Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowI have a situation leftover from a bookkeeper that left the business. It does not seem to follow the method outlined in the manual or in this community discussion:

Manage upfront deposits or retainers

We are trying to sort it out.

Solved! Go to Solution.

Good to see you again, Maverick2.

I appreciate taking the time to clarify some things on the issue. I'd like to shed some light on your steps in resolving the sales order and invoice issue.

I've done the exact same steps in my end. I removed the payment made on the first invoice and allocated the funds on the second one. There are no significant changes to how the funds reflect in your Chart of Accounts.

So, you'll want to simply open the Payment transaction in the customer's account profile. Uncheck the first invoice (to recalculate the payment), then check the second invoice. Click Save & Close to finalize the correction.

To void the first invoice, simply open it, click the arrow icon under the Delete button and select Void.

To show some transparency on what will happen, take a look at these screenshots:

To shed some more light on your previous post, it looks like the bookkeeper intended to show the customer's deposit on the invoice.

However, this leaves the sales order open since the raised invoice didn't copy the exact line items.

This leaves more chances of creating another invoice from it, which is the likely reason why the second invoice was created.

Moving forward, I would suggest following the steps in the retainer or deposits article. This ensures you'll be able to keep track of your transactions and record them properly in QuickBooks.

If you're up to the task in reconciling your books, I would highly recommend checking out this article if you need a guide: Reconcile an account in QuickBooks Desktop.

I hope you're having a wonderful Saturday. If you have more questions with the deposit recording processes (or any other processes) in QuickBooks, please let me know. I'd be glad to show you the details and steps again. Advanced happy holidays to you.

Thank you for the screenshots,

I’m here to share information about recording transactions in QuickBooks Desktop.

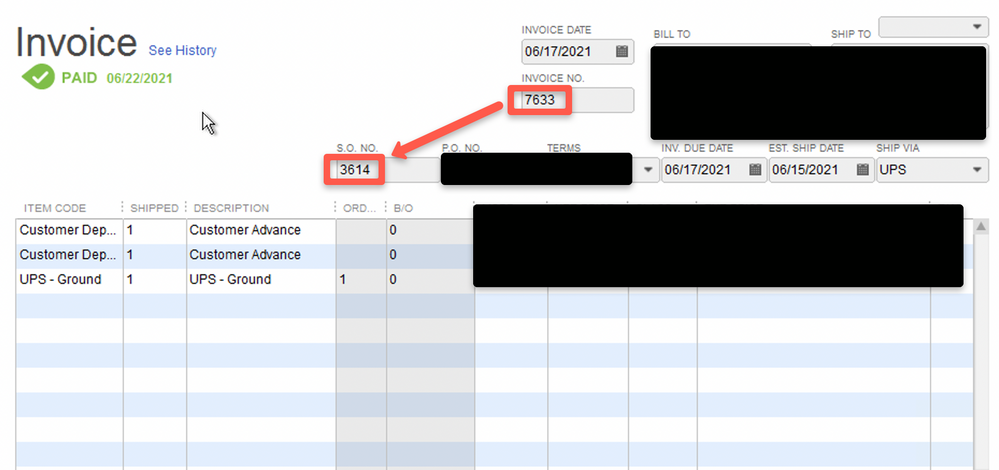

When you create an invoice from a sales order, you’ll have the option to either create an invoice for the whole amount or partial. Since the Invoice 7633 was already tagged as PAID, it was created in full amount.

If the deposit was supposed to be divide by the two invoices, you can reopen the payment of the Invoice 7633 and then modify it. From there, you can create another invoice out of the same Sales Order. This time, the amount will be the remaining of the previous one.

I’ve added this article for more information about creating an invoice from a sales order: Create an invoice.

I’m just around if there’s anything that I can help with. Keep safe!

Thank you for your reply @Adrian_A . Let me clarify what you are saying.

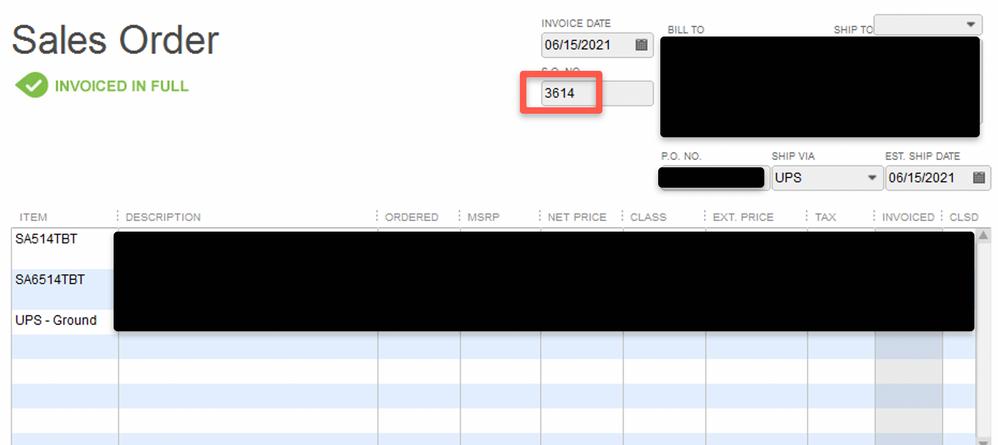

- As you stated, the first invoice 7633, created from the sales order 3614, shows as being paid. Look to the left of the 2nd screenshot (inv 7633) - it doesn't show the inventory items as it does on the sales order, but shows that the listed items were changed to the customer deposit item. This confuses me as to why that was done???

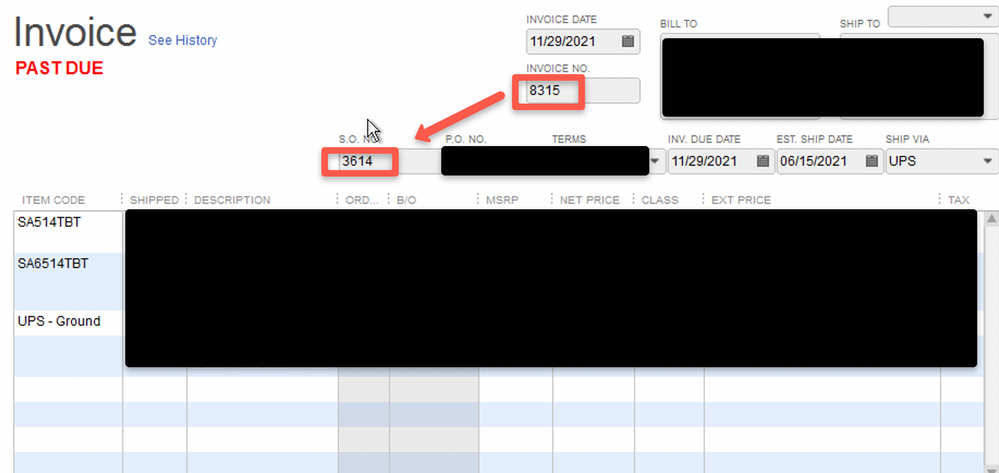

- However, the second invoice 8315 (created from the same sales order 3615), shows the correct inventory items and not the deposit items.

Would it make sense to:

1. Modify and remove the payment made on the first invoice 7633. If I did that, which accounting account would the funds move back to then?

2. Apply the payment to the second invoice 8315.

3. Because the first invoice 7633 will now show unpaid, can I void that invoice so it doesn't show up in my A/R as unpaid?

Good to see you again, Maverick2.

I appreciate taking the time to clarify some things on the issue. I'd like to shed some light on your steps in resolving the sales order and invoice issue.

I've done the exact same steps in my end. I removed the payment made on the first invoice and allocated the funds on the second one. There are no significant changes to how the funds reflect in your Chart of Accounts.

So, you'll want to simply open the Payment transaction in the customer's account profile. Uncheck the first invoice (to recalculate the payment), then check the second invoice. Click Save & Close to finalize the correction.

To void the first invoice, simply open it, click the arrow icon under the Delete button and select Void.

To show some transparency on what will happen, take a look at these screenshots:

To shed some more light on your previous post, it looks like the bookkeeper intended to show the customer's deposit on the invoice.

However, this leaves the sales order open since the raised invoice didn't copy the exact line items.

This leaves more chances of creating another invoice from it, which is the likely reason why the second invoice was created.

Moving forward, I would suggest following the steps in the retainer or deposits article. This ensures you'll be able to keep track of your transactions and record them properly in QuickBooks.

If you're up to the task in reconciling your books, I would highly recommend checking out this article if you need a guide: Reconcile an account in QuickBooks Desktop.

I hope you're having a wonderful Saturday. If you have more questions with the deposit recording processes (or any other processes) in QuickBooks, please let me know. I'd be glad to show you the details and steps again. Advanced happy holidays to you.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here