Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowHi,

our company had a long term liability account for a machine. Each time when we made a payment towards the loan, we recorded it against this account. The loan is paid off. The liability account balance is now $0

We now have a fully paid machine (asset) but it's not showing on the balance sheet.How do we show the asset in the balance sheet. Seems like it was not setup correctly in the first place. Thanks!

Hi there, @SudhaT.

I'd be glad to help you record your loan for an asset in QuickBooks Online. Your loan payment for a machine wasn't reflected in your asset account because of the transaction type. Instead, you'll need to create a journal entry for your loan to reflect in your assets. You'll also need to consult with your accountant about how to account for these variables when dealing with journal entries.

Please refer to this article for the steps to record your loan for an asset in QuickBooks Online.

To avoid double posting in your balance sheet, I'd recommend removing those transactions you paid for the loan. Then, you'll need to create multiple journal entries for each time you have paid partially. Make sure that the debit and credit should have the same value and remember to change the date to the correct one. Note that when doing these steps, you'll need to consult your CPA/Tax accountant.

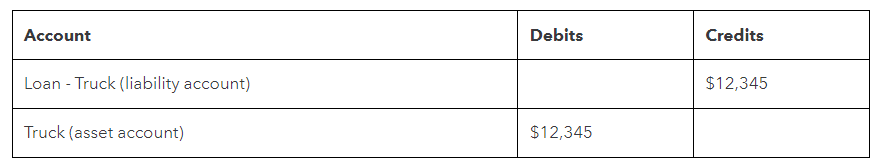

Here's an example:

Furthermore, I'd like to provide you with this article for future reference:

Run a balance sheet by class or location in QuickBooks Online.

Please let me know if you have further questions about recording a loan for an asset in QuickBooks Online. I'd be glad to help. Have a great day!

Yikes. Disregard @MarkAngeloG 's response. It's wrong on many levels. As I'm sure you're aware, you don't want to remove any transactions.

If the asset is not showing on your balance sheet it was most likely recorded as an expense, not an asset. Is that the case? If it was expensed, then there is no reason to add it at this point since it is considered to be fully depreciated so it will not impact any valuation or future gain on the sale/disposal of the asset. If depreciation was taken on it, then you need to contact the company's CPA.

Thanks for the response. Yes I was thinking the same since it was reconciled deleting the transactions will create whole another issue.

When initially liability account was setup the loan amount was entered in the total balance field.

The system in the back end debited Opening balance equity and credited Longterm liability account.

Questions: For the future long term liability account how do we setup in QB online?

Thanks for the response. Yes I was thinking the same since it was reconciled deleting the transactions will create whole another issue.

When initially liability account was setup the loan amount was entered in the total balance field.

The system in the back end debited Opening balance equity and credited Longterm liability account.

Questions:

1. How to add the asset (fully paid- long term loan) to the balance sheet?

2. For the future long term liability loan, how do we setup in QB online?

"The system in the back end debited Opening balance equity and credited Longterm liability account."

That was done incorrectly by whoever set up the loan liability account. It should have been set up originally with a journal entry that created the asset (debit) as the offset to the loan (credit) and any down payment (credit).

"1. How to add the asset (fully paid- long term loan) to the balance sheet?"

The asset is independent of the loan repayment. The asset should have been created at the same time as the loan. At this point, unless any changes have been made to the Opening Balance equity (OBE), there is a negative amount in OBE that represents this asset. To move it to an asset account, make a journal entry (JE) and debit the Equipment fixed asset account and credit OBE for the original cost. BUT, only do this with the consent of the company's CPA/tax accountant as, presumably, tax returns have been filed since the equipment went into service.

"2. For the future long term liability loan, how do we setup in QB online?"

You set it up a loan payable liability with a journal entry. For example, if the equipment cost is $100K and you financed 100%, the entry is a debit to the equipment fixed asset account and a credit to loan payable liability, both for $100K. If you put $10K down and financed $90K, the entry would be a $100K debit to the equipment fixed asset account, a $10K credit to the bank account, and a $90K credit to the loan payable liability account.

Hope this helps.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here