Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowMy partner and I have a small business and decided to each take 30% of profits and leave 40% in the business. I issue profit payments based on orders as salaries for the month (I calculate it in excel). My partner borrowed cash from the business which he chose to reimburse by decreasing the amount from his upcoming profit share/payment. I recorded the business loan by entering a check selecting loan to other as the category. Since his check was paid short of the loan amount, its just sitting in profits. What entry do I make to properly record this? Thank you in advance.

Hi @YLouis101,

Since we're talking about a loan, I suggest you set up a liability account. This way, you can properly record the repayment for it.

Here's how:

When it's time to pay for the loan, go with these steps:

At this point, you can continue to record your partner's draw with the reduced amount. Repeat the same steps above until the loan gets paid in full.

You can also consider opening this page: Add an owner or partner to your books. It has the steps on how you can include an owner or partner in your QuickBooks Online (QBO) company. It includes a short description of an owner and a partner.

Tap the Reply button, and let me know in the comments below if you have other concerns with your partner's draw. I'll get back to you as soon as I can.

@Ryan_M Thank you for your response. When I select check, which payee would I select? I do not have the account option to select the loan account, I have Category (I selected it there).

Thanks for your prompt response, @YLouis101.

You should select the Payee to where you give the check payment. It could be a lending company, vendor or customer. Then you're right under the Category column, you can pick the liability account.

This way, the asset will stay the same and the liability will be reduced based on the payment you've entered into the system.

Then you can continue to enter the payment via check until the loan is paid in full. You can also read the article shared by my colleague, @Ryan_M, about recording the partner's draw for the detailed steps.

Additionally, you can visit our Community page to learn more about recording income and expenses: Help Topics.

If you have other concerns about recording transactions, feel free to place them below. Anytime I can help. Keep safe!

@Jovychris_A He borrowed the money from our business. So is my business the payee? His check was written less the owed amount, so the cash is already in our account. Do I need to do a journal entry for this or a check?

I got your back, @YLouis101.

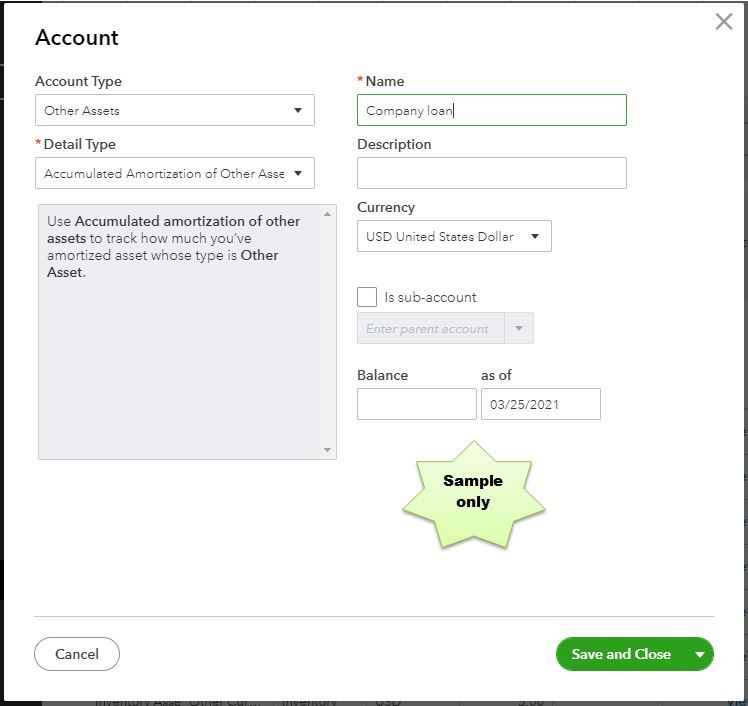

Since one of the owners borrowed money from the business and the loan is receivable by the business, you'll have to create an Asset Account. Here's how:

Then, write a check and use the created Asset account. Let me guide you on how:

Once your partner pays the loan from the shares, you can create a Journal Entry to reduce the asset account until the loan is fully paid.

You might also want to visit our help page to browse articles that can guide you with your QBO tasks. To get started head to our QBO help articles at this link.

Let me know how this goes and leave a reply below if you need further assistance in recording company loans in QuickBooks. I'm always around to help. Have a good one.

@DivinaMercy_N Thanks soo much! Seeing as the cash is already in my account as gross/net profits , what would the exact journal entry be? Credit the loan account and debit where?

Can anyone assist with which account to debit and which to credit in that regard? @DivinaMercy_N , @Jovychris_A , @Ryan_M

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here