Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowI wrote a customer refund check, but we only use QB for bookkeeping. How do I record the refund if I'm not having QB actually write the check.

Solved! Go to Solution.

I’m here to help you record this customer refund in QuickBooks, @ledoffice.

Thanks for reaching out to the Community. QuickBooks Desktop makes it easy to give money back or credit to your customers.

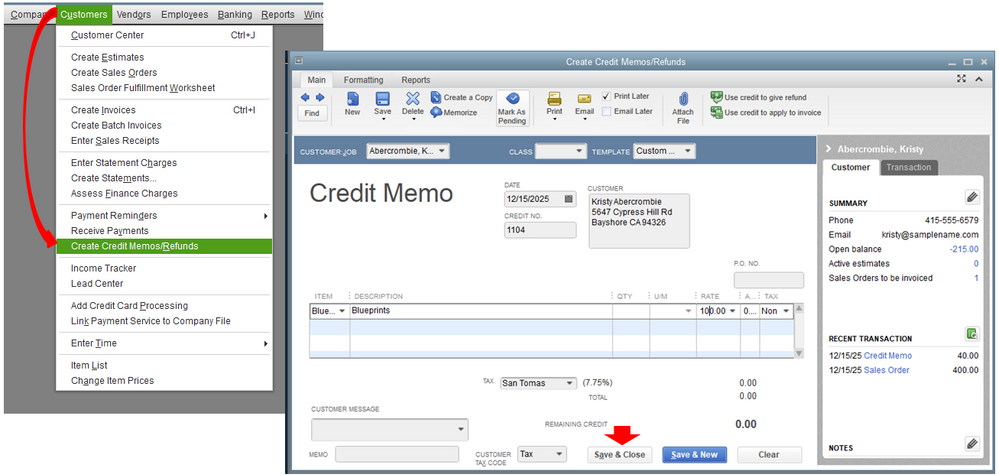

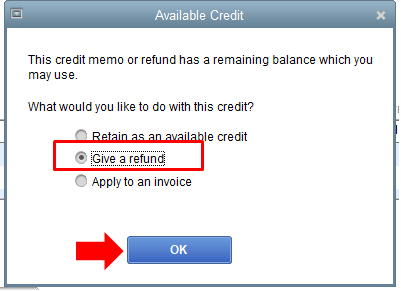

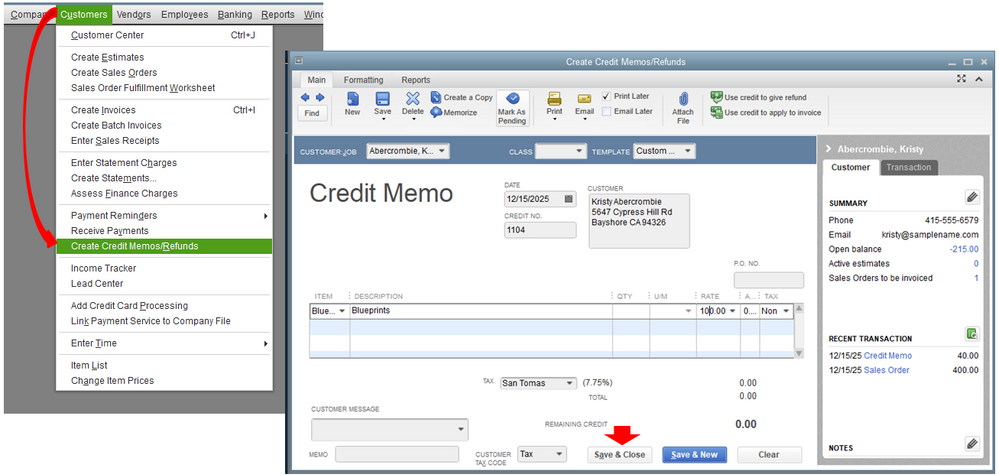

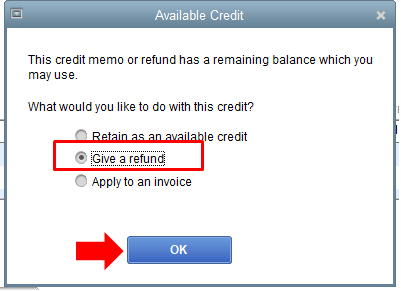

To enter a refund in the program, you’ll want to create a credit memo then choose Give a refund. As this is how to handle the said credit. Here’s how:

You might want to visit this article about recording refunds received from a vendor in QBDT. It has recommended steps depends on the scenario.

I'll be happy to help if you need any further assistance with this refund matter or anything else. Just leave me a message, and I’ll make sure to get back a soon as I can. Have a great day!

I’m here to help you record this customer refund in QuickBooks, @ledoffice.

Thanks for reaching out to the Community. QuickBooks Desktop makes it easy to give money back or credit to your customers.

To enter a refund in the program, you’ll want to create a credit memo then choose Give a refund. As this is how to handle the said credit. Here’s how:

You might want to visit this article about recording refunds received from a vendor in QBDT. It has recommended steps depends on the scenario.

I'll be happy to help if you need any further assistance with this refund matter or anything else. Just leave me a message, and I’ll make sure to get back a soon as I can. Have a great day!

Thank you, MadelynC! This worked for me!

You’re most welcome, @ledoffice.

Thanks for updating me. It's my pleasure to be of great help.

If you have any questions or concerns with QuickBooks, please don’t hesitate to let me know. I’m always here for you. Take care!

How do I do a refund on select items listed in a Invoice that hasn't been paid yet? They are returning the items they didn't use and I would also like to charge them a restocking fee, can you help me with all of this please?

Hello there, @littlegreekgirl.

I appreciate you chiming in the thread. I'll gladly add details on how to refund and charge a restocking fee within the invoice in QuickBooks Desktop.

We can refund the money to the customer if we receive payment for the entire invoice amount. However, we can edit or void the customer's invoice and create a new one.

Here's how:

We can also include a restocking in the invoice fee for the amount to be charged. We just have to add a negative sign on the amount.

Follow the steps below:

4. Next, tap the amount and add a Negative (-) sign. This will automatically deduct from the total amount of the invoice.

5. Hit Save.

I also suggest reaching out to your accountant to help you locate the exact account for the restocking fee.

I've also include this article for the detailed information on how to create invoice in QuickBooks Desktop. It also consist steps how to add customer job.

Moreover, QuickBooks Desktop offers a variety of reports to meet the needs of your business. A report is a set of instructions used by the program to display information from your company file. Want to create your sales report? Get it from here: Understand Report.

Fill me in if you need to track your transactions. I'd be happy share them with you.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here