Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Connect with and learn from others in the QuickBooks Community.

Join now

Rate my COA logic.

-COA-

asset:

Amazon.ca holding

revenue:

Amazon.ca sales

Amazon.ca refunds

Amazon.ca credits

expenses:

Amazon.ca selling fees

liability:

GST collected (liaiblity)

GST paid (asset)

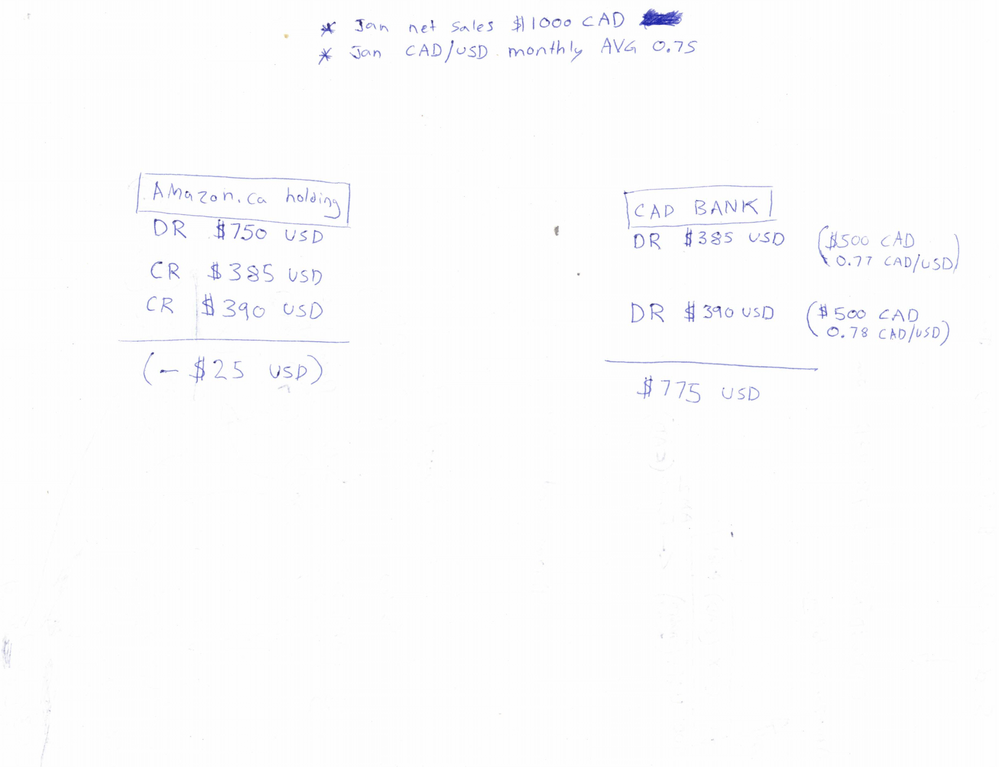

Amazon.ca holding is for the amazon.ca balance not deposited to your bank yet. The revenue + expenses net should equal whats in your Amazon balance. When a deposit hits your bank its treated as a "transfer" from Amazon.ca holding. The bank is a CAD bank. The funds are then transfered to a USD bank using a prefered exchange rate.

The expenses amazon.ca charges you includes GST which is claimable. They send monthly reports showing the amount they charged. Example, $1130 in Jan Amazon.ca expenses would be broken down as ($1000 expenses + $130 GST). In this scenario I would DR $130 GST paid (asset) & CR $130 Amazon.ca selling fees.

I do this monthly using the Amazon.ca summary reports. I convert all these values to USD using the

monthly CAD/USD exchange rate.

See discrepency I got from doing this. Not sure how to resolve.

Hello there, @Anonymous.

I appreciate you for providing on-point details and a screenshot of your concern. Let's dig deeper into the root cause of the discrepancy so we can resolve it.

I'd suggest running either the Customer Balance Detail or Vendor Balance Detail report to view your unrealized gains or losses. Then, customize them by following the steps below.

The screenshot below shows you the last three steps.

Once done, click each transaction for Amazon.ca holding and CAD bank accounts. Be sure they have the correct exchange rates and associated COA types.

You can also run the reports below to further review your unrealized gains or losses:

If the exchange rates are incorrect, you'll have to delete the journal entries associated with foreign currency transactions. Then, enter home currency adjustments to revalue them again. Before that, it's always a good idea to check with your accountant. This way, we can ensure your books are accurate in QBO.

Lastly, I recommend visiting the links below to get more details about the multicurrency feature and home currency adjustments:

I'll be around to help if you need anything else. Keep safe.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here