You can use the Bank Deposit feature to reimburse the amount paid, @sw1222.

Here's how:

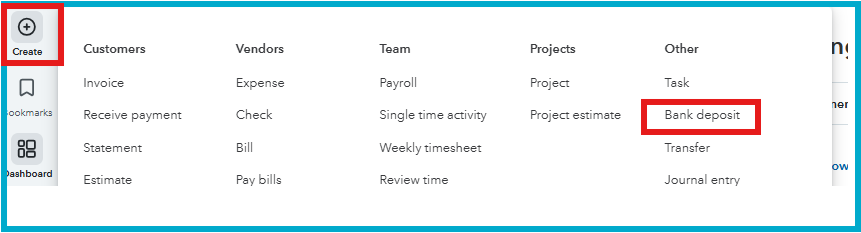

- Navigate to + Create and select Bank Deposit.

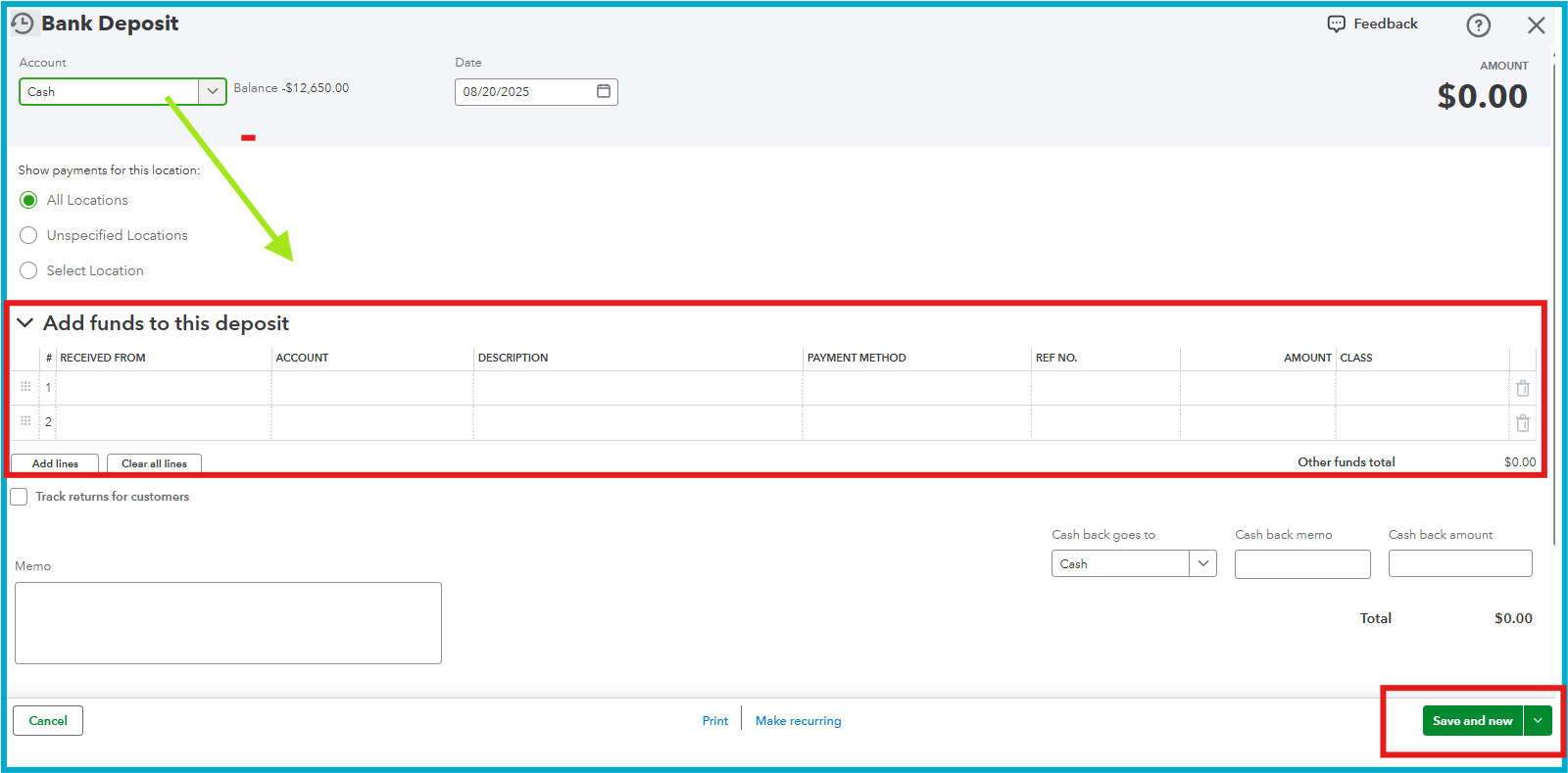

- Select the Account to add the reimbursement to, and enter the Date.

- Go to the Add funds to this deposit section. In the Received From field, enter the person who made the personal expense, then select the account. Note: Add the person as a customer if they aren't in your records yet. This is the recommended option, even if they're not an official customer.

- Select the Payment Method and enter the amount.

5. Click Save and close or Save and new.

Also I recommend consulting with your accountant to ensure the account selected is accurate and posted correctly without it being taxed as income.

To learn more about how to handle a personal expense in a business account in QuickBooks Online, refer to this article: Pay for personal expenses from a business credit card or bank account.

For more questions or concerns, please let us know.