Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

in the pay sales tax window, there is a link, not a button, to enter a discount, click that. Sales tax discounts are other income

Hello there, userpstewart00.

I'd like to share an idea about payroll taxes in QuickBooks.

QuickBooks allows you to record and track employee deductions. Therefore, payroll taxes are automatically calculated based on the taxable amounts provided by the state agencies.

Also, you can contact our payroll support for assistance in making any adjustments to your taxes.

Here's how:

Chat - Chat with a live expert.

Callback - Have us call you.

You can check this link for more related questions about payroll tax payment and forms: Get answers to your payroll tax payment and filing questions

Let me know if you have more questions about payroll taxes. I'll be here to help. Keep safe!

This is not for sales tax. This is a discount for paying Missouri payroll withholdings on time/early.

My CPA explained she cannot access my payroll settings, and explained there should be a "discount button" I need to choose there. She said it doesn't look like I've been getting my discount for paying my withholding taxes on time. I can't seem to find the switch to turn on the discount.

I'll help with your question about state payroll taxes, userpstewart00.

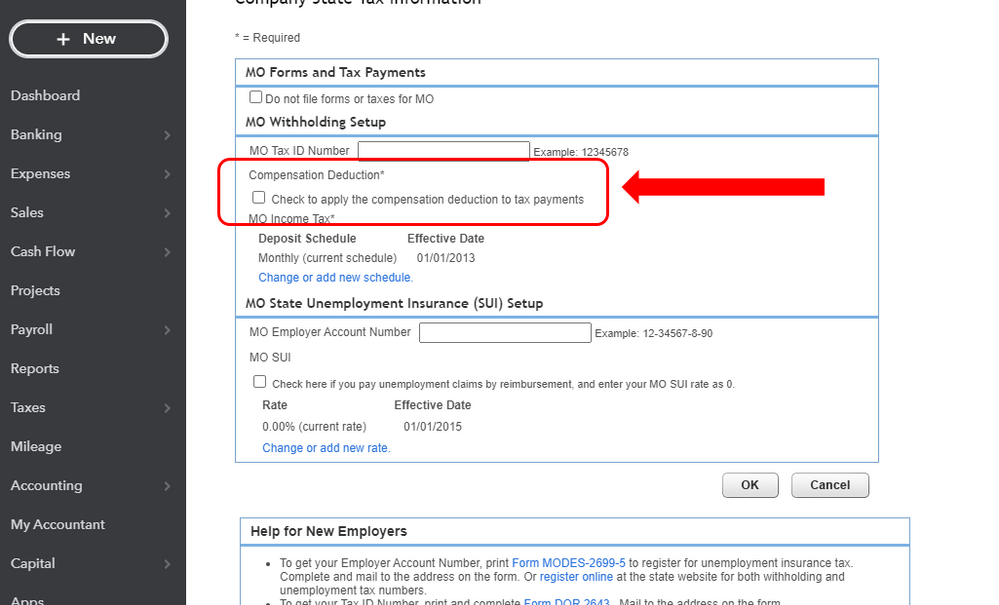

Are you referring to Missouri Compensation Deduction for withholding taxes? Let me share the steps on how you can select this option. Here's how:

Let me also share these article and links for additional reference:

The Community is always here if you need anything else.

How do you do this in Desktop Version 2020 or 2021?

How do you do the "Compensation" from Missouri Tax (to deduct for a timely payment)?

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here