Greetings, @mitesh-bohra.

Thank you for taking the time posting in the Community. I'd be happy to help share some insights about removing a payroll form in QuickBooks Online.

The payroll tax forms for filing are based on the employee's state tax and work location setup. You're on the right path in inactivating the employee and work location to avoid the form from showing after each payroll. Since the report shows a $0 amount, we can archive the form for Maryland.

Here's how:

- On the left pane, select Taxes.

- At the top left, select the Payroll Tax tab.

- Under Forms, click the Quarterly Forms or Annual Forms.

- Select the form you want to archive.

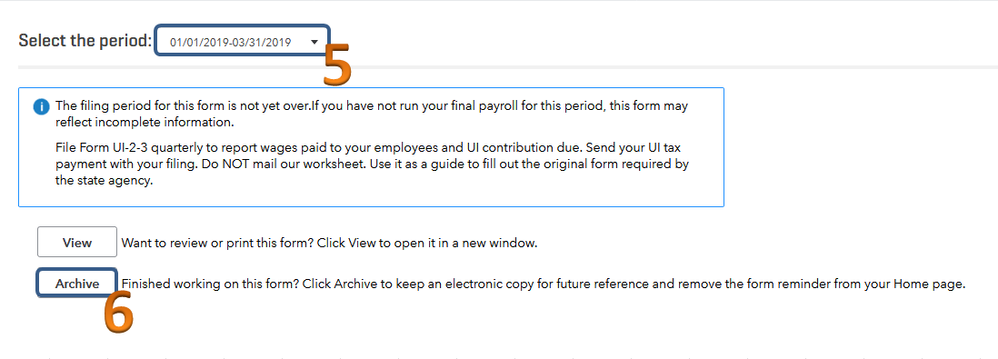

- Select the liability period.

- Click Archive.

Here's an article about archiving forms in QuickBooks Online: Archive forms.

With this information, you'll be able to remove the state forms in QuickBooks.

For additional support, feel free to reach out to our Payroll Support. They have the tools to check your account securely and get this fixed quickly.

That should point you in the right direction today. Don’t hesitate to get back to me if you have any other questions about payroll. I'll be happy to help you further. Have a great day ahead.