Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Connect with and learn from others in the QuickBooks Community.

Join nowOur company changed from a sole proprietorship to an LLC on 1/3/22.

I created a new company, restored my business from a back up, changed the business name, EIN and taxing type, and just want to move on with working.

Is there any good reason why this isn't a proper way to start 2022 as an LLC

Any help anyone can offer me is greatly appreciated as I'm not a bookkeeper, I'm just a girl who bills for jobs and pays employees.

Thanks,

Wendy

Hey there, mandrcu.

Allow me to provide a little more information regarding this matter.

One of an LLC's main benefits is that this type of business entity offers its owners limited liability. By separating your personal assets from the business, you protect your own property and ensure that the business's debts remain those of the LLC. That is, you are not personally liable for them.

Also, changing from a sole proprietorship to an LLC may be a smart move for your business as well as for the protection of your personal assets. Still, you should be aware that you could end up paying more in taxes and fees with an LLC than you would have if you had stayed a sole proprietor. Because there are so many individualized considerations involved in making this decision, professional legal advice is recommended.

You can check these articles for more tips and information about adding data and managing your new company file:

For additional assistance, feel free to reach out to our Customer Care Team.

Let me know if there's anything else you need, I'll be here to help. Have a great day!

Thanks for all of that information.

I spent over 3 hours yesterday on the phone with the Quickbooks paid "helpers" and they were unable to help me.

Both tried to get me to import IIF files that didn't work.

My questions are these: Is it absolutely wrong to just backup and restore all my information from the SP to the LLC. This way I can just migrate from one company to another and not lose any of my customers information already created.

And: how to work the checkbook? I have decided to have the owner open an LLC bank account so I will need to create that new.

If there are any professionals willing to take on an "idiot" about this stuff in the West Los Angeles area I might be open to having someone fix my issues.

Wendy

Hello there, mandrcu. Thanks for getting back to us.

Whenever you restore a backup of a QuickBooks Desktop (QBDT) company file, it recreates an exact copy of it.

About Checkbook, also known as a checkbook register, this is where you keep your daily bank balance. To make sure your bank balance is accurate, we highly encourage you to reach out to an accountant to make sure the recording is accurate. You can also ask for further guidance regarding the categorization of the accounts.

Feel free to post a reply in the comments below if you have other questions in QBDT. I'll get back to you as soon as I can. Have a pleasant day!

It would be extremely helpful to open a new check register for the new checking account for the LLC.

Any help explaining how to do that would be helpful.

Wendy

I'm happy to help you open a new check register in QuickBooks Desktop (QBDT), @mandrcu.

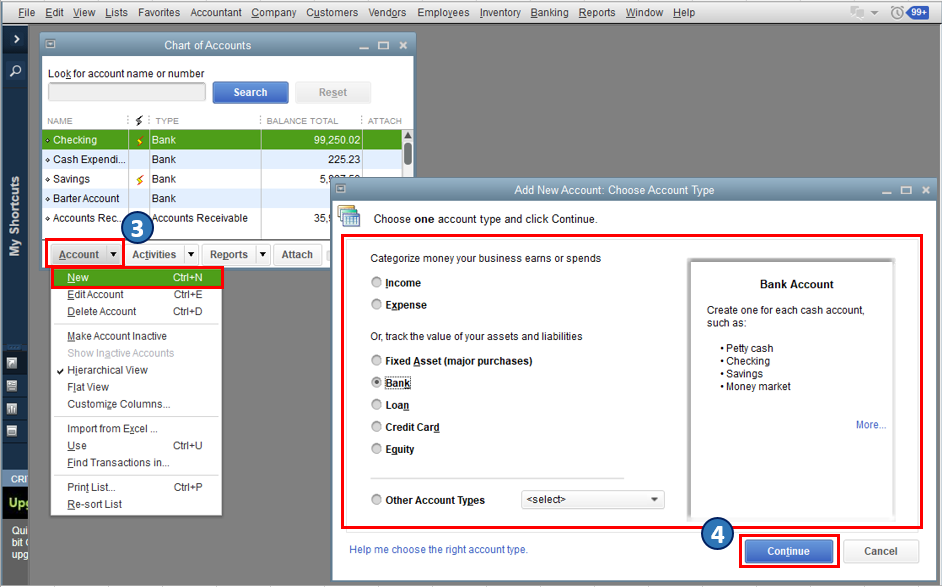

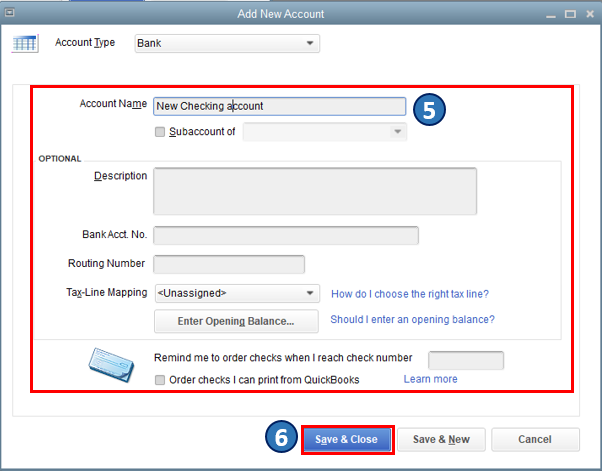

You can create a new checking account through your Chart of Accounts. With this, you're able to add more accounts if you need to track other types or sets of transactions. To do this, here's how:

To know more about managing accounts in QBDT, please refer to this article: Add, edit, or delete accounts in QuickBooks Desktop.

Also, to know more about the chart of accounts in QBDT, I'd recommend checking out this article: Learn about the chart of accounts in QuickBooks.

Let me know if you have other concerns about managing accounts in your chart of accounts and transactions in QBDT. Don't hesitate to drop a comment below, and I'll gladly help. Take care, and I wish you continued success, @mandrcu.

Fabulous.

Thank You so much.

This is a huge help.

Wendy

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here