Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

I can help you get these 1099's filed without QuickBooks, @jennifer15.

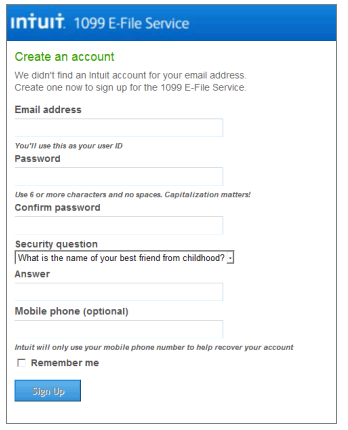

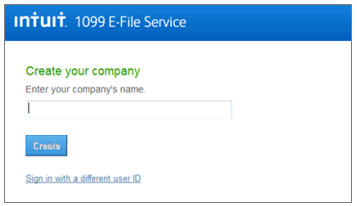

You can sign up to our E-file service website. This way, you can add your contractor's details and file their 1099-MISC forms to the IRS.

Here's what you'll need to do:

You can read about our 1099 E-file service fees on this link: http://payroll.intuit.com/additional-services/1099/efile-1099/.

For full details on this process, you can check out this article: How to file 1099-MISC forms using an e-file service.

Let me know if you have any questions on this process, you can leave a comment below. Take care!

hi, where is the start for free button? i can only find where to purchase a new plan

hi, where is the start for free button located as i can only find options to purchase a new software

It's a great pleasure to have you join the Community thread, @builder13. Let me walk you through the steps in utilizing the free trial on the E-file service websites.

You can use the Contractor payments to E-file unlimited 1099s without operating QuickBooks Online. Let me show you how to have the Try it free option:

You may also want to visit these articles to manage your 1099 forms and contractors moving forward:

I'm always available at any time if you need further help with your payroll forms. Don't hesitate to click the Reply button below or post in the Community again. We're always here to help. Keep safe!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here