Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowHello-

In my interior design firm I receive large retainers/deposits for a project for which we do not know exact costs at the outset. When I enter the deposit/retainer into QB, I create a Credit Memo in since there is as yet no open invoices to apply against the Credit Memo.

Problem 1: The system does not assign the credit memo a number, I have to do that manually.

Later, after work is performed, I create an invoice. There can be one or several invoices applied against the Credit Memo. QB asks me if I want to use the open Credit Memo to pay the invoice. I say yes. That works fine. Later, I can pull up the Credit Memo (payment) and see all the invoices I have applied against the open Credit Memo, until the Credit Memo is depleted and nothing more can be invoiced against it. That works fine.

However, my next issue: Also associated with this Credit Memo, on the other side of the equation, I am paying vendors for the product or service for which I am invoicing the client. Problem 2: There is no way in QB that I have found where I can tie the vendor payment back to the Credit Memo. The vendor is being paid from that Credit Memo. My goal is to see both invoices applied against the credit memo AND payments to Vendors associated with a credit memo. The difference between those two things is my profit. Can this be done?

Hello, @dddenise1.

Let me help record a retainer/deposit into QuickBooks and set a retainer item that'll be selected when creating a sales receipt for retainer payment.

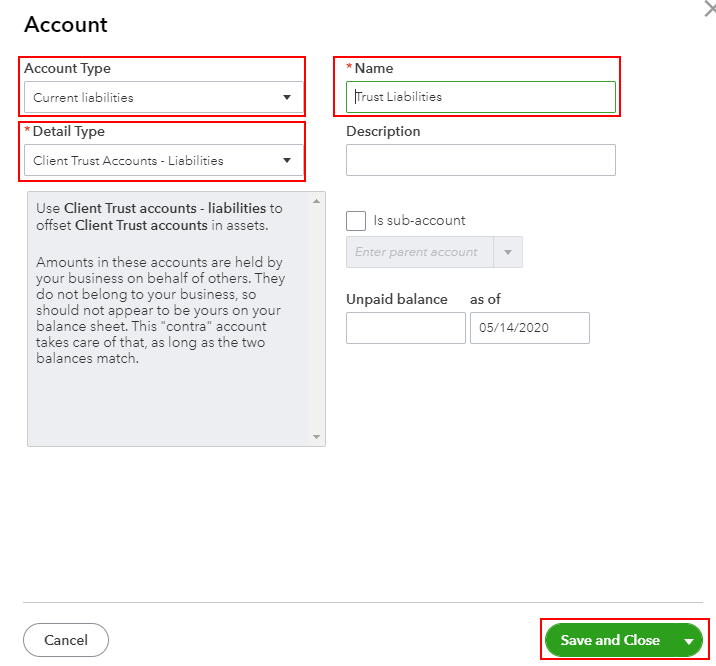

When setting up a deposit/retainer process for your company, this is treated as a liability to show that, although your business is holding the money, it doesn't belong to you until it's used to pay for services.

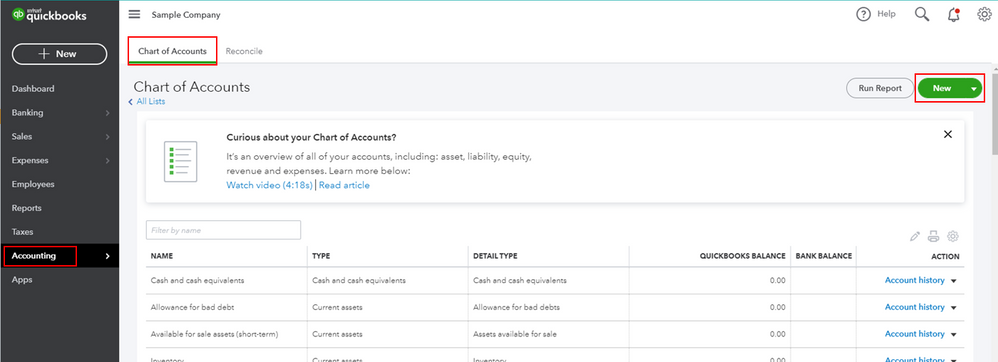

First, you'll need to create a liability account to track retainers. Here's how:

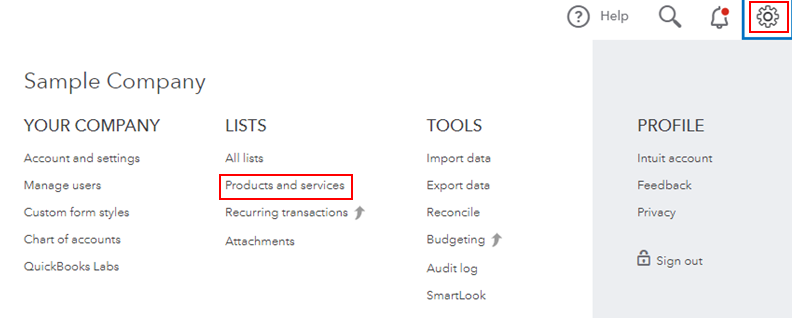

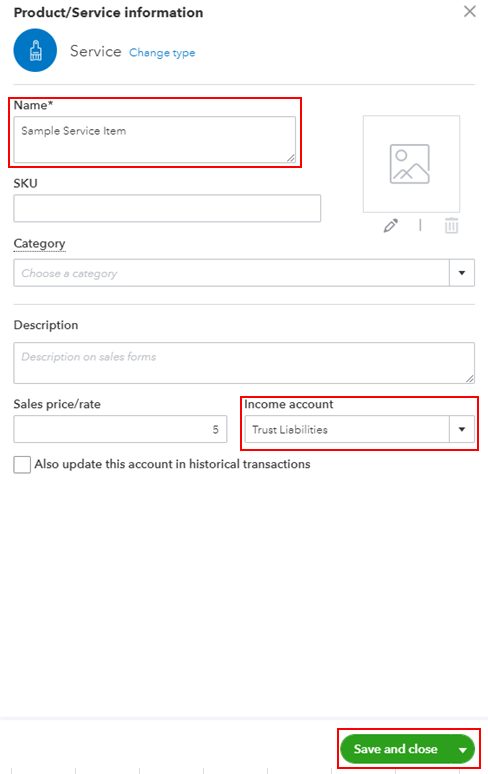

Next, create a retainer item:

The retainer item can now be selected when creating an invoice or sales receipt for a deposit or retainer payment. Once you have set up the accounts and the retainer or deposit item, you can begin to create Sales Receipts for the deposits or retainers you receive.

Here's how to create the sales receipt for deposit/retainer payment:

In addition to adding the retainer/deposit amount to your bank account, this increases the amount in your liability account to show that the money isn't truly yours yet, and to avoid treating it as income later.

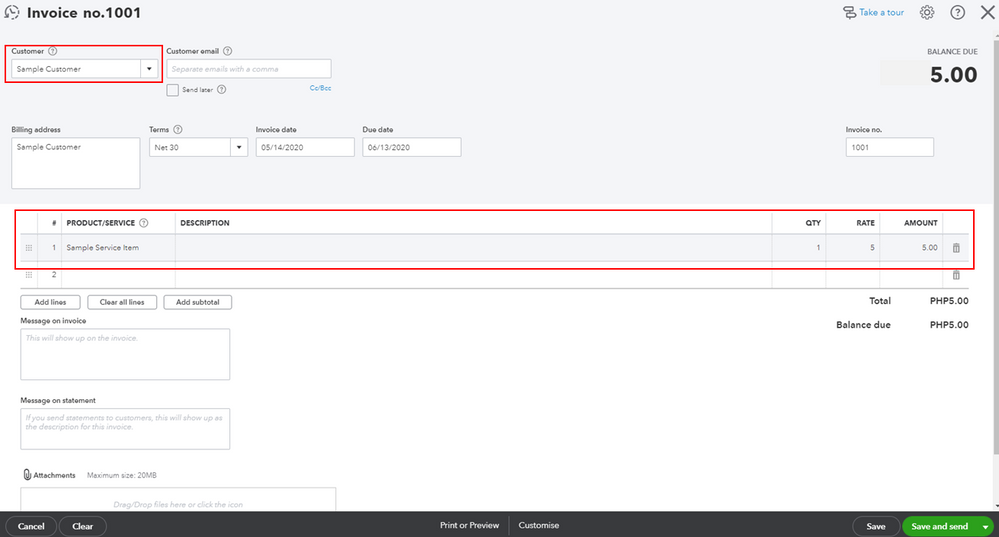

You can now create a credit memo using the retainer item. Let me show my sample below in creating an invoice and applying the credit memo.

You'll have to manually enter a credit memo number if needed. At this time, we don't have the option to automatically assign a credit memo number. Now when paying vendors using the retainer/deposit, you don't need to link this to a credit memo. Once you're done recording your retainer/deposit in QuickBooks, you can directly pay your vendor using your account where the retainer amount was deposited.

The transactions will now show on your P&L report. Just in case you'll need help with the whole process, you can always reach out to our Desktop Support to assist you with the steps using their screen share tool. You can also check out our site if you need some helpful references in the future: Help articles for QuickBooks Desktop.

That should do it. Let me know if you have additional questions about your retainer/deposit. I'm always here to help.

Thank you. I will test this and see if it works for my business.

You took a deposit and deposited those funds.

Now you pay a vendor from those funds, he is not being paid from the credit memo.

Make the contract a job under the customer, then use billable expenses to tag the vendor payment with the job name, do not mark it billable. that will associate the cost with the job.

on the job screen you can run a P&L by job report

Using a credit memo for the deposit, what item did you use and is it linked to a liability account? Or did you just deposit the funds and use the customer name as the source of the deposit?

Either way mis-states your accounts receivable on the balance sheet, since intuit holds customer credit in the A/R account, lowering actual A/R on the balance sheet

I prefer to create the deposit item which is linked to a liability account. Then as you create an invoice you use that same item with a qty of negative one and the amount of the deposit to apply.

Hello there, @dddenise.

Allow me to step in and help provide some additional information about tracking the transactions you've made in QuickBooks.

First, I'd like to acknowledge your effort in adding detailed information about your concern. To record the transactions correctly, you'll need to set up a deposit/retainer by following the detailed steps provided by my colleague. It will help you track your profits.

Then, when creating customer's invoice, you can use the job tracking feature so you can track the expenses for a job and compare those expenses to your revenue by pulling up the Job Profitability Detail report.

Here's how:

Also, if you'd like to view the invoices applied to the credit memo and the remaining credit, you can pull up the Customer Balance Detail report by following these steps:

You may also check this article on how to customize reports in QuickBooks Desktop.

Please know that you're always welcome to post again if you have additional questions. Have a good one.

Thanks for getting back to me, dddenise.

To answer your question, you can only create one service item and use it every deposit you made.

Wishing you and your business continued success.

Thank you for your website and kindness. Happy to have come across your thread. I too, am an interior designer and this is making my head run in circles. I know I am missing a connection, but not sure where that is. I have searched your suggestions within QB ONLINE SIMPLE START, and can't find a few key points:

Please confirm, this information I underlined is for the desktop or Plus accounts

"Make the contract a job under the customer, then use billable expenses to tag the vendor payment with the job name, do not mark it billable. that will associate the cost with the job.

on the job screen you can run a P&L by job report"

As well, I don't see where you can create a deposit item. I included a shot that show what is available to be "New" in Simple Start. (I am trying to determine if I can continue with Simple Start or if I really need to upgrade)

I prefer to create the deposit item which is linked to a liability account. Then as you create an invoice you use that same item with a qty of negative one and the amount of the deposit to apply.

I'd be glad to assist you with your concern, @MosaicStacey.

The steps you've underlined is for QuickBooks Desktop (QBDT). For QuickBooks Online (QBO), you'll have to upgrade your plan to Plus or Advanced to process the steps.

Since you prefer to record a deposit or retainer, I'd be happy to walk you through the process of how to do it.

First off, you'll have to create a liability account to track the amount of the retainers you receive from your customers. Here's how:

Once done, you'll want to create a deposit item. Let me guide you how.

After creating the service item, you can now create an invoice for deposits or retainers and use the service item you've set up.

I've got you an article you can read for more details: Record a retainer or deposit.

As always, feel free to visit our QuickBooks Community help website if you need tips and related articles in the future.

Please touch base with me here for all of your QuickBooks needs, I'm always happy to help. Have a good one and keep safe.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here