Thank you for reaching out, cj. Let me explain why a filing or payment schedule is modified.

It can happen when the filing schedule and payment frequency settings are changed. You can switch it back to quarterly by going to the Payroll Settings window.

Here's how:

- Sign in to your account.

- Tap on Payroll Settings from the Gear icon.

- Select Edit next to federal or the state you need to update (Federal tax or State tax).

- Click on the pencil icon.

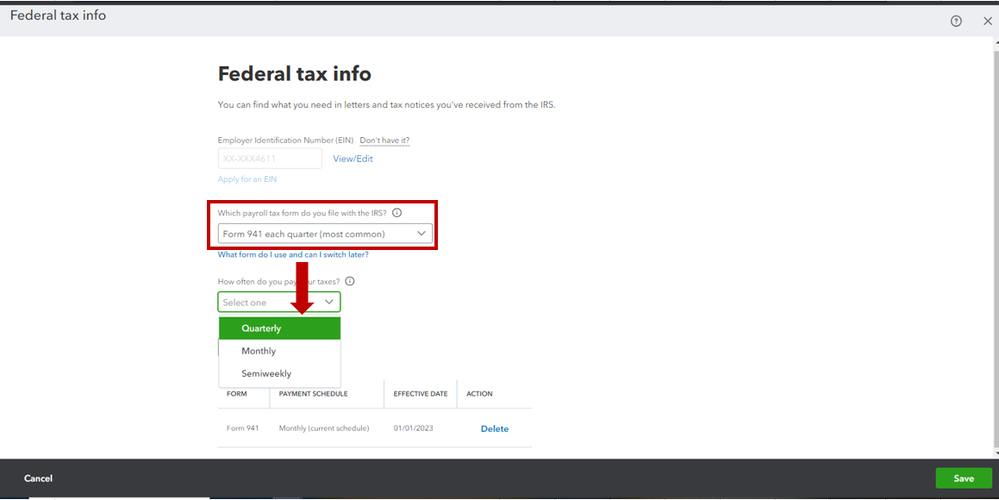

- Choose Edit from the How often do you pay your taxes? section.

- Set your new schedule and effective date.

- Save the changes.

To understand more about payroll form filing and payment frequency, you can run through the resources from this article: Change your payroll tax filing and payment schedule.

You may also get extra help while paying and managing your taxes with QuickBooks from this link: Pay and file payroll taxes and forms in Online Payroll.

Please let me know how else I can assist you with your payroll taxes. I'm just a few clicks away to help you again. Have a good one!