It’s nice to see you in the Community, HighlineConsulting.

Let me share some alternative solutions on how to split your payments. We’ll have to delete the transactions and manually enter each one with its correct category.

QuickBooks Self-Employed estimates federal tax payments based on your self-employed income, deductions, predicted future income for the year, and tax profile. That’s why tax payments are counted as estimated taxes.

Also, you’ll not be able to split entries if they’re manually entered. If you wish to classify them according to their category and transaction type, let’s input the tax payment one at a time.

Before we proceed, make sure to remove the older payments. I’ll help make sure the process is a breeze for you.

Here’s how:

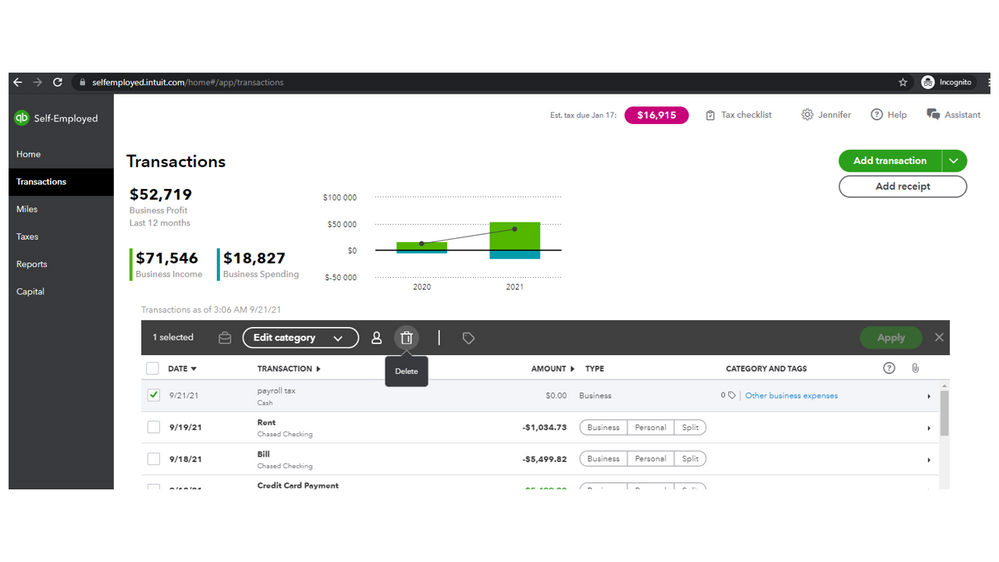

- Tap the Transactions menu on the left panel to see all entries recorded in your company.

- From there, tick the boxes for the tax payments and click the Trash icon.

- Press the Apply button and choose Yes to confirm the action.

Next, key in the older payments one at a time. Follow the step-by-step process in this article: Manually add transactions.

For additional resources, the links below contain a list of categories you can use to classify transactions. From there, you’ll learn how the self-employed program tracks your taxes.

Keep in touch if you have other concerns or questions about managing your tax payments. I’ll be around to help and make sure you’re taken care of.