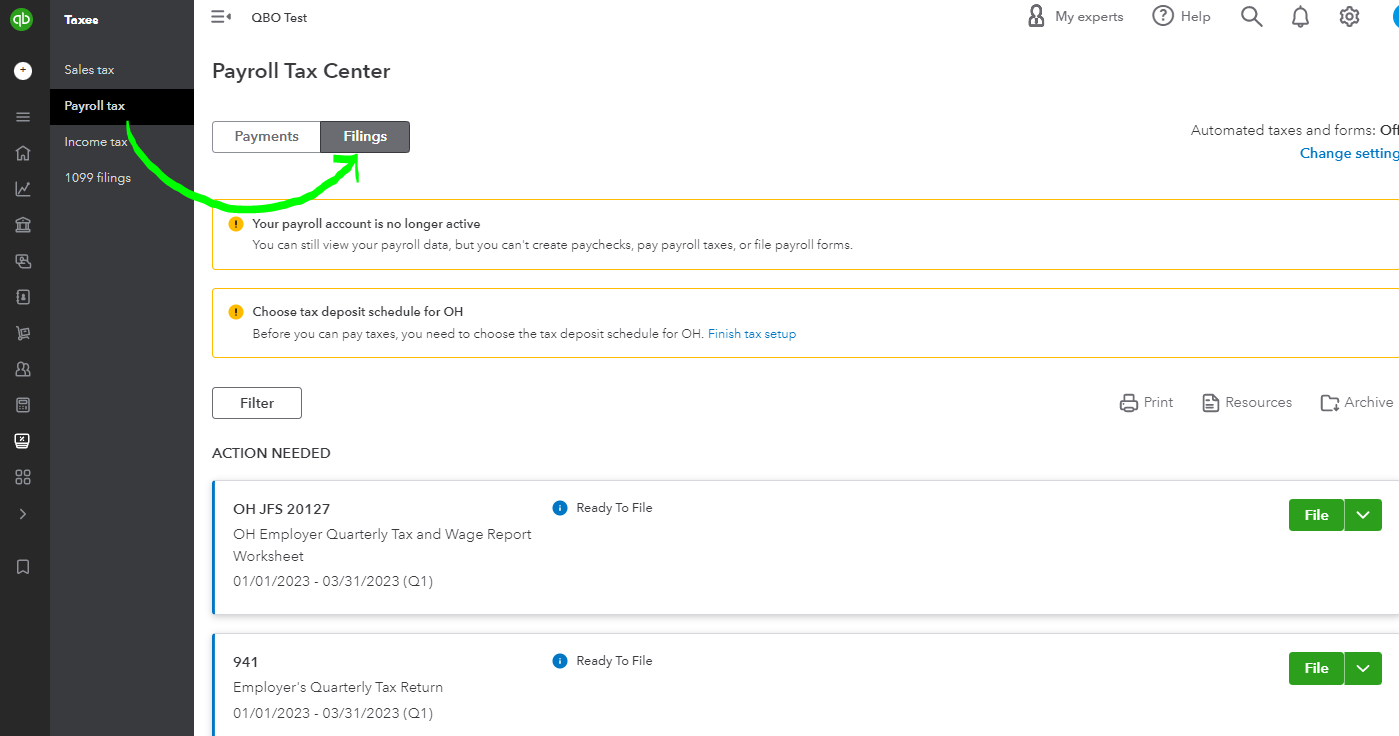

I can help share the updated directions in QuickBooks Online to find the previously filed state forms.

To access your previously filed DE9 and DE9C tax liability forms, you can still see them in the Archived forms and filings. But you'll have to click the Filings tab first in the Payroll Tax Center window.

Here's how:

That's it. You should be able to see your filed state forms after following the directions above. You can also bookmark this article as a reference: Access payroll tax forms and tax payments. It covers the link to view previously made tax payments.

However, if you filed the forms outside QuickBooks and are unable to track them in the Archived forms windows, I suggest contacting our Payroll Support team to help archive the forms for you. This way, you'll get a chance to view them in Archived forms window.

Please get back here and share some updates. If you have other tax forms concerns, let us know. We're always ready to lend a hand. Stay safe and well!

Thanks for this, but it still isn't accurate.

Quickbooks archives all of my forms at the time of filing and archived forms are not downloadable. I have to contact support each time I want a form and it takes a really long time.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here