Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Connect with and learn from others in the QuickBooks Community.

Join nowWe use a data collection program for collecting time data, piece rate pay, etc. We hire 200+ workers from Mexico on an H-2A work Visa. When Importing to QuickBooks using an IIF file, I receive the following error:

The record at (or starting at) this line could not be imported. The enumerated value "" in the field "state" is unknown or invalid for the qbXML version in use. [3110]

Using a local address is not an option as we are required to use their permanent address for their W2. Is there any way to allow States from outside the United States in QuickBooks, as the IRS requires for the W2?

There isn't a way import or manually record these addresses.

QuickBooks does not support foreign addresses for employees.

Thanks for visiting the Community for your IIF file concern, @tmartinez.

I'd like to ensure you'll get routed to the right direction to help you in getting rid of the error that you received when importing the IIF file.

To give you the resolution on what's the right thing to do in fixing the error 3110 that you received, I suggest reaching out to our Intuit Developer. This team is the best resource for such inquiries as they are the experts when it comes to qbXML status code for IIF files.

You can reach their forum through this link: Intuit Developer.

On the other hand, QuickBooks doesn't allow you to enter an address outside the United States to show in their W-2 form.

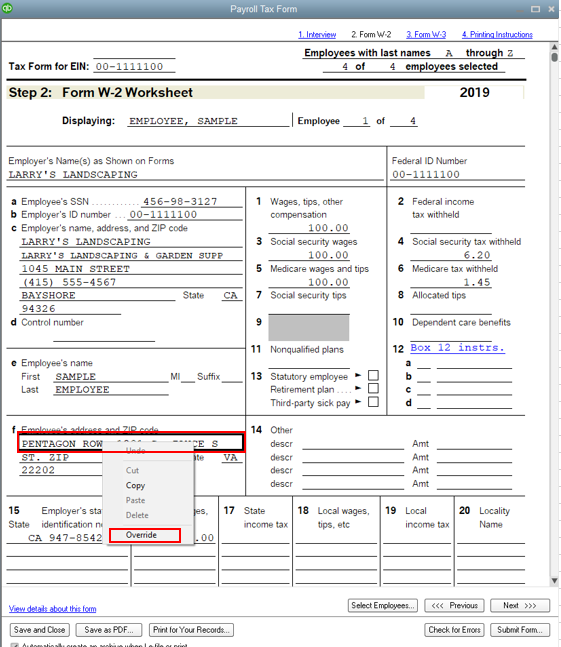

As a workaround, you may consider pulling up the W-2 form, then manually enter or override the home address of the workers from Mexico.

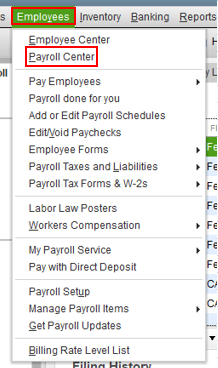

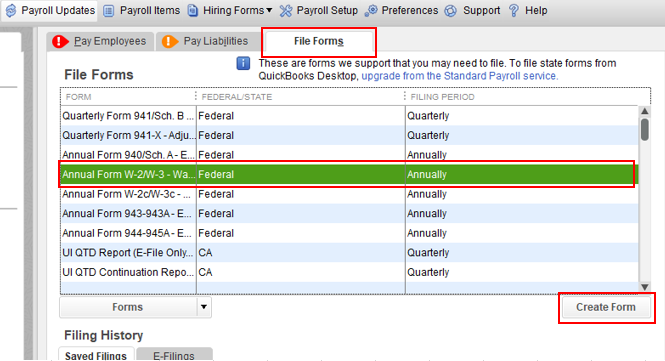

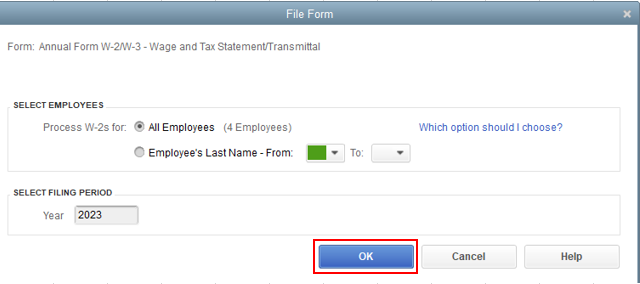

To do that:

You can always visit this IRS article and refer to page 15 for the employee's name and address in W-2: https://www.irs.gov/pub/irs-pdf/iw2w3.pdf.

Know that you can always get back to me here if you need anything else. I'm always up for further assistance. Have a lovely day!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here