Hi there, @ Patsypat20.

You're on the right track in recording the gift certificate to your client. In the balance sheet report, when you issue a credit, it set towards the existing balance on a buyer's account to reduce the total.

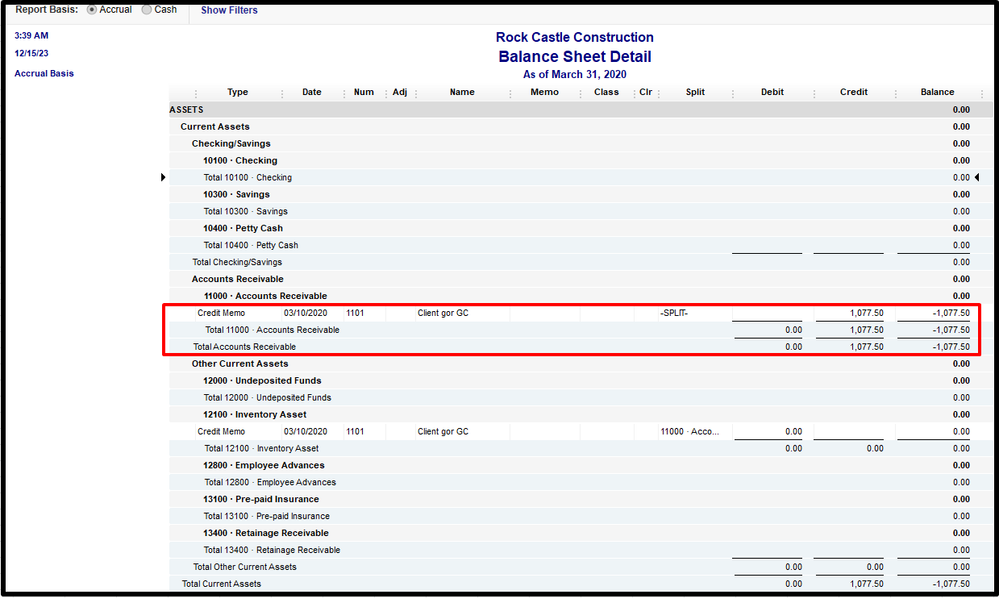

The credit will result in the following entry in accounting records. In other words, the credit memo reduced Seller's net sales and its accounts receivable.

As I replicated what you have worked on, I have this screenshot shows the negative amount in the Balance Sheet.

For your reference, you can follow the detailed steps on to remove credit for your customers: Remove or unapply a credit from an invoice or bill.

Don't hesitate to leave a comment below if you have additional questions about the credit memo. I'd be happy to answer them for you. Have a great day.