Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowhow do i print the chart of accounts with the tax lines of QBO so that i can see if things are posting correctly when i upload them in my tax soft wear like turbo tax when i file taxes this year

and one other thing, how do you make something inactive and stay inactive

Solved! Go to Solution.

Thanks for swinging by the Community, @Irhmail451.

First, I appreciate the detailed screenshots you provided to give me a better understanding of your concern. I've got some insights about tax-line mapping in QuickBooks Online (QBO) and why some accounts keep showing in your Chart of Accounts after inactivating them.

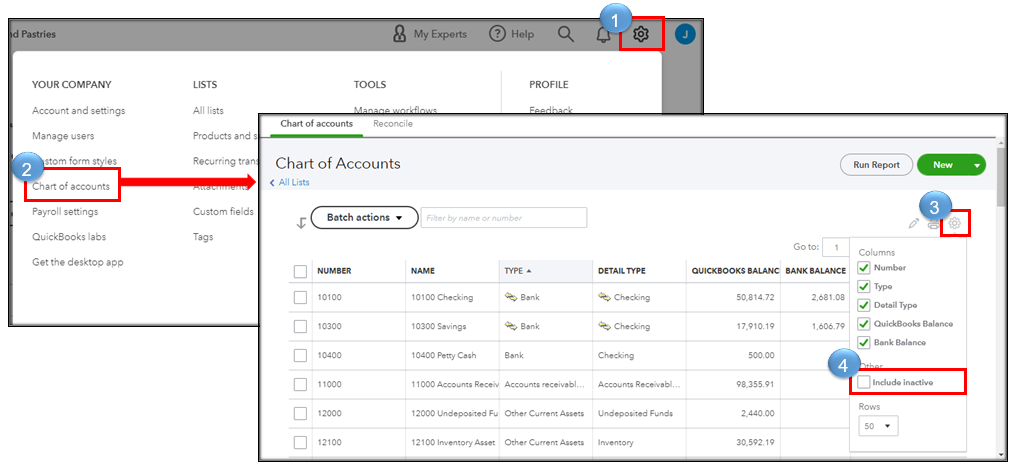

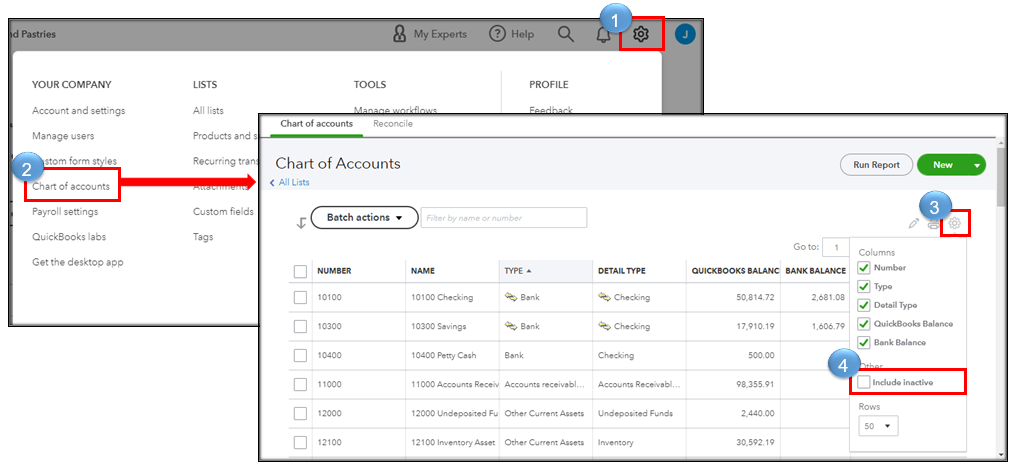

Unfortunately, the option to set up tax lines in QBO is unavailable, as well as printing the Chart of Accounts with them. The column you highlighted in your screenshot isn't the tax line, but the account type. Selecting the appropriate account type sets you up with accurate reports so you can assess the financial health of your business. Currently, setting up tax-line mapping is only available in QuickBooks Desktop.

In addition, let's uncheck the Include inactive box to ensure that inactive accounts will not show in your Chart of Accounts.

I'll guide you on how:

Moreover, there are default or special accounts in QBO that can't be inactivated, edited, or merged. They include Inventory Assets and Reconciliation Discrepancies accounts, as what you refer to on your screenshots. These accounts are created by QBO automatically, and we're unable to use them for any other purpose.

When you run reports, inactive accounts and their transactions are still visible. QBO includes them to maintain accuracy. However, you may customize them to hide inactive accounts, but doing so may affect accuracy.

Please don't hesitate to ask the Community more questions about the Chart of Accounts, we'll make sure your concerns are well-taken care of. Have a good day, and stay safe!

Thanks for your prompt response, @lrhmail451. I appreciate you following my colleague's suggestions.

I can share some insights on why QuickBooks Desktop is built differently from QuickBooks Online.

QuickBooks Desktop is a more traditional accounting software that can be downloaded and installed on your computer. That said, it is more likely to have many features since the program stores the business data on your computer device and depends on your processor and operating system.

Since we're continuously adapting to a digital world and marketing, our engineers created a cloud-based QuickBooks Online accounting system to manage business anywhere to account for your finances quickly in lighter memory space. If it's based on the desktop version, QuickBooks Online will mainly depend on the device operating system, internet connection speed, and the cloud-based server capacity and processor. The slower data processing means not cost-effective and only a limited number of persons will buy the service.

On the other hand, I recommend submitting your suggestion to QuickBooks Online since you have shared awesome ideas. You can click the Gear icon on the top right and hit Feedback. Enter your product suggestion regarding the chart of accounts report and click Next to submit. This way, you will be heard and might add your requests in the next product update.

Furthermore, since QuickBooks Online and QuickBooks Desktop are independent programs, you can export the chart of accounts from QuickBooks Online. Then ensure to convert the QuickBooks Online chart of accounts data file to an IIF file using a third-party application so you can import them to QuickBooks Desktop. You can visit our Desktop Apps website to look for a file converter tool.

Then you can import it into QuickBooks. For more information, please take a look at these resources:

Here's how to run a chart of accounts report and print the tax line mapping in QuickBooks Desktop:

If you have other QuickBooks concerns, please don't hesitate to comment. I'm still here to help. Have a safe day ahead!

Thank you for getting back, lrhmail451. Let me give you insights about loading your QuickBooks Online (QBO) file into TurboTax.

Being able to import your QBO data directly to TurboTax is unavailable. For now, you need to convert your QBO data to QuickBooks Desktop (QBDT) through a trial version. You can open this article for the complete steps: Convert QuickBooks Desktop file to QuickBooks Online.

Once done, import your data to TurboTax by following these steps:

Here's an article you can open for more detailed steps: How do I import QuickBooks data into TurboTax Business?.

Another way around this is to use a third-party app. Thus, you can move your QBO data directly into your TurboTax account. If you wish to continue, visit our QuickBooks App Center.

Please feel free to mention my name in the comment section below if you have follow-up questions. I'm always here to help you again. Have a good one!

Thanks for swinging by the Community, @Irhmail451.

First, I appreciate the detailed screenshots you provided to give me a better understanding of your concern. I've got some insights about tax-line mapping in QuickBooks Online (QBO) and why some accounts keep showing in your Chart of Accounts after inactivating them.

Unfortunately, the option to set up tax lines in QBO is unavailable, as well as printing the Chart of Accounts with them. The column you highlighted in your screenshot isn't the tax line, but the account type. Selecting the appropriate account type sets you up with accurate reports so you can assess the financial health of your business. Currently, setting up tax-line mapping is only available in QuickBooks Desktop.

In addition, let's uncheck the Include inactive box to ensure that inactive accounts will not show in your Chart of Accounts.

I'll guide you on how:

Moreover, there are default or special accounts in QBO that can't be inactivated, edited, or merged. They include Inventory Assets and Reconciliation Discrepancies accounts, as what you refer to on your screenshots. These accounts are created by QBO automatically, and we're unable to use them for any other purpose.

When you run reports, inactive accounts and their transactions are still visible. QBO includes them to maintain accuracy. However, you may customize them to hide inactive accounts, but doing so may affect accuracy.

Please don't hesitate to ask the Community more questions about the Chart of Accounts, we'll make sure your concerns are well-taken care of. Have a good day, and stay safe!

thanks for the advice but my box for include inactive is already blank

who do i contact about getting QBO to fix that problem on the chart of accounts

its very hard to recommend the QBO for others when you can not do what you need to do in it

why is QBO not base off of the desktop version

you still need the same information in either or

why is QBo so limited on what you can do

can i upload my QBO chart of accounts in a QB desktop and then print what i need so i can check my tax line mapping

just saw where you said these could be accounts that can not be deleted

Thanks for your prompt response, @lrhmail451. I appreciate you following my colleague's suggestions.

I can share some insights on why QuickBooks Desktop is built differently from QuickBooks Online.

QuickBooks Desktop is a more traditional accounting software that can be downloaded and installed on your computer. That said, it is more likely to have many features since the program stores the business data on your computer device and depends on your processor and operating system.

Since we're continuously adapting to a digital world and marketing, our engineers created a cloud-based QuickBooks Online accounting system to manage business anywhere to account for your finances quickly in lighter memory space. If it's based on the desktop version, QuickBooks Online will mainly depend on the device operating system, internet connection speed, and the cloud-based server capacity and processor. The slower data processing means not cost-effective and only a limited number of persons will buy the service.

On the other hand, I recommend submitting your suggestion to QuickBooks Online since you have shared awesome ideas. You can click the Gear icon on the top right and hit Feedback. Enter your product suggestion regarding the chart of accounts report and click Next to submit. This way, you will be heard and might add your requests in the next product update.

Furthermore, since QuickBooks Online and QuickBooks Desktop are independent programs, you can export the chart of accounts from QuickBooks Online. Then ensure to convert the QuickBooks Online chart of accounts data file to an IIF file using a third-party application so you can import them to QuickBooks Desktop. You can visit our Desktop Apps website to look for a file converter tool.

Then you can import it into QuickBooks. For more information, please take a look at these resources:

Here's how to run a chart of accounts report and print the tax line mapping in QuickBooks Desktop:

If you have other QuickBooks concerns, please don't hesitate to comment. I'm still here to help. Have a safe day ahead!

hey there while we are on the subject

how do you load you QBO file into turbo tax to do you taxes

i have four companies that we use QBO

| NORTH STAR HEALTHCARE LLC | PARTNERSHIP | |

| POLARIS CONTRACTED SERVICES LLC | PARTNERSHIP | |

| NORTH STAR PAIN MANAGEMENT | S CORP | |

| LINDA A FOSTER DBA (NORTH STAR PRIMARY CARE) | S CORP |

Thank you for getting back, lrhmail451. Let me give you insights about loading your QuickBooks Online (QBO) file into TurboTax.

Being able to import your QBO data directly to TurboTax is unavailable. For now, you need to convert your QBO data to QuickBooks Desktop (QBDT) through a trial version. You can open this article for the complete steps: Convert QuickBooks Desktop file to QuickBooks Online.

Once done, import your data to TurboTax by following these steps:

Here's an article you can open for more detailed steps: How do I import QuickBooks data into TurboTax Business?.

Another way around this is to use a third-party app. Thus, you can move your QBO data directly into your TurboTax account. If you wish to continue, visit our QuickBooks App Center.

Please feel free to mention my name in the comment section below if you have follow-up questions. I'm always here to help you again. Have a good one!

that's what i needed to know

thanks so much

You're always welcome, @lrhmail451.

I'm glad that we're able to provide the information you need. We couldn't do it without your cooperation as well.

Please don't hesitate to let us know if there's anything else you need to manage your business's growth using QuickBooks Online (QBO). Take care, and I wish you continued success, @lrhmail451.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here