Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowWe prepare Estimates and when I go to invoice the customer it will pop up and ask if I want to covert the estimate to an invoice, and I do. But even after it is invoiced it will still pop up. Is there a way that once I convert the Estimate to an Invoice that it will not pop up as an open Estimate? And if so, is there a report that I could run that would show how many Estimates were converted to Invoices?

Thank you.

Hello, missmissySEI. I'll explain why estimates continue to pop up as open estimates even after they have been converted into invoices.

I can provide a more detailed explanation. In QuickBooks, an estimate is a document that outlines the costs of products or services that will be provided to a customer. Once the estimate is created, it can be converted into an invoice.

Usually, the estimate you converted to an invoice will pop up once the entire amount of the estimate was not 100 percent used. For example, if you create an estimate worth $500 but don't enter it and then convert only half to an invoice, the remaining estimate balance will still show up. The Open Estimate section shows the outstanding balance of all estimates that must be fully converted into invoices. Therefore, the remaining $250 from the $500 estimate will still be shown in the Open Estimate section as waiting to be converted into an invoice.

If you still see an open estimate, we can use it to convert another invoice. This will zero out the remaining balance on your Open Estimate.

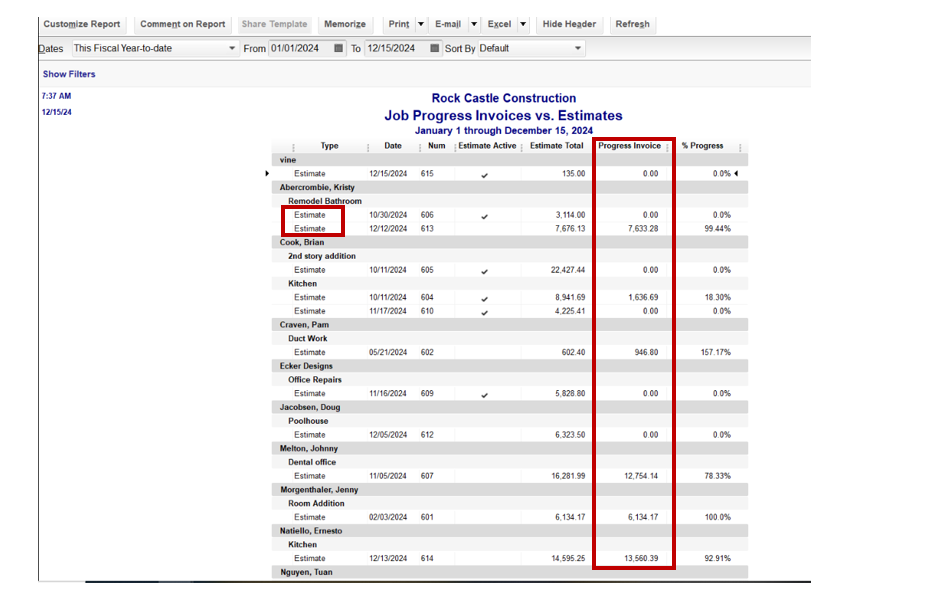

If you want to track how many Estimates have been successfully converted to Invoices, the Job Progress Invoices vs Estimates report can be beneficial. This report provides detailed information about each invoice's progress and estimate, clearly showing which invoices have been completed 100%. By reviewing this report, you can quickly determine how many Estimates have been converted to Invoices and better understand your business's financial performance. So, if you're looking for a detailed report to track your Invoices and Estimates, the Job Progress Invoices vs. Estimates report is a great place to start.

If you want to know what reports are available in QuickBooks Desktop, you can refer to this article: Understand reports.

Additionally, I've added these articles for more insights on the different available workflows to track your income and expenses in QuickBooks:

Don't hesitate to contact me if you need anything else while working with your QuickBooks. I'm here to keep helping. Have a great day!

I do invoice for the full estimate when I convert the estimate to an invoice. I noticed under "Edit", "Preferences", "Jobs & Estimates", there is an option that says "Close estimates after converting to an invoice". I do not currently have that selected. I was wondering if I select that option would that close the estimate? I don't want to delete the estimate, but would like to know which estimates have been invoiced and which ones are still active.

Thanks for getting back to the thread, @missmissySEI.

Let me join to this conversation and provide you with further insights on how estimate works in QuickBooks Desktop.

It's possible that your company preferences was set to progress invoicing. This is why the Close estimates after converting to an invoice box is unclickable.

To fix this, you'll have to turn off the Progress Invoicing feature. Here's how:

Doing this automatically close the estimates after it is converted to an invoice. However, this changes will only apply to the new estimates that you've created after the preferences is changed.

I can see how this option would help you in managing your estimates in the program. Therefore, I'll take note of this as a suggestion to improve your experience in QuickBooks. On the other hand, you can send feedback to our developers so they can review your request and most likely include it in future updates.

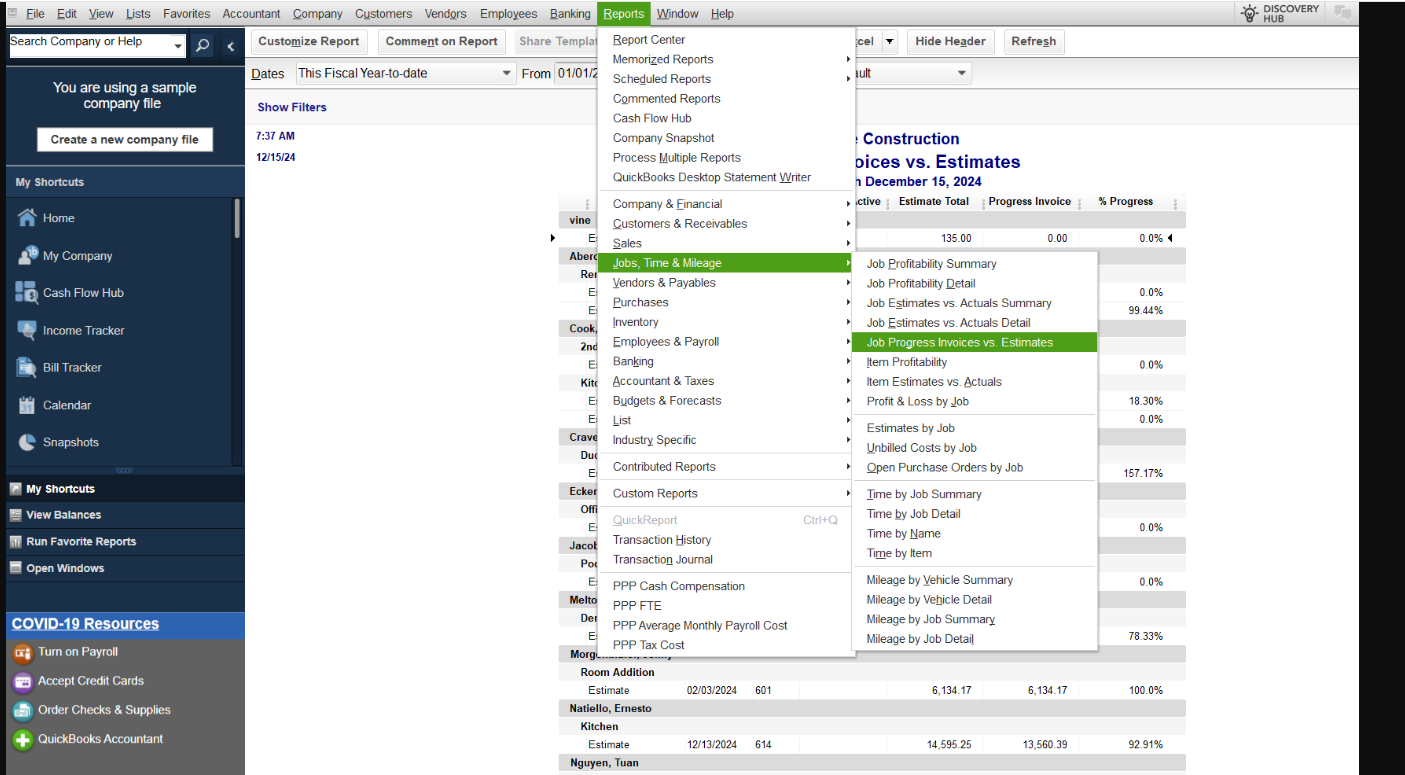

To know which estimates have been invoiced and which ones are still active, I'd suggest running the Job Progress Invoices vs Estimates report. This will show you the percentage of estimates converted to an invoice. Simply go to the Reports menu and select Jobs, Time & Mileage. Then, click the Job Progress Invoices vs Estimates report.

For future reference, check out this article: Receive and process payments in QuickBooks Desktop.

If you have further questions with regards to handling estimates, please let me know in the comment. I'll be more than happy to share some help with you with estimates and sales. Have a good one!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here