Yes, we can delete a credit memo to avoid duplication and it should not be recorded as bank deposit, admin350. Let me add information and guide you through the process below.

Regarding the provisional bank credit due to a fraudulent withdrawal, it should not be documented as a bank deposit. Instead, you should handle it as a bank adjustment to accurately reflect the temporary credit provided by the bank for the fraudulent transaction.

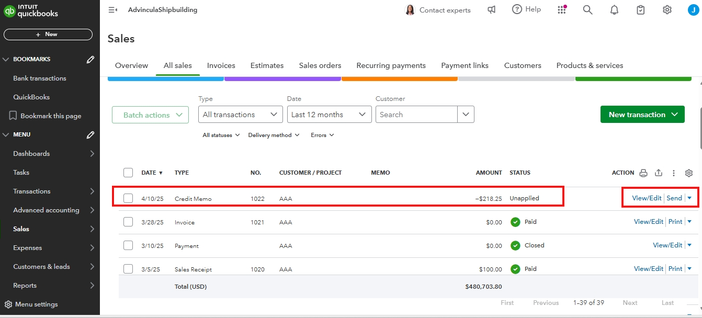

Now, let's proceed with removing the credit memo, follow these steps:

- Navigate to the left menu, click on Sales, and select All Sales.

- Locate the credit memo using the search feature, then click the Edit button in its Action column.

- At the bottom, click on More and choose Delete.

- Confirm the deletion by clicking Yes.

I've provided screenshots for your reference.

Moreover, we can open this resource on how to issue a credit memo or delayed credit to customers: Create and apply credit memos or delayed credits in QuickBooks Online.

For future reference on how to match your bank and credit card transactions with records already in QuickBooks, check out this resource: Confirm suggested matches for bank transactions in QuickBooks Online.

Before we wrap up, I suggest you explore QuickBooks Live Expert Assisted to streamline your accounting, maintain precise financial records, and access professional support. This could free up valuable time, allowing you to concentrate on expanding your business.

If you have further questions regarding your bank transaction in QBO, don't hesitate to reach out. We'll provide prompt assistance. Have a nice one.